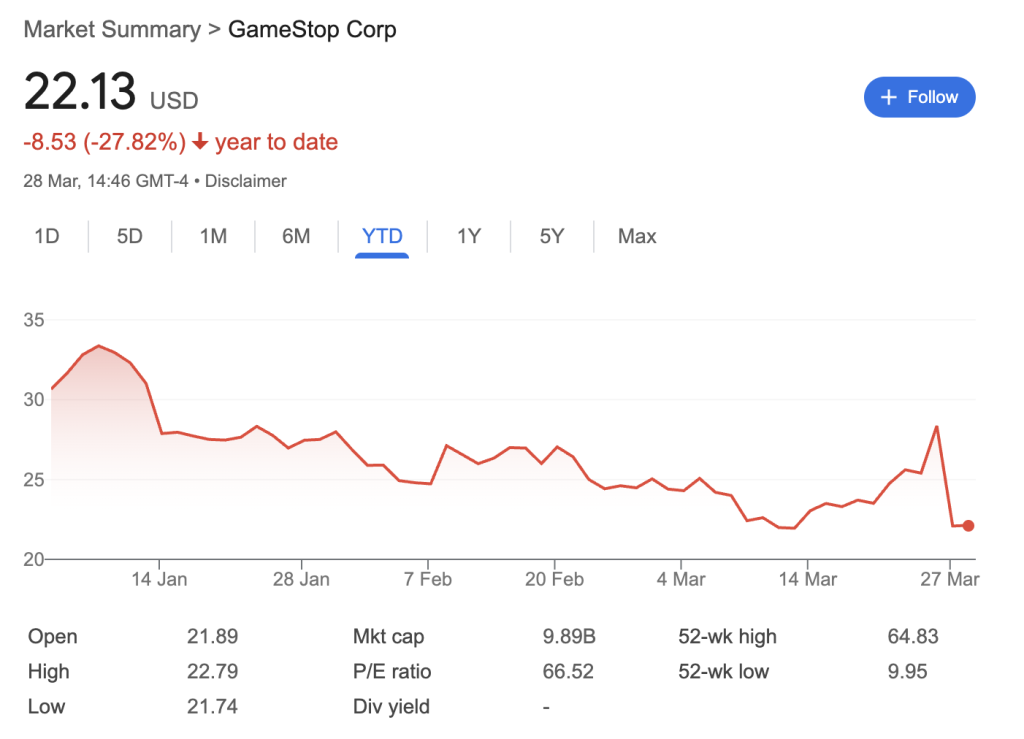

GameStop’s official announcement that it’s going to begin investing in Bitcoin has gone down like a lead balloon.

For months now, there’s been feverish hypothesis that the troubled online game retailer was planning to carry this cryptocurrency as a reserve asset.

GME’s share value spiked when the corporate’s CEO, Ryan Cohen, posted chummy photos of him grinning alongside Michael Saylor earlier this yr.

pic.twitter.com/wlOwEGli6n

— Ryan Cohen (@ryancohen) February 8, 2025

Given Wall Avenue had initially been receptive to those rumors, you is perhaps questioning why the inventory tanked 25% in intraday buying and selling as soon as the plans had been truly confirmed.

Effectively, the sell-offs are linked to a number of elements — not least the precise particulars of what GameStop intends to do.

Ripping a web page out of Technique’s playbook, GameStop revealed on Thursday that it plans to boost $1.3 billion with a purpose to begin amassing BTC.

However critics argue that it makes little sense for buyers to snap up this debt. In spite of everything, they might simply determine to purchase this Bitcoin for themselves — or achieve publicity by means of an exchange-traded fund.

There’s additionally been a good bit of frustration on the timing of this announcement. Bitcoin has been languishing under $90,000 for many of March, and it’s possible investor sentiment would have been far more upbeat if the crypto markets had been exhibiting bullish momentum.

24h7d30d1yAll time

And right here’s the cherry on the highest: GameStop has additionally disclosed that will probably be shutting down a “important quantity” of its shops — constructing upon a considerable variety of closures lately.

At one level, there have been roughly 6,000 GameStop shops all over the world, however this determine has nearly halved over the previous decade. You would argue this was considerably inevitable given so many fans now obtain titles immediately from on-line shops arrange by the likes of Nintendo.

The fast succession of those bulletins nearly looks as if GameStop is now intent on turning its again on its core enterprise so it could possibly change into a automobile for digital belongings.

There’s yet one more ingredient to throw into the combo right here: the variety of merchants shorting GME inventory has risen dramatically, a lot in order that the New York Inventory Change has needed to activate short-term restrictions.

You’ll keep in mind that is important due to what occurred again in January 2021, when the Reddit group WallStreetBets triggered a brief squeeze and prompted hedge funds to lose eye-watering quantities of cash. GameStop was successfully changed into a “meme inventory,” and it’s struggled to shake off this fame since.

Gold bug and crypto skeptic Peter Schiff has been struggling to include his enthusiasm as he watched GameStop’s inventory, writing on X:

“Smarter buyers are promoting as they notice that losing money shopping for Bitcoin isn’t a viable long-term enterprise mannequin.”

He went on to argue that, from a dealer’s perspective, “playing on corporations shopping for Bitcoin isn’t an excellent funding technique.”

It may very well be argued that there’s advantage on this assertion. Firms with excessive publicity to BTC — like Technique and Coinbase — typically expertise outsized strikes each time the crypto markets endure a downturn. Take Friday, for instance. Bitcoin had fallen by 3.8% in a 24-hour interval, whereas MSTR was down 10%.

GameStop received’t be going anyplace quickly. Regardless of the dire state of its core enterprise, it has a big money pile price greater than $4 billion — amassed by providing new inventory and diluting the worth of current shares.

However it stays within the throes of a critical identification disaster. Virtually 90% of console video games are actually downloaded fairly than purchased in-store, leaving it closely reliant on {hardware} and equipment. Earlier makes an attempt to modernize, resembling a foray into NFTs, have additionally fallen nicely wanting the mark. Continuous shifts in technique (investing in Bitcoin being the most recent) imply buyers and analysts are left scratching their heads on GameStop’s future route.

You need to ponder whether GameStop has overpassed the explanation why it grew to become a publicly listed firm. The 15-year-old shopping for their very own online game for the primary time after saving each cent from the cash on their paper spherical. The devoted gamers queuing within the chilly at midnight to get their palms on a shiny new console that’s been years within the making. The clueless dad and mom on the lookout for somewhat recommendation on a recreation their youngsters will love.

All of those prospects nonetheless exist, however Bitcoin doesn’t serve any of them. GameStop’s shift is perhaps a step ahead in the case of crypto adoption, however it reveals the corporate now not focuses on the folks it’s meant to serve.

The put up Why GameStop’s Bitcoin Announcement is Backfiring appeared first on Cryptonews.