TL;DR

- Massive buyers scooped up greater than $7 billion price of ETH within the final 30 days.

- The asset’s worth is attempting to lastly break $4,200. Contemporary ETF inflows and a nine-year low in alternate balances level to additional positive factors, although an RSI above 70 alerts the opportunity of a short-term cooldown.

Whales Crammed Their Baggage

The worth of Ethereum (ETH) has been on a major uptrend up to now month, rising by nearly 50% to only south of $4,200. The resurgence was aligned with an enormous accumulation from whales (buyers who maintain between 10,000 and 100,000 cash), who purchased greater than 1.8 million tokens throughout that timeframe.

The USD equal of the stash is over $7 billion, whereas this cohort of market contributors now controls 28.5 million property, or roughly 23.6% of ETH’s circulating provide.

Purchases of this sort depart fewer cash accessible on the open market and will propel an extra worth rally (ought to demand stay regular or head north). The whales’ exercise can be intently monitored by smaller gamers who may resolve to imitate their transfer and distribute recent capital into the ecosystem.

Shortly after revealing the dimensions of the buildup, the favored X person Ali Martinez made a extremely bullish worth prediction. He argued that $6,400 turns into “a magnet” if ETH breaks above $4,000.

Different optimistic analysts embody CryptoELITES and Crypto GEMs. The previous set the subsequent goal at $4,500, whereas the latter envisioned a worth enhance past $5,000 this summer time.

Observing These Elements

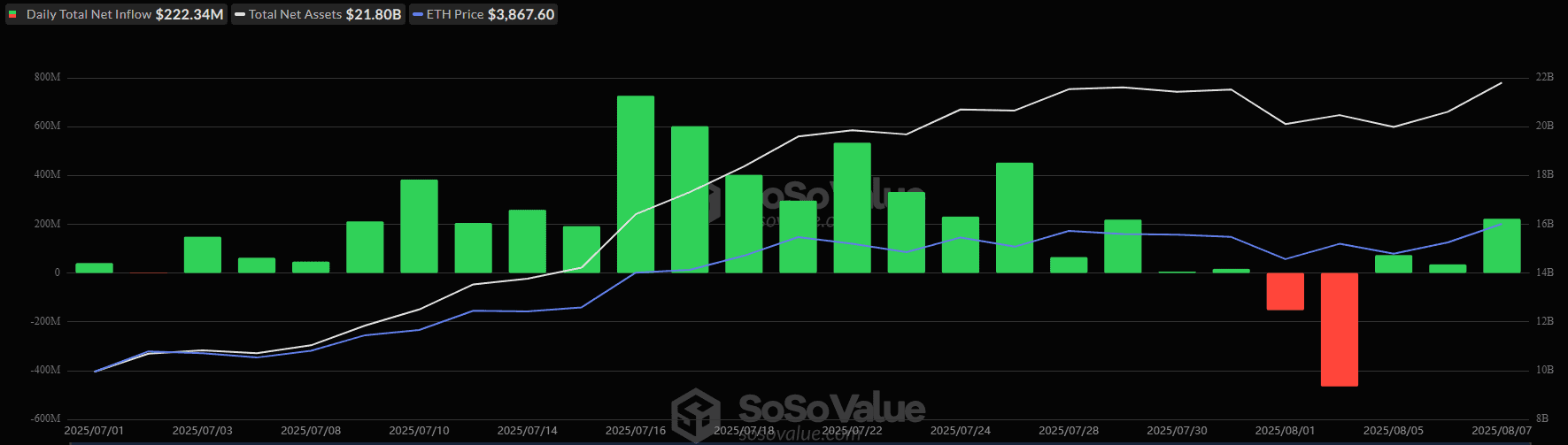

At the beginning of the month, spot Ethereum ETFs skilled important outflows; nevertheless, over the previous three days, capital has begun flowing again into the funds. This means that investor curiosity stays stable.

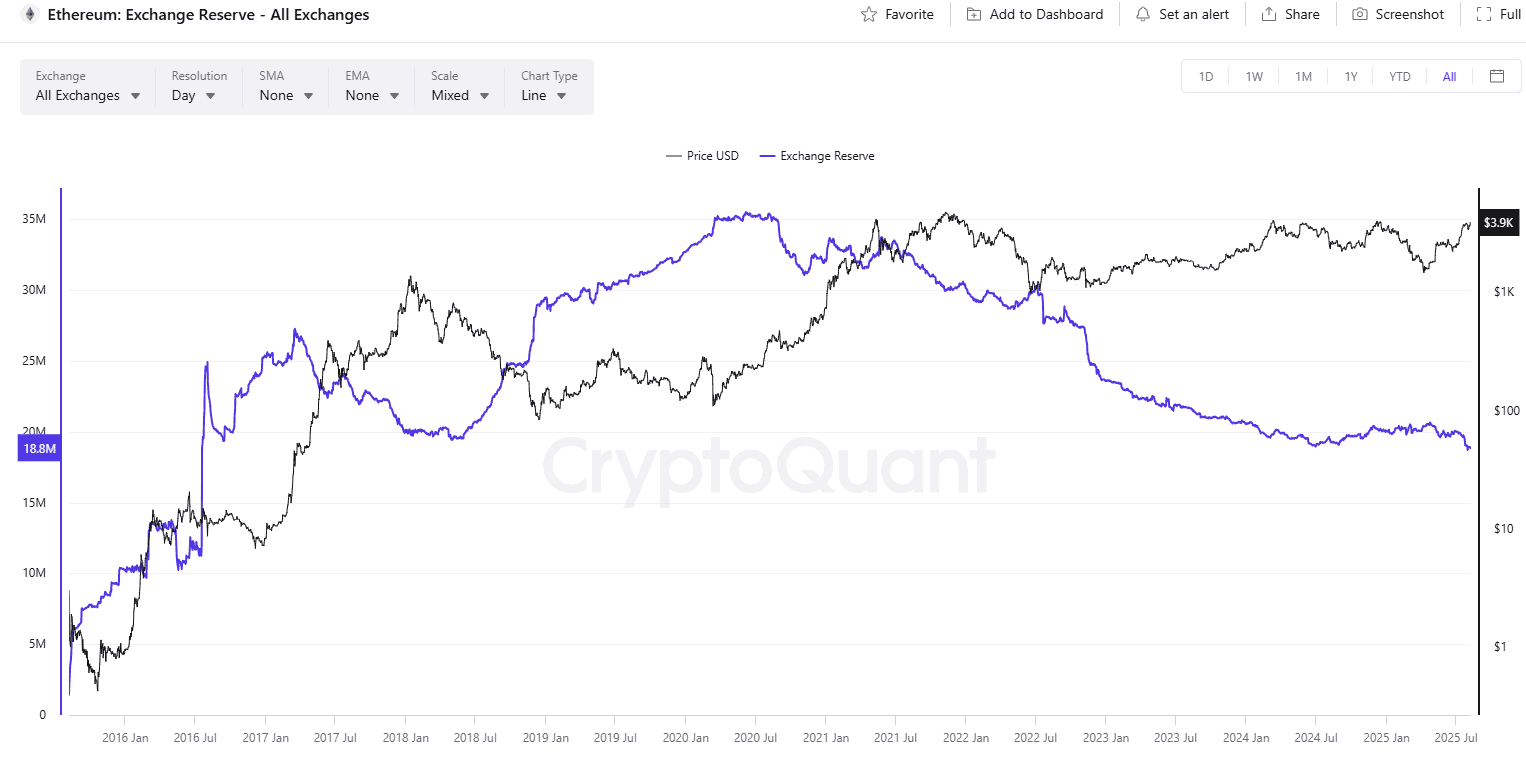

Subsequent on the checklist is the quantity of ETH saved on crypto exchanges, which not too long ago dropped to a nine-year low. This growth means that many buyers have shifted from centralized platforms towards self-custody strategies, which reduces the instant promoting strain.

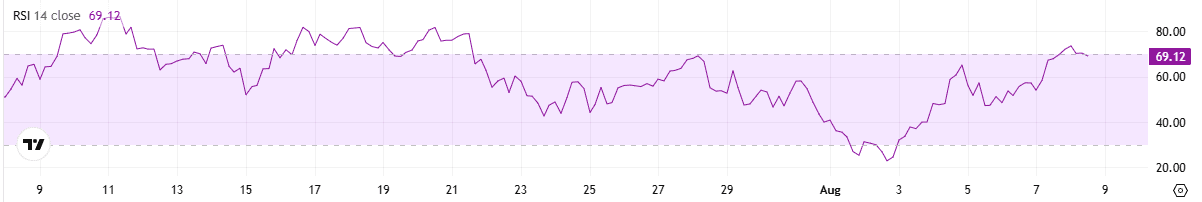

Then again, ETH’s Relative Energy Index (RSI) has climbed to bearish territory of 70. The technical evaluation software measures the velocity and magnitude of current worth modifications, and merchants use it to identify potential reversal factors. Readings above 70 point out that the valuation has soared too quickly in a brief interval and could possibly be a precursor to a pullback. Something beneath 30 is taken into account a shopping for alternative.

The put up What Are Massive Ethereum (ETH) Buyers Up To? appeared first on CryptoPotato.