Bitcoin bears have been in management currently, with the asset buying and selling effectively beneath final 12 months’s peak ranges.

The query now’s whether or not BTC can stage a decisive comeback or if a brand new painful pullback is on the way in which.

The Bullish Situation

The first cryptocurrency began the month on the flawed foot, with the correction intensifying on February 6 when it plummeted to round $60K, the bottom level since October 2024. Within the following days, it reclaimed some misplaced floor and at the moment trades at roughly $68,200 (per CoinGecko’s information).

One particular person touching upon the latest worth dynamics of BTC is the favored analyst Ali Martinez. He assumed that the asset seems to have shaped an “Adam & Eve” sample, wherein a break above $71,500 might set off a further pump to $79,000.

The bullish setup consists of two bottoms: a pointy drop (Adam) adopted by a rounder one (Eve). Some merchants see it as an indication that promoting stress is fading and that the worth might submit a considerable short-term revival.

Bitcoin’s Market Worth to Realized Worth (MVRV) helps the bullish outlook. The index compares the present worth of all BTC to the worth individuals initially paid to amass their holdings. Excessive ratios imply that traders are sitting on large income and will enhance promoting stress, whereas low readings is perhaps interpreted as the top of the bear market.

Over the previous few weeks, the MVRV has been steadily declining and now sits close to 1.25. In line with CryptoQuant, ratios above 3.7 point out a worth high, whereas values below 1 trace that the underside might have been reached.

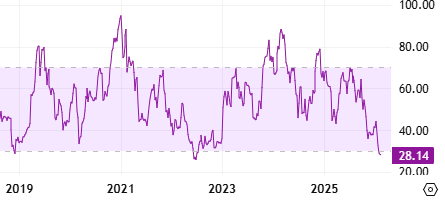

Bitcoin’s Relative Power Index (RSI) can also be price observing. The technical evaluation device measures the pace and magnitude of latest worth adjustments and supplies merchants with indications of potential reversal factors. It ranges from 0 to 100, with values beneath 30 seen as shopping for alternatives and suggesting that BTC could also be oversold. Quite the opposite, ratios above 70 are usually thought of a warning of a potential pullback. The RSI has fallen to twenty-eight on a weekly scale.

The Bear Section Is Simply Beginning?

Different analysts, together with Chiefy, consider one other painful decline is the extra probably choice for BTC within the quick time period. The X consumer argued that the asset is perhaps on the verge of a significant dump to $29,000 as early as this week and added:

“The ultimate Bull Entice of 2026 is over, and based on this chart, the subsequent crash has already began. Are you truly ready for the longest bear market in historical past?”

In the meantime, BTC balances on centralized exchanges have been climbing in latest weeks. Though this growth doesn’t assure additional draw back, it may very well be interpreted as a bearish signal as a result of it means the variety of cash that may be offloaded at any time is rising.

The submit Prime Bitcoin (BTC) Value Predictions: Revival to $80K or Brutal Crash Beneath $30K? appeared first on CryptoPotato.