Get your daily, bite-sized digest of blockchain and crypto news today – investigating the stories flying under the radar of today’s news.

In crypto news today:

- Why is crypto down today?

- Digital Asset Investing Platform ETZ Now Offers SUI to Retirement Account Holders

- Bybit Introduces Zero-Fee Block Trading and Spot Liquidity Pairing Program

- Bitget Partners with Upland to Launch Its Metaverse Headquarters with 888 Exclusive Properties

__________

Why is crypto down today?

The global cryptocurrency market capitalization is largely unchanged today. Over the past 24 hours, it fell 0.4% to $2.52 trillion.

Total crypto trading volume in the last day is $102 billion.

While more coins are in the green compared to this time yesterday, the majority of the coins is still in the red.

The reddest of them all are CORE and Celestia (TIA). Each is down 7.8% to $1.42 and $6.42, respectively.

BEAM is next, with a fall of 4.9% to the price of $0.01786.

As for the green coins, Ethena (ENA) is the day’s best performer. It appreciated 10.4%, now trading at $0.4762.

Next up is Helium (HNT). Its price increased by 6.1% to $5.3.

The rest of the list is up 4.7% and below per coin.

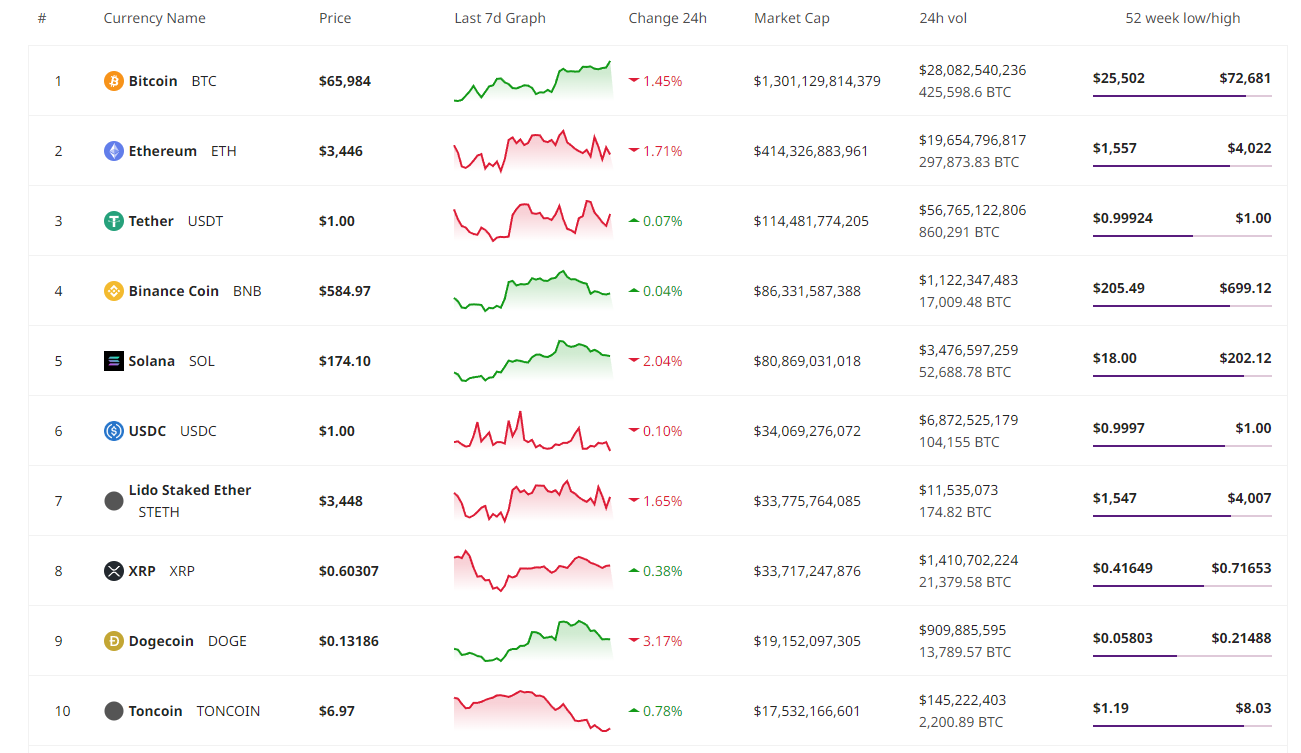

Zooming into the top 10 coins per market cap, we find that only three are up today.

All three green coins increased by less than 1%.

Toncoin is up 0.8% to just below $7, while XRP appreciated 0.4% to $0.60307.

Binance Coin (BNB) is also green, but with a 0.04% rise to $585, it’s unchanged over the past day.

On the other hand, Dogecoin (DOGE) saw the biggest loss. It fell 3.2% to $0.13186.

Solana (SOL) decreased by 2% to $174.1.

At the same time, Bitcoin (BTC) fell 1.45%, currently trading at $65,984, while Ethereum (ETH) decreased by 1.7%, changing hands at $3,446.

Meanwhile, Bitcoin spot exchange-traded funds (ETFs) saw outflows amounting to $77.9704 million on July 23, marking the first net outflow after twelve consecutive days of net inflows.

Also, Mt Gox transferred 37,477 BTC (worth $2.47 billion) on Wednesday from a cold wallet to an unknown address.

Digital Asset Investing Platform ETZ Now Offers SUI to Retirement Account Holders

ETZ, a service designed to simplify and improve digital asset investing in retirement accounts, announced that it now offers SUI, the utility token powering Layer 1 blockchain and smart contract platform Sui, as an investment option integration for holders of its IRAs.

In the USA, IRA stands for ‘individual retirement account,’ a special account in which individuals can save and invest money for retirement without having to pay taxes until withdrawals are made.

According to the press release, SUI can be held as an asset in a Tax-Advantaged Traditional or Roth IRAs, “offering an unparalleled solution for investors looking to diversify their retirement portfolios while maintaining all of the tax advantages of keeping their assets in such a fund.”

Welcome to Sui, @etzSoftIRA!

ETZ has done an immense amount of work breaking down barriers to open up a new category of options to real people looking to secure a financial future for themselves and their families.With the unique tooling and products that ETZ has… pic.twitter.com/lGQTXZYHSp

— Sui (@SuiNetwork) July 24, 2024

Also, ETZ employs a regulated, state-chartered trust company to hold self-directed IRAs and custody of assets.

This, said the announcement, ensures a secure and compliant investment environment while facilitating rollovers of IRAs and 401(k)s.

A 401(k) is a retirement savings plan in the US that provides tax advantages to savers.

The SUI integration comes with 24/7 access to their investments, the support of dedicated representatives, advanced security measures, and streamlined tax reporting.

Moreover, ETZ is insured up to $320 million. It provides Federal Deposit Insurance Corporation (FDIC) insurance on cash balances, as well as digital asset access through a tax-advantaged Simplified Employee Pension (SEP) IRA to “help companies attract top talent by providing a more modern and diverse retirement platform as a benefit.”

Bybit Introduces Zero-Fee Block Trading and Spot Liquidity Pairing Program

Crypto exchange Bybit has launched its Block Trading feature.

According to the press release, Block Trading offers zero fees, making trading accessible to all users.

It also enables traders to maximize returns without incurring additional expenses, it said.

Moreover, Bybit enforces strict verification processes and employs robust scanning protocols.

“This ensures transactions occur in a secure environment, minimizing the risk of fraud and maintaining transaction integrity,” the team said.

Bybit Block Trading enables users to complete the buying or selling of large-scale assets with a single transaction.

Furthermore, it reduces price slippage by matching large-scale demands.

This feature supports a range of fiat currencies, as well as USDT.

Join the Bybit Ethereum Ecosystem Bonanza!

Trade and Deposit to Earn From 20 ETH + 50,000 USDT Prize Pool. Embrace the Ethereum hype — trade and deposit to win a share of the massive prize pool!

Get started today: https://t.co/bwZmhazHK5#TheCryptoArk #BybitTrading pic.twitter.com/rqIrxBM9EI

— Bybit (@Bybit_Official) July 24, 2024

Additionally, the exchange announced the launch of the Spot Liquidity Pairing Program, offering liquidity providers the opportunity to join and collaborate with Bybit.

This initiative aims to connect quality Market Makers with projects seeking improved liquidity, the press release said.

Bybit will highlight Liquidity Providers in the ‘Premium’ category on the recommendation list to projects.

“This recognition helps in establishing strong partnerships and attracting more potential projects,” the team said.

The Premium Market Makers for July include Amber Group, Auros, CyantArb, DWF Labs, Flow Traders, Pulsar Trading, and Raven.

Bitget Partners with Upland to Launch Its Metaverse Headquarters with 888 Exclusive Properties

Major crypto exchange Bitget and Layer 1 gaming platform Upland have announced a strategic partnership centered around the launch of the utility token SPARKLET on Ethereum.

According to the press release, the collaboration will establish Bitget’s virtual headquarters in the metaverse built by Upland.

Bitget has purchased Treasure Island, comprising 888 properties. The properties will be distributed as rewards.

“This marks the final opportunity to receive unminted properties in the last unminted neighborhood of San Francisco, which was fully sold out two years ago,” the team said.

Bitget will establish the ‘Traders’ Hub’ on Treasure Island, featuring the Bitget Headquarters and a café with educational content.

The #Bitget Launchpool for #SPARKLET @UplandMe starts July 24, 13:00 (UTC) – don't miss it!

Join here: https://t.co/AVHWkvW4yr

Check out the past APRs for #Launchpool projects. pic.twitter.com/K8Ny4vJHJv

— Bitget (@bitgetglobal) July 24, 2024

Also, the collaboration will include extensive token airdrops and rewards for Upland and Bitget communities.

The giveaway campaigns will include a Bitget launchpool to farm SPARKLET, increased rewards for SPARKLET holders, a leaderboard for additional rewards, and staking SPARKLET for UPX rewards, among other things.

Additionally, eligible Upland users who owned SPARKLET before the Token Generation Event (TGE) will be rewarded with a 3.5 million SPARKLET pool of tokens over the next six months and a drop from a pool of $50,000 worth of Bitget Token (BGB).

__________

For the latest crypto news updates, bookmark this page and subscribe to our newsletter!

The post What’s Happening In Crypto Today? Daily Crypto News Digest appeared first on Cryptonews.