Key Takeaways:

- Lawmakers at each ranges are rethinking asset storage via digital coin reserves.

- Proposals discover utilizing seized crypto to construct an extended‐time period monetary safeguard.

- The talk focuses on financial stability and debt‐administration advantages.

- Various methods reveal differing visions for a digital asset reserve.

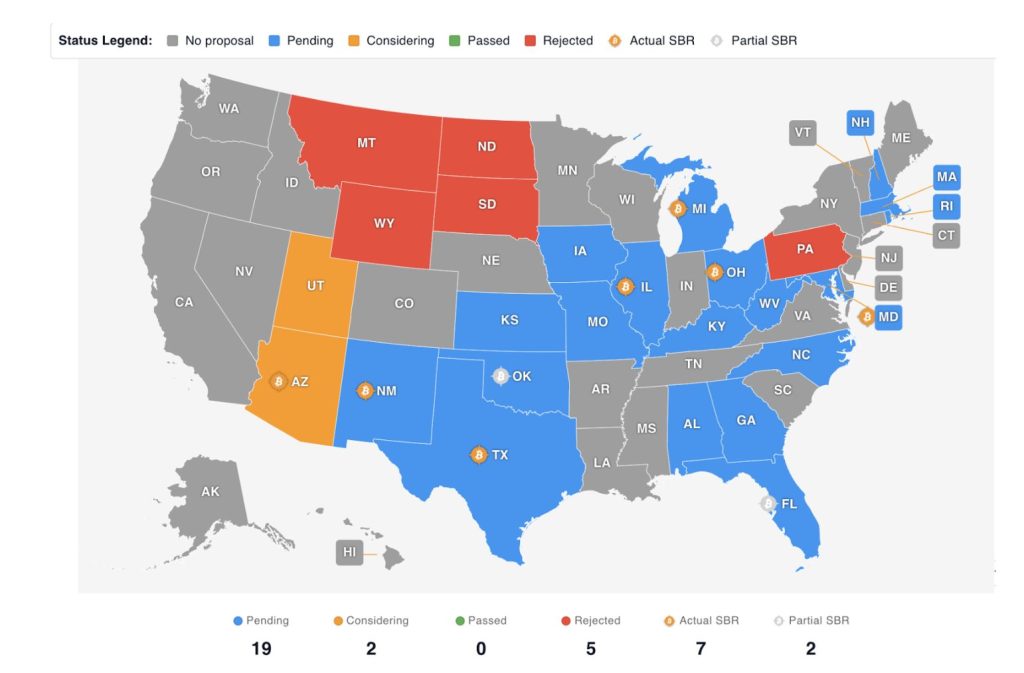

America authorities, together with numerous states throughout the nation, is at present exploring a Bitcoin Strategic Reserve (SBR).

On March 11, Senator Cynthia Lummis reintroduced laws to create a SBR.

The invoice, first launched final yr, proposes buying 1 million Bitcoin (BTC) over 5 years.

This may imply that the US authorities would formally acknowledge Bitcoin as a strategic holding, just like that of gold or oil.

U.S. lawmakers push for Bitcoin adoption—@RepNickBegich joins @SenLummis to introduce a invoice that might set up Bitcoin as a nationwide reserve asset. Might this reshape fiscal coverage? #CryptoPolicy #BitcoinReservehttps://t.co/zfQgh3BZgB

— Cryptonews.com (@cryptonews) March 11, 2025

Nineteen US states even have pending cryptocurrency reserve laws.

What A Nationwide SBR Might Look Like

Whereas it’s notable that each the US authorities and a handful of states are contemplating an SBR, these reserves will differ.

Ben Weiss, co-founder and CEO of digital forex platform CoinFlip, advised Cryptonews {that a} Nationwide Strategic Bitcoin Reserve will act as a rustic’s security web and energy play rolled into one.

“The US SBR will likely be managed by the federal authorities and goals to guard the nation’s financial system; assist hedge towards inflation and even strengthen its place in world commerce,” Weiss stated.

He added that the aim for a nationwide SBR is to behave as a digital gold vault for your complete nation, serving to to provide it monetary independence and a backup plan if conventional programs probably fail.

US Strategic Reserves Right now

The US at present holds substantial reserves in gold and oil. As of the third quarter of 2024, the US holds roughly 8,133.46 metric tons of gold.

Within the case of oil, the US maintains a Strategic Petroleum Reserve (SPR). As of August 2024, this reserve holds round 372 million barrels.

The SPR was established within the Seventies in response to the oil disaster and is valued at roughly $28 billion at present market costs.

Nonetheless, the US Bitcoin holdings are comparatively small when in comparison with gold and oil. This may possible change as soon as a SBR is formally launched.

Whereas many of the Bitcoin at present held by the US authorities has been seized via confiscations and illicit actions, Congressman Nick Begich (R-AK) not too long ago launched companion laws to Senator Cynthia Lummis’ BITCOIN Act.

U.S. lawmakers push for Bitcoin adoption—@RepNickBegich joins @SenLummis to introduce a invoice that might set up Bitcoin as a nationwide reserve asset. Might this reshape fiscal coverage? #CryptoPolicy #BitcoinReservehttps://t.co/zfQgh3BZgB

— Cryptonews.com (@cryptonews) March 11, 2025

If handed, the invoice would set up a program to buy 1 million Bitcoin items, representing 5% of the whole Bitcoin provide.

Texas SBR At A Look

Whereas a handful of US states are exploring a SBR, Texas seems to be main the way in which.

On March 6, the Texas Senate voted to approve Senate Invoice 21 to create a Texas SBR. The measure strikes on to the Home after a 25-5 vote.

On March 11, Texas lawmakers launched Home Invoice 4258, because the state’s second Bitcoin reserve invoice. The invoice proposes a $250 million allocation from the state’s Financial Stabilization Fund for investments in Bitcoin and different cryptocurrencies.

Lee Bratcher, President of The Texas Blockchain Council, advised Cryptonews that Texas has a finances surplus. This implies the Lone Star State has the funds to spend money on Bitcoin with out having to incur debt.

“Texas has a balanced finances and a finances surplus, so any funds spent will likely be funds invested on behalf of the state just like the ‘Wet Day Fund’ in any other case referred to as the Financial Stabilization Fund,” Bratcher stated.

“These funds would then be used to re-invest in Texas in case of emergencies. Texas already invests in lots of property like shares and actual property, so this isn’t a departure from the norm,” he added.

Bratcher added that the Texas Comptroller will use the identical prudent investor requirements to make a small allocation to Bitcoin to be held with a professional custodian.

“With Texas’ vital finances surplus, the Texas Strategic Bitcoin Reserve affords a forward-thinking funding alternative,” Bratcher remarked. “Bitcoin’s long-term potential as a retailer of worth aligns with our state’s historical past of creating sensible, diversified investments in rising property.”

A State Versus Nationwide SBR

Weiss identified {that a} State SBR is localized, which may probably enhance its financial system, entice tech innovation, and assist create a monetary cushion for its residents.

“Each a nationwide and state SBR are about getting ready for a world the place Bitcoin performs a much bigger position, however one’s a nationwide technique, and the opposite’s a state technique,” he stated. “They’re each vital to advancing crypto, our financial system, and our nation’s place as a pacesetter on the planet’s digital financial system.”

This seems to be the case. Terrence Yang, strategic advisor at Swan Bitcoin, advised Cryptonews {that a} federal SBR may help pay down the $36.22 trillion in federal debt.

“Long run, Bitcoin ought to proceed to outperform different liquid danger property and gold,” Yang stated. “Bitcoin is a $1.7 trillion asset, whereas gold is an $18 trillion asset.”

Yang additionally believes that it’s a matter of nationwide safety for the USA to personal each gold and Bitcoin.

“Doing so protects towards greenback debasement and will assist mitigate frontrunning at scale by different international locations like China, Germany, and Russia,” he acknowledged.

Whereas Texas’ SB-21 SBR invoice handed the Texas Senate 25-5, Yang famous that not like Trump’s SBR govt order, it makes no point out of conserving Bitcoin confiscated from asset forfeitures, and so forth. The Texas SBR can also be capped at simply $250 million.

“And sadly, Utah’s SBR part was eliminated earlier than its Bitcoin invoice was handed, and Wyoming’s SBR invoice died,” Yang added. “Texas appears the furthest alongside of any state, as SB-21 handed the Senate 25-5, and it’s now as much as the Texas Home to behave.”

Challenges That Might Impression a SBR

Whereas the joy round a nationwide and state-level SBR grows, there are challenges to think about.

For example, Eli Cohen, common counsel at real-world asset platform Centrifuge, advised Cryptonews that the primary problem for all of the proposals revolves across the worth of Bitcoin.

“The value of BTC is plummeting, making this appear to be a foul funding,” Cohen stated. “The brand new cash proposals are particularly challenged as a result of there’s already enormous cost-cutting occurring, significantly on the federal authorities.”

Worth apart, Yang believes that each a nationwide and state SBR seem like an initiative proposed solely by President Trump.

“The challenges related to the nationwide SBR and a state SBR are that the SBR seems an excessive amount of like a ‘Trump factor’ and never sufficient of a pro-America or pro-Texas initiative,” he stated.

Yang additional believes that Trump’s SBR govt order suffered from unhealthy timing as a result of danger property like shares and Bitcoin itself usually offered off considerably across the time he signed the order.

“I imagine this can give legislators at each the federal and state ranges – equivalent to in Texas – pause earlier than shifting ahead with an SBR,” Yang remarked.

All issues thought-about, Yang talked about that if a nationwide and state SBR are seen as bipartisan, these choices will additional legitimize Bitcoin as an asset meant to be held long-term by federal and state governments.

The submit US Strategic Bitcoin Reserve: Comparability of a Nationwide Versus State Providing appeared first on Cryptonews.