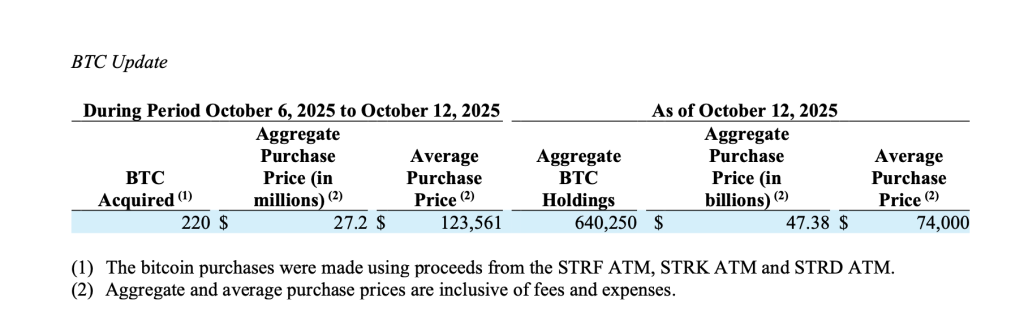

Technique Inc. has expanded its already-massive Bitcoin treasury, buying an extra 220 BTC for $27.2 million at a median value of $123,561 per bitcoin in the course of the week of October 6–12.

Technique has acquired 220 BTC for ~$27.2 million at ~$123,561 per bitcoin and has achieved BTC Yield of 25.9% YTD 2025. As of 10/12/2025, we hodl 640,250 $BTC acquired for ~$47.38 billion at ~$74,000 per bitcoin. $MSTR $STRC $STRK $STRF $STRD https://t.co/Ft9ZCh1EGx

— Technique (@Technique) October 13, 2025

The corporate’s complete Bitcoin holdings now stand at 640,250 BTC, bought for an mixture $47.38 billion at a median value of $74,000 per BTC.

The most recent accumulation reveals Technique’s continued conviction in Bitcoin as a core treasury reserve asset and follows the corporate’s ongoing collection of fairness gross sales by means of its At-The-Market (ATM) applications.

ATM Applications Gasoline Bitcoin Accumulation

Technique funded its most up-to-date Bitcoin purchases utilizing proceeds from its STRF ATM, STRK ATM, and STRD ATM applications. Based on the corporate’s submitting, these applications collectively raised round $27.3 million in complete notional worth in the course of the reporting interval.

The STRF ATM, tied to Technique’s 10.00% Sequence A perpetual strife most popular inventory, bought 170,663 STRF shares, producing $19.8 million in internet proceeds.

In the meantime, the STRK ATM, related to its 8.00% Sequence A perpetual strike most popular inventory, introduced in $1.7 million from 16,873 shares. The STRD ATM, primarily based on its 10.00% Sequence A perpetual stride most popular inventory, contributed $5.8 million from 68,775 shares.

Collectively, these choices have change into key financing automobiles for Technique’s ongoing Bitcoin accumulation technique—mirroring the corporate’s long-standing follow of changing fairness proceeds into digital belongings.

Strategic Growth Throughout Fairness Courses

Past its lively ATM applications, Technique maintains substantial capability for future issuances.

As of October 12, the corporate had $1.7 billion, $4.1 billion, $20.3 billion, and $15.9 billion accessible for issuance below its varied most popular and customary inventory courses (STRF, STRD, STRK, and MSTR, respectively).

This supplies a large monetary runway for additional growth of its Bitcoin reserves, signaling that further purchases might observe as market situations evolve.

Reinforcing Management within the Bitcoin Treasury House

With 640,250 BTC now below administration, Technique stays among the many world’s largest company holders of Bitcoin—alongside friends resembling MicroStrategy and publicly listed digital asset companies adopting comparable treasury fashions.

The corporate’s daring transfer displays rising institutional confidence in Bitcoin amid tightening financial coverage and elevated regulatory readability throughout main markets.

By mixing artistic capital-raising methods with disciplined accumulation, Technique continues to redefine how companies combine Bitcoin into their stability sheets—cementing its status as one of many pioneers within the digital-asset treasury panorama.

The publish Technique Boosts Bitcoin Holdings to 640,250 BTC After $27.2M Buy appeared first on Cryptonews.