TL;DR

- XLM breaks its 10-day SMA after a robust rally, opening the door for short-term weak point.

- Analysts outlined $0.8 and $8.00 targets if the worth regains momentum and breaks resistance zones.

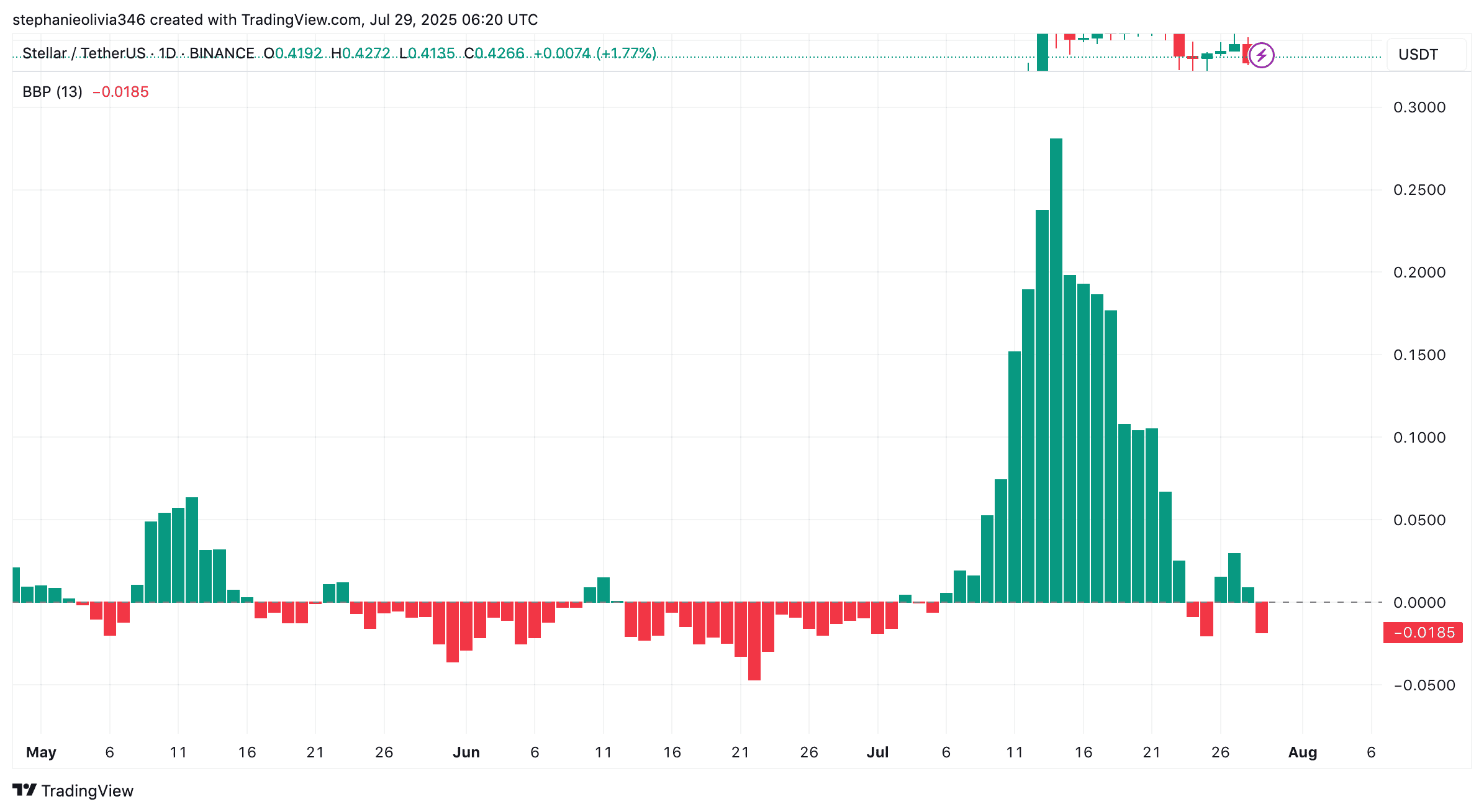

- The BBP indicator turns adverse, signaling that momentum has shifted from consumers to sellers this week.

XLM Breaks Quick-Time period Help

Stellar (XLM) has moved under its 10-day easy transferring common (SMA), a stage that not too long ago acted as assist throughout its July rally. The shift follows a robust month-to-month run that took the worth from under $0.30 to only over $0.50.

As of press time, XLM trades at $0.43 after falling almost 6% on the day. The 7-day efficiency reveals a drop of about 8%. The candle that broke the SMA closed with greater promoting quantity than the earlier periods. This drop under the transferring common has drawn consideration from merchants watching short-term momentum.

Chart analyst Ali Martinez posted:

Stellar $XLM simply misplaced the 10-day SMA as assist: bullish above, bearish under! pic.twitter.com/f3wkMHZhqd

— Ali (@ali_charts) July 29, 2025

To date, the worth has not recovered to the extent.

Evaluating Previous and Current Patterns

Some analysts are pointing to earlier market cycles for reference. Javon Marks famous that the present chart mirrors XLM’s 2015–2018 cycle. That ancient times featured a protracted downtrend, a wedge sample, and a breakout, adopted by a steep climb.

Marks wrote:

“Costs could be getting ready right here for one more 80% upside to and above the $0.79783 stage.”

If the worth breaks above that space, the analyst sees potential for a transfer towards $8.00, returning to the degrees seen in 2018. That will mark a 10x achieve from the place XLM trades now.

Primarily based on $XLM (Stellar)’s efficiency within the 2015-2018 bull cycle and the similarities on this one, costs could be getting ready right here for one more >80% upside to and above the $0.79783 stage!

Above that stage and XLM may push one other +900% to a greater than $8.00 worth level!

That’s a… pic.twitter.com/FC0igkrhi0

— JAVON

MARKS (@JavonTM1) July 29, 2025

On the identical time, dealer Peter Brandt warned that key ranges should nonetheless be met. “XLM should maintain above its April low close to $0.22 and should shut decisively above $1,” he wrote, or the token will “stay vary sure.”

Steadiness of Energy Flips Detrimental

The Bull-Bear Energy (BBP) indicator studying is now in adverse territory. The present worth is -0.0182. This comes after a big bullish transfer earlier in July, the place inexperienced bars on the indicator mirrored sturdy purchaser exercise.

In the meantime, that development has shifted. Purple bars at the moment are forming, suggesting that sellers are beginning to take management. The transition from inexperienced to crimson additionally reveals that momentum has cooled. If BBP stays under the zero line, it might level to continued strain.

What to Watch Subsequent

XLM is buying and selling slightly below its short-term assist. The $0.42–$0.45 zone may act as a call level. If consumers handle to push the asset above $0.45 with substantial quantity, a return towards $0.50 is feasible.

If not, merchants might even see additional promoting. With key ranges from previous cycles nonetheless distant, Stellar must stabilize above short-term strains earlier than any bigger transfer can start.

The put up Stellar (XLM) at Danger of a Main Crash After Dropping Key 10-Day Help appeared first on CryptoPotato.