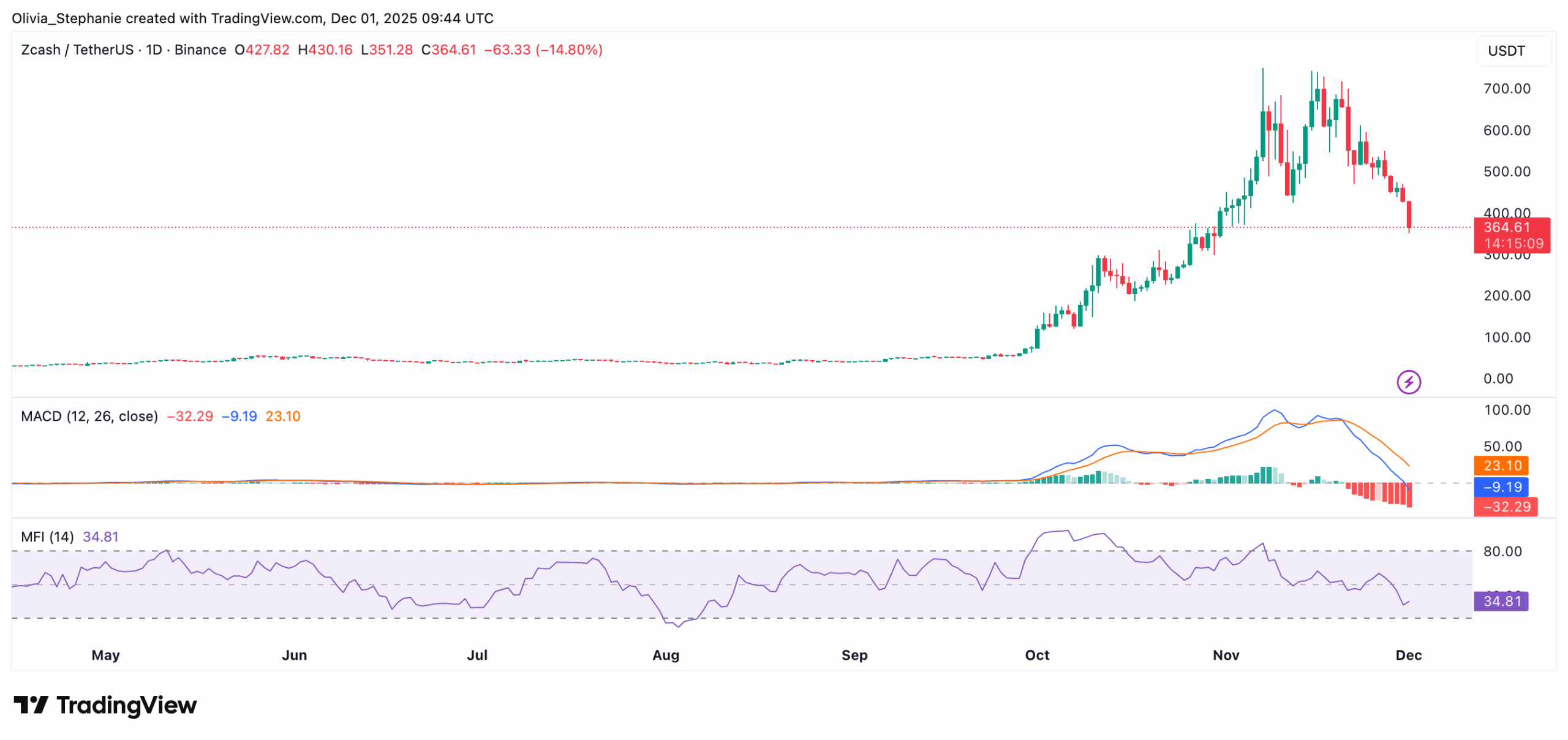

Zcash is underneath stress after a steep worth decline, falling greater than 32% over the previous week. The token is buying and selling round $365 after dropping over 20% within the final 24 hours. The transfer follows the lack of key assist ranges, with merchants watching whether or not the downtrend will proceed.

ZEC had just lately posted sturdy features, rallying from $40 to $700 in only a few months. The present pullback, nevertheless, means that the development could have shifted, with momentum now favoring the draw back.

Key Technical Ranges Breached

ZEC misplaced a number of necessary ranges in a brief interval. The breakdown beneath the 50-day easy shifting common, the $480 horizontal assist, and the 38.2% Fibonacci retracement opened the door to additional declines. Because of this, the asset fell into the primary main liquidity space round $400.

Crypto analyst Ardi had warned of rising weak point, pointing to a failed breakout within the RSI development. “Repeated warnings of construction being damaged” have been famous after the lack of early assist. He additionally cautioned that overexposed lengthy positions have been creating threat, including, “5% strikes have been inflicting a cascade of liquidated lengthy positions,” resulting in even bigger drawdowns.

Furthermore, Zcash continued decrease, reaching a second liquidity zone close to $370. Ardi famous that he closed half his brief place at this degree. He added that if this zone breaks, the subsequent space to observe is between $297 and $311, which incorporates the 61.8% Fibonacci degree and a big pool of earlier liquidity.

Buying and selling quantity has spiked, crossing $1 billion prior to now 24 hours. ZEC has traded between $356 and $457 within the final day, with the broader 7-day vary exhibiting a excessive of $585 and a low close to $358 (per CoinGecko information).

Momentum Indicators Present Additional Weak spot

Technical indicators assist the present downtrend. The MACD continues to maneuver decrease, with the sign line confirming destructive momentum. Purple histogram bars are growing in dimension, exhibiting sturdy promoting stress.

In the meantime, the Cash Stream Index now stands at round 35, pointing to continued outflows, although nearing ranges the place previous reversals have occurred.

Analyst Ali Martinez famous that ZEC had returned to a identified assist zone close to $440.

“Bounce or breakdown?” he requested in a latest submit.

That degree has now damaged, confirming decrease lows and sustaining the bearish construction.

Uncertainty Over Lengthy-Time period Path

Market opinion stays divided. Max Keiser commented,

“The $ZEC ‘pump ‘n dump’ is over. A visit again to $55 seems inevitable.”

His view displays rising skepticism after the latest drop. Individually, it was just lately reported that Grayscale has plans to transform its Zcash Belief into an exchange-traded fund (ETF). If accepted, the ETF may make it simpler for traders to realize publicity to ZEC with no need to carry the asset instantly.

The submit Zcash (ZEC) Nosedives After RSI Breakdown – Extra Ache Forward? appeared first on CryptoPotato.