A Bitcoin mining pool is a bunch of miners who mix their computational (hash) energy to spice up their possibilities of mining new blocks. To clarify extra merely, the miners join the mining {hardware} on the pool’s server slightly than creating your individual. Furthermore, the pool rewards are distributed amongst individuals based mostly on how a lot hash energy every supplies.

Mining swimming pools emerged as Bitcoin mining turned extra aggressive and resource-intensive, making it troublesome for smaller, solo miners to earn constant rewards. With out contemplating the expense of vitality and energy provides, the person would wish appreciable sources and capital to earn a constant, profitable reward.

Fast Navigation

-

- Advantages of Becoming a member of a Mining Pool

- How Does Bitcoin Mining Work?

- How are Rewards Distributed in Bitcoin Mining Swimming pools?

- Dangers of Utilizing Bitcoin Mining Swimming pools

- Greatest Bitcoin Mining Swimming pools

- Foundry USA

- AntPool

- ViaBTC

- Luxor Mining Pool

- F2Pool

Advantages of Becoming a member of a Mining Pool

- Consistency: Extra frequent rewards in comparison with solo mining.

- Accessibility: You may take part with out large {hardware} or electrical energy investments.

- Help: Many swimming pools provide less-experienced miners help, instruments, and steerage.

Mining swimming pools additionally improve community safety by rising the variety of miners concerned, sustaining decentralization, and stopping anyone entity from dominating the blockchain.

It’s a tricky market on the market for miners, given how fierce the competitors is, which is why most would go for pool mining resulting from steadier returns whereas nonetheless contributing to the community’s safety and decentralization. However, like something in life, there are a couple of execs and cons to every:

Solo mining execs:

- Full management over any mined rewards.

- No charges to a pool operator.

And cons:

- Irregular rewards; doubtlessly very lengthy gaps between successes.

- Excessive value for {hardware} and electrical energy.

Pool mining execs:

- Extra constant earnings resulting from collaborative efforts.

- Decrease preliminary funding in comparison with solo mining.

And cons:

- Pool charges cut back total revenue.

- Much less autonomy because the pool operator typically makes selections.

How Does Bitcoin Mining Work?

Now that the fundamentals have been defined, it’s time to dive a bit deeper into the specifics. To clarify how Bitcoin mining works, let’s use organising and becoming a member of a BTC mining pool for instance.

Selecting a Bitcoin Miner

Most Bitcoin miners use ASIC units, like an Antminer S19 or S9, as a result of conventional GPUs and CPUs are now not worthwhile for BTC mining. The mining rig ought to meet present effectivity requirements to remain aggressive.

Transferring on, match your energy provide unit (PSU) to the miner’s energy draw. For example, an Antminer S9 can eat roughly 1,375 watts, so a strong and dependable PSU is crucial.

Subsequent, arrange a steady, wired Ethernet connection (advisable) to attenuate downtime and guarantee your rig can talk constantly with the pool’s servers. It is because your shares (i.e., your items of labor to show your contribution to fixing the cryptographic puzzle) should be submitted as rapidly as doable, and wi-fi connections could expertise interruptions resulting from a number of parts (bodily obstacles, excessive latency, inconsistent bandwidth resulting from community congestion, and so on.).

Miner Settings and Pool Navigation

Naturally, you need to plug within the miner and the PSU and join an Ethernet cable to your native community. The subsequent step is to make use of a community scanner, like Indignant IP Scanner, to search out your miner in your native community.

The instrument will scan your community and present the IP addresses of all related units. Discover the miner’s IP deal with and enter it into an internet browser to open its management panel. Miners have default login particulars, typically “root/root” username and password, however it’s possible you’ll need to instantly change these credentials for safety so nobody else can entry your miner.

Choosing a Bitcoin Mining Pool

New miners ought to analysis swimming pools based mostly on charges, payout schemes, safety measures, and server geography. A number of the finest Bitcoin mining swimming pools embody F2Pool, Foundry USA Pool, and Slush Pool.

When you’ve chosen a pool, you have to create your employee credentials, that are mainly your username and password. Your username (needs to be) typically a mix of your pool account title and an non-obligatory “employee” identifier (e.g., account_name.worker_name), however the password will be of any worth (or the one advised by the mining pool).

Configuring the Miner

Subsequent, examine the pool’s web site and go to the dashboard to examine the listing of Stratum addresses. This can be a URL protocol that your miner will use to submit work and obtain duties. Whereas mining swimming pools provide a common/default Stratum URL, ideally, you need to select the closest server geographically resulting from decrease latency and higher effectivity.

For instance, in North America, it needs to be one thing like this:

stratum+tcp://btc-na.f2pool.com:3333.

In your rig’s management dashboard, go to miner configuration or settings and enter the Stratum deal with particular to your chosen mining pool, alongside together with your pool username and password.

After saving, your miner will start directing its hashing energy towards the pool.

Linking a Bitcoin Pockets

Join your Bitcoin pockets deal with to the pool. This may be a part of your account profile on the pool’s web site. Some swimming pools enable individuals to set a minimal payout threshold, controlling how typically their earnings are despatched to their wallets.

When you don’t have one already, try our information on a number of the finest Bitcoin wallets in 2025, from sizzling to chilly options.

Beginning the Mining Course of

After it’s configured, your miner will ship shares (the items of labor) to the pool, which aggregates all individuals’ hashing energy to search out legitimate blocks. In return, you obtain a proportion of block rewards proportional to your contribution. The extra you contribute, the extra you might be rewarded.

You may monitor your miner’s efficiency both via its personal interface or the pool’s web site.

How Are Rewards Distributed in Bitcoin Mining Swimming pools?

There are three sorts of payout fashions for rewards. Every method includes particular trade-offs regarding charges, rewards, and threat:

- Pay-Per-Share (PPS): With PPS, you obtain a set, predetermined payout for each share your mining {hardware} submits to the pool. The pool operator absorbs the danger of whether or not a block is definitely discovered, providing you predictable and regular revenue.

- Full Pay-Per-Share (FPPS): FPPS builds on PPS by paying a set price per share and together with an estimated share of transaction charges along with the block reward. This methodology gives much more predictable earnings by smoothing out the variability of transaction price revenue, however it will possibly include barely larger charges because the pool operator is assuming extra threat.

- Pay-Per-Final-N-Shares (PPLNS): This methodology pays out solely when the pool finds a block, distributing rewards based mostly on the proportion of the final N shares submitted by all miners. Your payout can fluctuate. If the pool is unfortunate otherwise you disconnect earlier than a block is discovered, your earnings for that interval could also be low or zero. Over time, nonetheless, this methodology can yield larger rewards throughout fortunate durations.

Learn how to Select the Correct Payout Methodology

Selecting a reward distribution mannequin is as essential as selecting the best pool. There are 4 details to contemplate: threat tolerance, charges, mining objectives, and dependency on operators, which will be summarized as follows:

- PPS and FPPS are good suits for many who desire a gentle revenue and keep away from fluctuations tied to dam discovery. Nonetheless, PPS and FPPS swimming pools are likely to cost larger charges as a result of they assume extra threat however pay their individuals no matter block discovery.

- Nonetheless, PPLNS swimming pools provide decrease charges however are rather more unstable. They typically have uneven payouts relying on how typically the pool finds blocks. In different phrases, the extra blocks which are discovered, the upper the yield.

Usually talking, there are two explanation why a miner would select PPs or FPPS: both they’ve restricted sources, or they need predictable, regular revenue. Nonetheless, these with substantial hashing energy and sources typically gravitate towards PPLNS due to the larger yields. This maximizes total earnings in occasions of bullish market exercise however accepts some short-term uncertainty, all in change for the largest rewards.

Dangers of Utilizing Bitcoin Mining Swimming pools

When utilizing a BTC mining pool, there are three foremost dangers miners ought to pay attention to.

- Energy focus

It’s no secret that giant swimming pools can dominate the share of the Bitcoin community’s whole hashrate. Such a focus of energy defeats the aim of decentralization, as a couple of entities wield elevated affect over transaction validation and block manufacturing.

One other threat to contemplate is chain and pool manipulation. Swimming pools could commit sure unethical practices, like withholding legitimate blocks to realize a bonus or censoring particular transactions to compromise the community’s safety and trustworthiness. Furthermore, operators maintain important management over reward distribution, and people dishonest could manipulate payouts, delay rewards, and even vanish with individuals’ funds (in what is named an exit rip-off).

- Safety considerations:

When assessing any mining pool, it’s prudent to confirm its monitor report of uptime, the safety measures in place, corresponding to superior Distributed Denial-of-Service (DDoS) safety, and its historical past of dealing with potential threats. In that sense, a safe and reliable pool protects your earnings and operational consistency.

A pool experiencing repeated disruptions (DDoS assaults, most frequently) can result in server downtime, impacting income. For example, in 2020, Poolin, one of many largest Bitcoin mining swimming pools on the time, suffered a DDoS assault wherein the pool’s servers have been flooded with malicious visitors. This brought about downtime and a lack of income for collaborating miners.

- Pool popularity

Along with the above, researching a pool’s popularity and transaction historical past is all the time a elementary step earlier than becoming a member of one.

Besides, there’s no assure {that a} respected mining pool gained’t interact in questionable habits. For example, F2Pool, a number one miner by way of community hashrate, drew criticism again in 2023 when it started filtering transactions linked to addresses sanctioned by the US Workplace of International Property Management (OFAC). It was discovered that the pool excluded particular transactions from its blocks, imposing exterior compliance measures inside what is meant to be a impartial, decentralized community.

For sure, this motion ran counter to Bitcoin’s precept of censorship resistance, sparking group backlash. F2Pool finally halted its filtering patch, however the level stays the identical.

Greatest Bitcoin Mining Swimming pools

A number of the high Bitcoin mining swimming pools are listed under, in response to their hashpower, reputation, payouts and costs, safety, and key options, amongst different essential issues.

Foundry USA

Foundry USA is the most important Bitcoin pool in 2025, controlling over 30% of the community hashrate.

Key Options

- Institutional-grade companies: Along with customary pool operations, Foundry gives treasury administration, BTC custody, and derivatives merchandise, that are principally focused at large-scale enterprises.

- Safety and compliance: Foundry has SOC 2 Kind 1 and Kind 2 certifications, which implies sturdy inside controls and operations. Furthermore, all members should fulfill Know Your Buyer (KYC) and Anti-Cash Laundering (AML) necessities earlier than becoming a member of, which can deter miners preferring anonymity however supplies a safer surroundings for each retailers and mining firms.

- Transparency and reliability: Detailed price constructions, exportable knowledge, and in-depth analytics. This enables miners to judge and monitor their efficiency rather more effectively.

Charges and Fee Strategies

Foundry USA has a tiered construction that adjusts charges in response to a miner’s quarterly common hashrate. Deductions come from the FPPS payouts, together with newly minted Bitcoin, e.g., block subsidies and transaction charges. Underneath FPPS, miners profit from common and predictable funds credited each day.

Furthermore, a 0.001 BTC minimal payout threshold makes Foundry approachable for smaller-scale operations, permitting frequent distributions even for these not contributing large quantities of hash energy.

Hashrate and Supported Gear

Foundry USA is the most important mining pool, contributing roughly 277 to 280 EH/s to the Bitcoin community. This implies it finds blocks rapidly, offering dependable payouts for collaborating miners.

The pool helps varied standard ASIC miners, together with Antminer S19 fashions, WhatsMiner M50 sequence, and AvalonMiner rigs.

Professionals and Cons

Professionals defined:

- Steady FPPS payouts, which embody transaction charges

- Excessive-level safety with SOC certifications and sturdy compliance measures

- Institutional companies, offering lending, custody, and superior monetary merchandise

- Superior analytics and instruments for miners

Cons defined:

- KYC/AML necessities, which will be off-putting for sure miners

- Holding over a 3rd of the community hashrate means the pool has an enormous affect on the Bitcoin community

AntPool

AntPool, launched by Bitmain Applied sciences in 2014, stays one of the influential Bitcoin mining swimming pools.

As of early 2025, it instructions near 19% of the community’s whole hashrate, offering miners with a strong infrastructure and a number of reward constructions. Though primarily targeted on Bitcoin, AntPool additionally helps different proof-of-work cryptocurrencies.

Key Options

- Multi-currency help: Along with Bitcoin, AntPool helps Bitcoin Money (BCH) and Litecoin, amongst different standard PoW choices.

- International server: AntPool operates servers worldwide, serving to cut back latency and off shares. This community design contributes to extra steady efficiency, no matter a miner’s geographic location.

- Day by day payouts and reliability: As soon as a miner’s stability reaches 0.001 BTC, earnings are despatched out each 24 hours. Safety measures embody two-factor authentication (2FA), DDoS safety, and pockets locks, all of which safeguard person accounts.

- Instruments and sources for miners: The dashboard gives real-time hashrate metrics, detailed revenue histories, and built-in profitability calculators. These options simplify monitoring and assist customers fine-tune their operations.

Charges and Fee Strategies

AntPool gives three payout schemes, they usually include various charges, influencing particular person earnings:

- PPLNS: 0% price (transaction charges not included).

- PPS+: 2.5% price.

- FPPS: 4% price.

Miners obtain payouts as soon as they exceed the 0.001 BTC threshold. Distributions happen each day after that stability is reached.

Hashrate and Supported Gear

With a reported output of roughly 132.7 EH/s, AntPool contributes near 19% of the full Bitcoin community hashrate. AntPool accepts many ASIC miners, together with Bitmain’s Antminer sequence (S19 Professional, S19 XP), WhatsMiner (M50), and AvalonMiner units. Though it’s developed by Bitmain, different SHA-256 ASIC rigs can join with out concern.

Professionals and Cons

Professionals defined:

- A number of payout fashions

- Zero price for PPLNS (transaction charges not included)

- Backed by Bitmain’s longstanding mining experience

- International server infrastructure for lowered latency

Cons defined:

- FPPS has the next price (4%) in comparison with some options

- Massive share of hashrate could improve centralization considerations

- Some customers discover the interface much less streamlined than different swimming pools

ViaBTC

ViaBTC is without doubt one of the finest crypto mining swimming pools, with a popularity for sturdy infrastructure, intensive coin help, and an unlimited suite of sources and instruments for miners.

Headquartered in China, it has turn out to be the third-largest Bitcoin mining pool globally, holding about 14% of the community’s hashrate as of early 2025. Along with BTC, ViaBTC covers quite a few different PoW cryptocurrencies.

Key Options

- Wide selection of property: ViaBTC helps over 20 crypto property, together with BTC, BCH, LTC/DOGE (merged mining), ZEC, and DASH.

- International server: Distributed servers decrease latency and guarantee steady connections for individuals throughout totally different areas.

- Auto-conversion: Miners aren’t required to manually commerce their BTC earnings because the pool can robotically convert their income.

- Safety measures: ViaBTC implements two-factor authentication (2FA), multi-level threat controls, and pockets locks for enhanced account safety.

- Superior instruments and cloud mining: The pool gives real-time efficiency monitoring, cellular apps for on-the-go monitoring, and a cloud mining function for many who desire mining with out proudly owning bodily tools.

Charges and Fee Strategies

ViaBTC gives PPS and PPLNS for miners, charging 4% and a pair of%, respectively.

Hashrate and Supported Gear

ViaBTC contributes round 83.5 EH/s, accounting for about 14% of Bitcoin’s whole hashrate.

Furthermore, ViaBTC helps ASIC miners for Bitcoin and different SHA-256 cash and GPU rigs for altcoins corresponding to Ethereum Basic (ETC) or Zcash (ZEC). It additionally gives varied setup guides for mining software program like PhoenixMiner or T-Rex Miner.

The default minimal threshold for payouts is 0.0001 BTC, making the pool accessible to smaller-scale individuals. Miners are paid as soon as they exceed this quantity, with disbursements sometimes processed each day.

Professionals and Cons

Professionals defined:

- Helps a number of cryptocurrencies for diversification

- Completely different payout strategies

- Low payout threshold to go well with smaller miners

- Robust safety features

- Auto conversion and different instruments to simplify person expertise

Cons defined:

- PPS charges are larger than most rivals

- Cloud mining continues to be thought-about dangerous because it’s typically related to market volatility

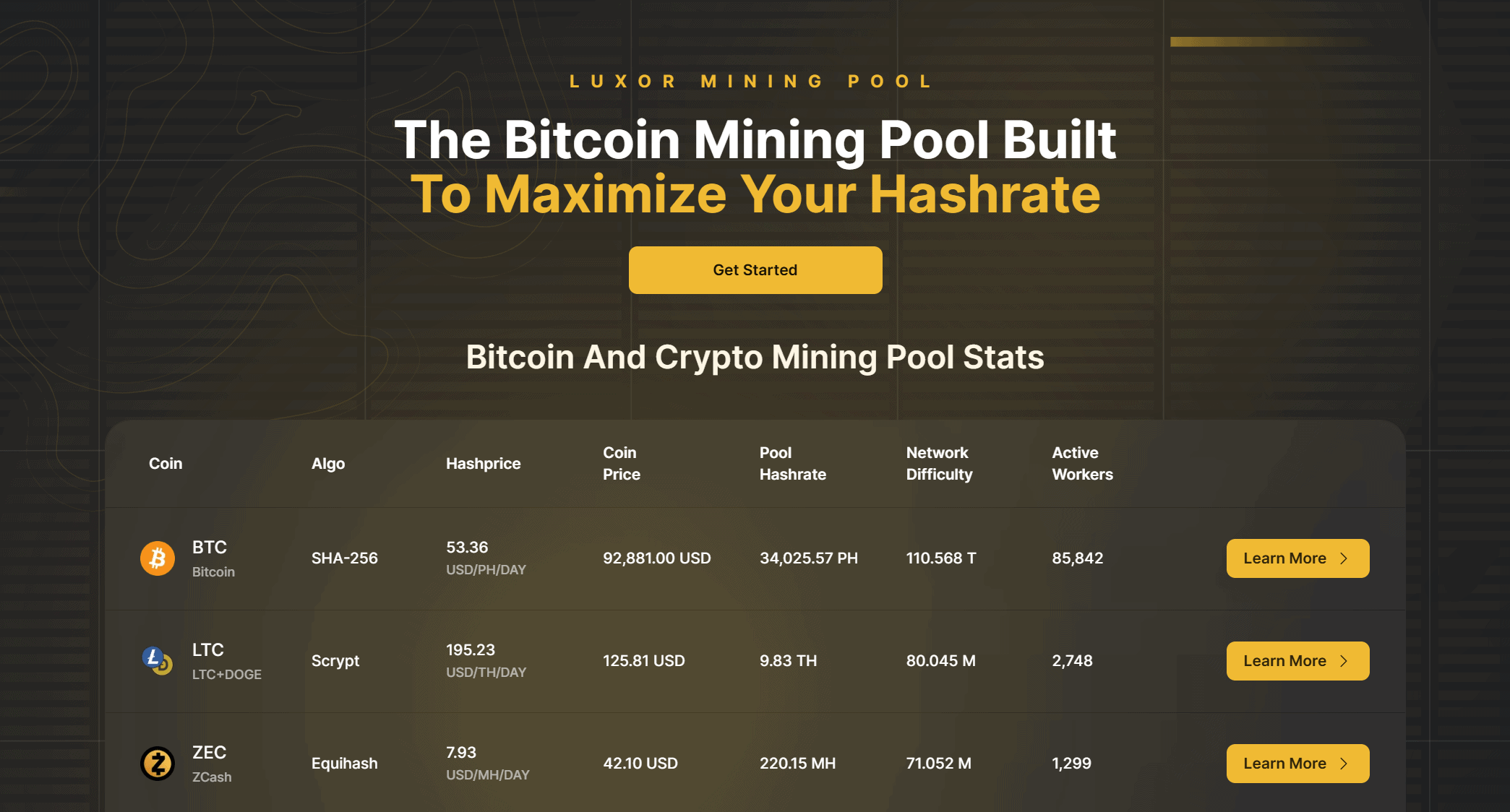

Luxor Mining Pool

Luxor Mining Pool, established in 2018, is a North American-based operation acknowledged for its Full Pay Per Share (FPPS) mannequin and broad help for a number of cryptocurrencies.

- Picture through: Luxor

Although its Bitcoin hashrate is decrease than some market-leading swimming pools, Luxor stays a robust selection for miners searching for hourly payouts, aggressive charges, and further companies like Catalyst, which permits mining altcoins however receiving rewards in Bitcoin.

Key Options

- Catalyst service: Multi-coin miners can direct their hash energy to cash like Zcash or Sprint however go for Bitcoin payouts, simplifying portfolio administration throughout varied networks.

- International servers: These are unfold throughout Asia, Europe, and the Americas to scale back latency and bolster uptime for miners worldwide.

- Superior analytics and developer instruments: Luxor’s dashboard gives detailed efficiency monitoring, an API for customized integrations, and user-friendly sources for real-time monitoring.

- Safety: The pool is licensed SOC 2 Kind 2, bolsters accounts with 2FA, and maintains cloud redundancy to safeguard miner knowledge.

- Tax reporting integration: Miners can companion with Luxor’s advisable platforms to automate tax filings for cryptocurrency revenues, streamlining compliance.

Charges and Fee Strategies

The pool expenses a price of 0.7% for Bitcoin, solely underneath the FPPS system, with constant hourly payouts based mostly on submitted shares, together with block rewards and transaction charges. For altcoins, the price construction could fluctuate, as some altcoins use PPS or PPLNS fashions (sometimes at 0% for PPLNS).

Luxor’s 0.7% price underneath FPPS compares favorably in opposition to different main swimming pools, particularly these with larger percentages for full pay-per-share payouts.

Hashrate and Supported Gear

Luxor contributes an estimated 20 EH/s to the Bitcoin community, which places it behind some bigger rivals but retains it influential in North America.

The pool works with main ASIC miners:

- Bitmain Antminer (e.g., S19 Professional, S19 XP)

- WhatsMiner (e.g., M50 sequence)

- AvalonMiner units

GPU mining can also be supported underneath the Catalyst function for sure altcoins. The minimal Bitcoin payout is 0.004 BTC.

Professionals and Cons

Professionals defined:

- Aggressive 0.7% FPPS price

- Hourly payouts for steady earnings

- Catalyst service converts altcoin beneficial properties into Bitcoin

- Robust safety (SOC 2 Kind 2, 2FA)

- Developer-friendly API for superior analytics

Cons defined:

- Roughly 20 EH/s—smaller than main swimming pools like Foundry USA or AntPool

- Larger payout threshold (0.004 BTC) will be much less handy for small-scale miners

- No merged mining help (can not mine a number of cash concurrently underneath a single algorithm)

F2Pool

F2Pool is among the many market’s longest-running and most various cryptocurrency mining swimming pools. Established in 2013, it helps over 40 digital property, together with Bitcoin, Ethereum PoW (ETHW), Litecoin (LTC), and lots of extra.

- Picture through: F2Pool

Alongside its broad coin protection, F2Pool gives a spread of payout constructions (PPS+, FPPS, and PPLNS), each day automated distributions, and powerful safety features to safeguard miners’ earnings.

Key Options

- Multi-currency help: F2Pool accommodates greater than 40 cryptocurrencies. It additionally helps totally different {hardware} for these altcoins.

- Superior instruments: F2Pool delivers in-depth statistics like real-time hashrate monitoring, income historical past, and profitability projections. It additionally helps cross-platform accessibility via internet and cellular apps, making it easy for miners to trace and handle their operations on the go.

- Safety measures: Robust DDoS defenses and safe payout methods assist decrease disruptions. The corporate’s popularity, constructed over practically a decade, is a testomony to its reliable infrastructure and immediate responses to potential threats.

Charges and Fee Strategies

2FPool gives three sorts of fee strategies, relying on the person’s want: PPS+, FPPS, and PPLNS.

F2Pool’s Bitcoin mining charges fluctuate based mostly on the payout mannequin, usually starting from 2% for PPLNS to 4% for FPPS. Though this can be barely larger than smaller swimming pools, many miners discover the steadiness and reliability worthwhile. Once more, all of it is determined by the person’s objectives and desires.

Bitcoin miners can anticipate a minimal payout of 0.005 BTC by default, which they’ll alter of their account settings to go well with their preferences.

Hashrate and Supported Gear

F2Pool supplies about 10% of the full Bitcoin community hashrate in 2025, translating into roughly 81.4 EH/s. This implies the pool typically finds blocks comparatively rapidly. Furthermore, most fashionable ASIC units, just like the Antminer S19 sequence, are appropriate, and F2Pool additionally accommodates GPU mining for sure altcoins.

Professionals and Cons

Professionals defined:

- A strong monitor report since 2013

- A variety of mineable cryptocurrencies

- Complete mining statistics and real-time monitoring

- Strong safety and DDoS protections

Cons defined:

- Larger charges than some competing swimming pools

- Has engaged in questionable practices that contradict Bitcoin’s decentralized nature, fueling considerations about Bitcoin mining centralization

The put up The 5 Greatest Bitcoin Mining Swimming pools in 2025: Full Information appeared first on CryptoPotato.