Belief Pockets has launched a prediction markets characteristic that lets its 200 million customers commerce real-world occasion outcomes immediately from their wallets with out leaving the app.

The wallet-native instrument went dwell on December 2 on Myriad on BNB Chain, with integrations with Polymarket and Kalshi to comply with quickly.

The transfer positions Belief Pockets inside a quickly increasing sector the place platforms like Kalshi just lately raised $1 billion at an $11 billion valuation, and Polymarket dominates with $248 million in whole worth locked.

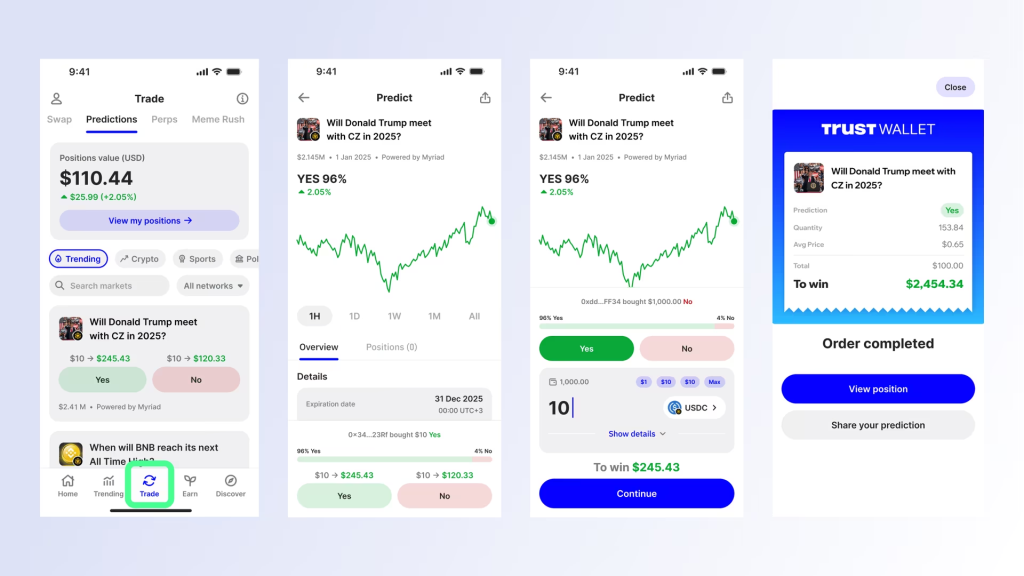

Belief Pockets customers can now browse curated occasions spanning crypto milestones, politics, sports activities, and world tendencies, then take YES or NO positions on outcomes tracked absolutely on-chain in self-custody.

Introducing Predictions in Belief Pockets

The primary main pockets with native predictions.

Commerce sports activities, crypto, politics & extra. Multi functional place & self-custodial.

Powered by @MyriadMarkets (dwell). @Polymarket & @Kalshi coming quickly.

Replace now: https://t.co/VHh3snlsip pic.twitter.com/LCOu9BbjTH— Belief Pockets (@TrustWallet) December 2, 2025

Pockets-Native Buying and selling Removes Platform Friction

Belief Pockets’s Predictions tab seems on the Swaps web page, eliminating the necessity for separate apps or accounts.

Customers choose occasions, select end result positions, and maintain tokenized shares completely on-chain by way of vendor sensible contracts.

Actual-time pricing and sentiment knowledge are surfaced immediately within the interface, whereas occasion decision is dealt with by built-in companions reasonably than Belief Pockets itself.

Myriad operates on BNB Chain for non-US areas, Polymarket runs through Swap.xyz on Polygon, and Kalshi presents regulated markets on Solana for US and world customers.

Entry varies by jurisdiction, with computerized geofencing utilized primarily based on every vendor’s compliance necessities.

The pockets handles regional restrictions robotically, routing eligible members to acceptable markets whereas blocking others.

The combination consolidates a number of prediction platforms right into a single interface, permitting customers to discover markets from totally different suppliers with out switching between web sites or managing separate accounts.

Every place sits on-chain within the person’s personal pockets, sustaining full transparency and self-custodial management aligned with Web3 rules.

Prediction Markets Present Robust Development Regardless of Early Dangers

Prediction markets have generated $3.7 billion in buying and selling quantity as of November, in keeping with Dune knowledge, with Opinion main at $1.5 billion, Kalshi at $1.2 billion, and Polymarket at $952 million.

Whole worth locked throughout the sector reached $337 million in November, up sharply from earlier within the yr as customers found they might revenue in stablecoins no matter broader crypto market circumstances.

The sector’s enchantment facilities on outcome-based returns that stay impartial of crypto market fluctuations.

Most bets are positioned in stablecoins, with outcomes decided solely by whether or not predictions show appropriate.

This construction has attracted members who constantly earn even throughout market downturns, although questions on insider-like conduct and pockets patterns persist throughout platforms.

The sector’s booming development has attracted massive gamers as properly.

Leaked screenshots present @Coinbase growing a prediction markets platform constructed on @Kalshi’s regulated infrastructure.#Kalshi #Coinbasehttps://t.co/2aWPAEBQcV

— Cryptonews.com (@cryptonews) November 19, 2025

Final month, Coinbase confirmed plans to launch its personal prediction platform through Kalshi. On the similar time, Robinhood and Susquehanna agreed to accumulate 90% of LedgerX to function a devoted prediction futures alternate launching in 2026.

Robinhood mentioned clients traded 9 billion contracts throughout greater than 1 million accounts within the first yr, making prediction markets its fastest-growing product by income.

Gemini additionally filed with the CFTC to turn out to be a delegated contract market, and Crypto.com launched a prediction product with Trump Media.

In reality, Google Finance introduced it should combine Kalshi and Polymarket knowledge immediately into search outcomes, bringing crowd-priced odds on future occasions alongside conventional market knowledge.

Intercontinental Alternate, proprietor of the New York Inventory Alternate, additionally agreed in October to take a position as much as $2 billion in Polymarket.

Belief Pockets Expands Monetary Providers Past Buying and selling

Belief Pockets CEO Eowyn Chen beforehand outlined plans to remodel the pockets right into a Web3 neobank providing self-custody, asset publicity, DeFi entry, staking, and identification administration in a single globally accessible app.

The corporate partnered with Ondo Finance in September to launch tokenized shares and ETFs, giving customers publicity to US equities with out conventional brokerage accounts.

Chen mentioned RWAs present entry to monetary merchandise beforehand unavailable to customers in rising markets, permitting participation with out sacrificing custody or counting on centralized platforms.

Thus far, Belief Pockets has built-in the 1inch Swap API to consolidate costs from decentralized exchanges throughout Ethereum, BNB Chain, Polygon, and Solana.

The put up Belief Pockets Enters Prediction Markets Race With New Buying and selling Function appeared first on Cryptonews.