TL;DR

- Many cryptocurrencies managed to interrupt their respective all-time highs through the ongoing cycle, together with a number of of the biggest ones.

- Ethereum is among the many few which might be but to attain such an unbelievable feat, however it has closed down the hole to its 2021 ATH.

Is it Time?

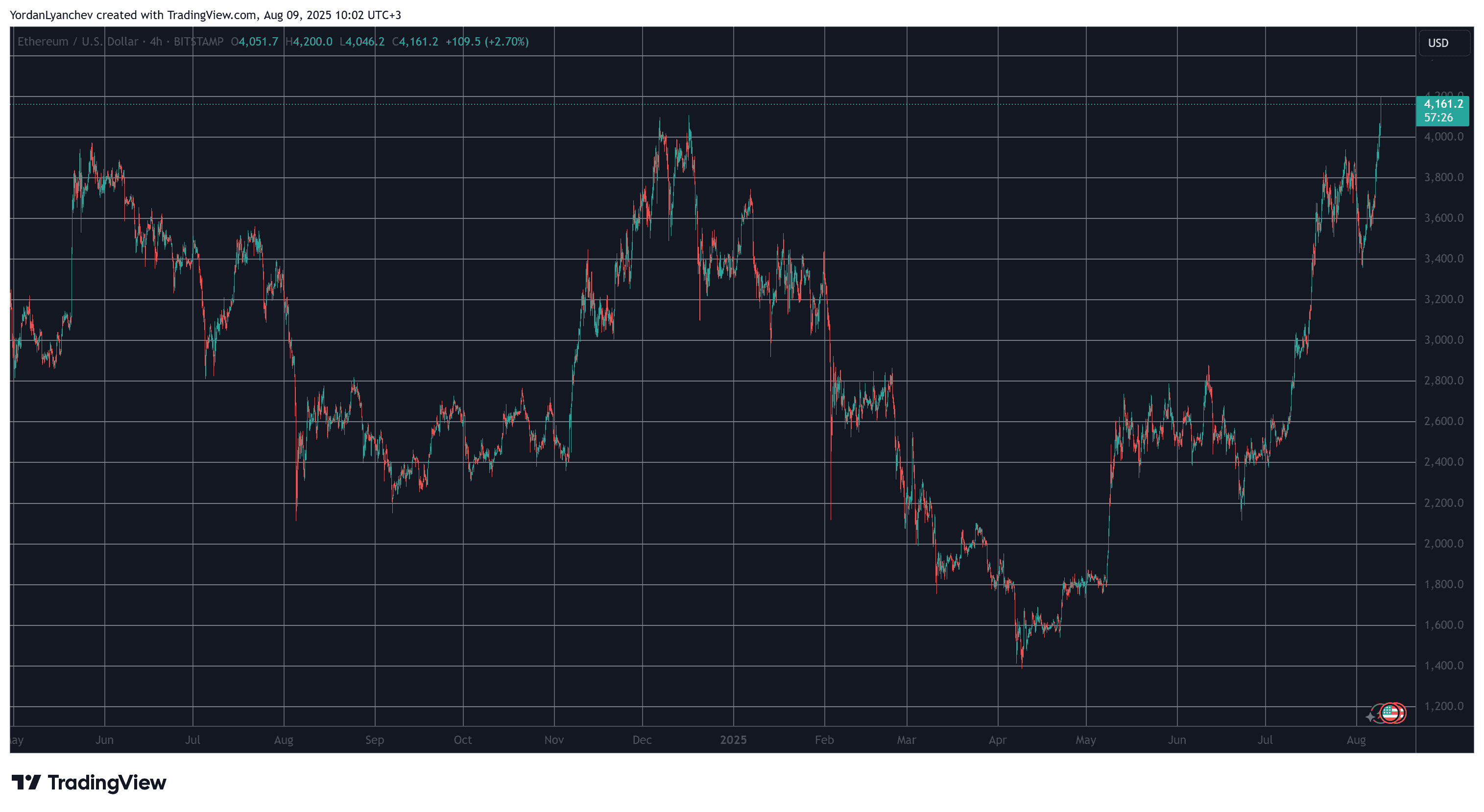

The 4-hour graph above paints a really attention-grabbing image. Ethereum, alongside the remainder of the market, rocketed on the finish of 2024 after the US elections. Nonetheless, whereas BTC managed to surge previous $100,000 to chart a recent peak, ETH’s rally was capped at round $4,000. It tried to interrupt that essential resistance a couple of instances, however it confronted speedy rejection.

The final one, which passed off in early 2025, was notably painful because it led to a violent correction that culminated in early April with a worth dump to underneath $1,400. On the time, the sentiment across the largest altcoin was extraordinarily bearish, with a number of holders disposing of their ETH holdings.

Nonetheless, the panorama shortly turned, and it wasn’t lengthy till ether managed to rebound previous $2,000. It stayed there for a couple of weeks earlier than the bulls stepped on the gasoline pedal and drove the asset north laborious. By the top of July, it had neared the acquainted $4,000 resistance, however couldn’t penetrate it.

This lastly occurred final evening when ETH shot up previous it and shipped to a brand new three-and-a-half-year excessive of $4,200. This meant that the world’s second largest cryptocurrency had added 200% in simply 4 months.

Now, although, all eyes are turning to the November 2021 all-time excessive of virtually $4,900 (CoinGecko information), which is roughly 15% away. If it manages to interrupt it, ETH will be a part of the likes of BNB and XRP as a few of the altcoins which have gone into uncharted territory throughout this cycle.

What’s Driving ETH’s Pump?

The reply to that is multi-fold. Traders utilizing the ETFs to realize ETH publicity went berserk by accumulating huge shares inside a comparatively brief time interval. In truth, July outperformed all 11 earlier months mixed wherein the ETH ETFs existed.

Then, there have been corporations that went all in by spending billions to accumulate extra ether. Whales have additionally gone on a shopping for spree, and all of this has helped the underlying asset to realize traction and outperform a lot of its rivals previously few months. Nonetheless, the large goal remains to be forward of it, and solely time will inform if that is certainly ETH’s second to take the highlight and run with it.

The submit XRP, BNB, BTC Have Accomplished It: Is It ETH’s Time to Shine Now? appeared first on CryptoPotato.