Uniswap ($UNI) climbed 15% this week, pushing previous $7.73 as merchants renewed their deal with the DeFi chief. The regular rise marks a transparent restoration from June’s low of $6.26, supported by a constant every day buying and selling quantity of over $350 million.

The upward transfer coincides with Uniswap v4’s robust adoption, dealing with billions in trades post-launch, whereas enhancing regulatory readability attracts extra institutional consideration to the protocol’s ecosystem.

From Regulatory Readability to Document Quantity: Why Uniswap Is Main the Subsequent DeFi Wave

Uniswap stays some of the compelling DeFi protocols to look at and purchase, due to its relentless tempo of innovation and rising institutional curiosity.

Institutional traders are additionally flocking to the protocol. The January 2025 launch of Uniswap v4 marked a turning level. This improve fully redesigned the structure by consolidating liquidity swimming pools right into a single PoolManager contract and including ERC-6909 assist.

ERC-6909 is a multi-token contract customary, a simplified various to ERC-1155.

In contrast to ERC-1155, ERC-6909 removes callbacks and batching from the interface, making it extra environment friendly.— Bloqarl | Zealynx (@TheBlockChainer) July 26, 2024

The ERC-6909 token customary helps each fungible and non-fungible tokens, providing flexibility. Apparently, “hooks” now permit builders to inject customized logic into swimming pools, unlocking new layers of automation, danger administration, and good routing in DeFi.

The impression has been instant. In keeping with blockchain information researcher Sean Kennedy, Uniswap v4 has already crossed $1 billion in complete worth locked (TVL) and processed over $86 billion in buying and selling quantity inside six months, indicating fast adoption.

UniSwap v4 simply surpassed $1B in TVL & over $86B in all-time v4 quantity since launching January thirty first pic.twitter.com/3k8g3yPPxW

— Sean Kennedy (@Sean_Kennedy_) July 1, 2025

Past v4, Uniswap can be producing substantial on-chain income. As of mid-2025, it persistently ranks among the many high fee-generating DeXs, with a 7-day common of roughly $2.3 million in every day charges, in response to CryptoFees.

It stays the most important DEX by cumulative quantity, surpassing $3 trillion in all-time trades throughout Ethereum and Layer 2 networks, together with Arbitrum, Optimism, and Base.

In the meantime, in a significant coverage shift, the U.S. SEC indicated in early 2025 that some decentralized protocols may very well be exempt from securities registration, providing regulatory respiratory area for Uniswap and doubtlessly sparking a “DeFi Summer time 2.0.”

For traders, Uniswap is greater than only a DEX. It’s the spine of infrastructure for decentralized finance. Its technical superiority, increasing cross-chain attain, and favorable regulatory developments make it some of the promising belongings within the present crypto cycle.

V-Formed Rebound or Bull Entice? $UNI’s 24% Surge Faces Key Take a look at

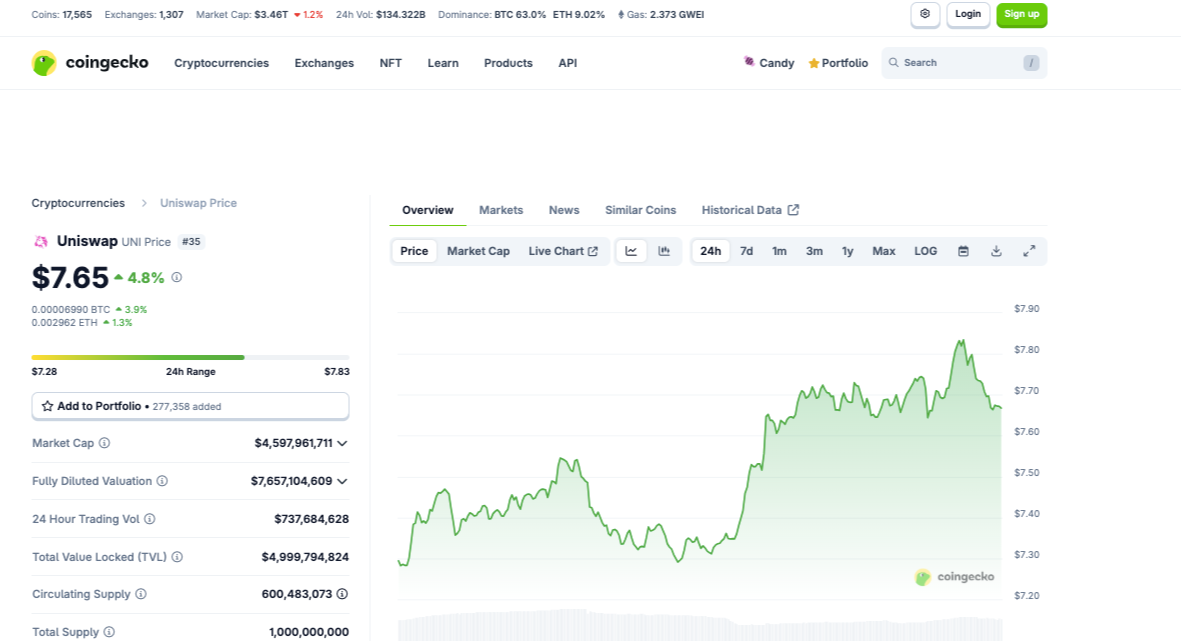

The $UNI/USDT 1-hour chart presents a traditional V-shaped restoration after a pronounced sell-off, now exhibiting indicators of near-term bullish exhaustion following its vertical rally.

From late June via early July, Uniswap consolidated between $7.00 and $7.30 earlier than a steep sell-off on July 1 drove the value all the way down to $6.26.

The following rebound was explosive, because the asset jumped 24% to $7.74 in below 48 hours, forming a near-perfect V-bottom reversal. This means robust bullish momentum, doubtless fueled by brief protecting and opportunistic shopping for at oversold ranges.

Nonetheless, the restoration’s sustainability is now in query. The present session’s worth ($7.684) sits just under the rally’s excessive ($7.745), accompanied by declining quantity—an indication of fading participation.

The MACD (12,26) tells an identical story. Whereas a bullish crossover initially supported the rally, the MACD line (0.108) has now dipped under the sign line (0.148), and the histogram (+0.140) is shedding upward momentum.

The convergence of weak quantity, bearish MACD divergence, and rejection close to $7.75 suggests profit-taking or purchaser fatigue.

A agency shut above $7.8 with growing quantity may invalidate bull exhaustion, whereas a failure to carry $7.6 may open $UNI to a extra substantial pullback towards $7.4, the place dip consumers could enter.

Whereas the V-bottom construction stays technically bullish, the confluence of weak quantity, bearish MACD crossover, and rejection at highs warrants warning. Merchants ought to await affirmation on the key ranges above or put together for a pullback to higher-probability assist.

The publish Uniswap Rallies 24% in 48-Hour V-Bounce – Can Bulls Defy Looming $7.60 Take a look at? appeared first on Cryptonews.