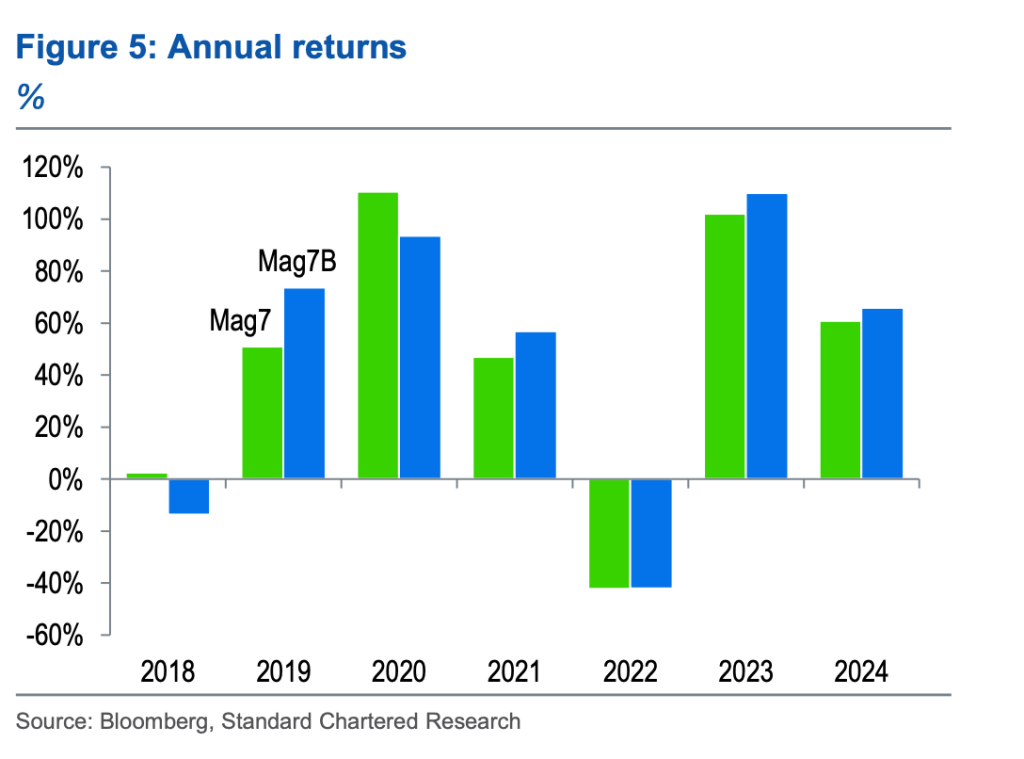

Customary Chartered has reimagined the “Magnificent 7” tech index by changing Tesla with Bitcoin—creating a brand new lineup dubbed “Magazine 7B.” The outcome? A mannequin that delivered 5% increased returns and almost 2% decrease volatility since December 2017.

Bitcoin’s market cap now exceeds $1.7 trillion, greater than double Tesla’s $800 billion.

In response to Geoffrey Kendrick, head of digital belongings analysis at Customary Chartered, BTC’s short-term correlation to the Nasdaq—not gold—suggests it now capabilities extra like a tech inventory than a conventional hedge.

“If Bitcoin serves each as a TradFi hedge and a tech asset, it broadens its institutional utility,” Kendrick mentioned.

The Magazine 7B mannequin beat the unique in 5 of the final seven years, with the next data ratio of 1.13 versus 1.04—underscoring stronger risk-adjusted returns.

Institutional Bitcoin Use Good points Momentum

Bitcoin’s institutional presence is rising steadily. Because the launch of spot BTC ETFs in early 2024, entry to Bitcoin has turn out to be as seamless as buying and selling big-name tech shares—drawing main gamers off the sidelines.

MicroStrategy bought 6,911 BTC ($584M) in March, lifting its whole holdings to 506,000 BTC—over 2% of the full provide, valued close to $33.7 billion.

$MSTR – MICROSTRATEGY PURCHASES 6,911 BITCOINS BETWEEN MAR 17 – MAR 23 AT AN AVERAGE OF $84,529

TOTAL: $584.10M pic.twitter.com/00eELp2d7g— PeloSwing

(@PeloSwing) March 24, 2025

Metaplanet, regardless of a 16% inventory decline final week, added 150 BTC and now holds 3,350 BTC. The corporate targets 10,000 BTC by 2025 and 21,000 BTC by 2026.

In the meantime, Trump Media is getting into the ETF area by way of a partnership with Crypto.com. The agency’s upcoming Fact.Fi-branded ETFs will embrace digital belongings like Bitcoin and Cronos, and be distributed throughout the U.S., Europe, and Asia.

TF is happening?

Trump’s media firm, Trump Media, simply signed an settlement with @cryptocom to launch crypto-ETFs

When Trump was speaking about successful a lot, I assumed he was speaking about us successful, not himself pic.twitter.com/Wa9McPoBsZ— Tehsin.eth (@Tehsin_Amlani) March 24, 2025

The deal—coupled with the addition of Eric Trump to Metaplanet’s Strategic Advisory Board—is including a layer of political capital to Bitcoin’s institutional story.

- MicroStrategy now holds over 2% of whole BTC provide.

- Trump Media’s ETF launch ties politics and crypto nearer than ever.

- Metaplanet targets 21,000 BTC by 2026 regardless of inventory stress.

Bitcoin Breaks Above $86.4K Triple Prime, Bullish Engulfing Alerts Extra Upside

Bitcoin (BTC/USD) lately broke above a triple-top resistance stage at $86,450, confirming the breakout with a bullish engulfing sample on the 4-hour chart. Worth is holding above the 50-period EMA at $85,227, reinforcing the short-term bullish construction.

If momentum sustains, the following resistance ranges to look at are $88,778 and $90,750. A every day shut above these ranges may set the stage for a check of $92,800. On the draw back, help rests at $86,450 and $84,870.

So long as BTC trades above the breakout zone, technical bias stays upward—notably as buyers place forward of potential tariff bulletins and key Fed alerts later this week.

Abstract Factors:

- Customary Chartered’s “Magazine 7B” index with Bitcoin outperformed Tesla in each returns and volatility.

- Bitcoin’s market cap ($1.7T) now greater than doubles Tesla’s, reinforcing its tech-stock correlation.

- MicroStrategy and Metaplanet proceed to build up BTC; institutional adoption reveals no indicators of slowing.

- Trump Media’s ETF push and Eric Trump’s involvement sign a rising political-financial hyperlink to crypto.

- BTC breaks above $86,450; momentum factors to $88,778 and $90,750 as subsequent resistance ranges.

BTC Bull: Earn Bitcoin Rewards with the Hottest Crypto Presale

BTC Bull ($BTCBULL) is making waves as a community-driven token that routinely rewards holders with actual Bitcoin when BTC hits key value milestones. In contrast to conventional meme tokens, BTCBULL is constructed for long-term buyers, providing actual incentives via airdropped BTC rewards and staking alternatives.

Staking & Passive Earnings Alternatives

BTC Bull provides a high-yield staking program with a formidable 119% APY, permitting customers to generate passive earnings. The staking pool has already attracted 882.5 million BTCBULL tokens, highlighting sturdy neighborhood participation.

Newest Presale Updates:

- Present Presale Worth: $0.002425 per BTCBULL

- Complete Raised: $4M/ $4.5M goal

With demand surging, this presale offers a chance to accumulate BTCBULL at early-stage pricing earlier than the following value enhance.

The publish Customary Chartered Says Bitcoin Beats Tesla in Returns and Volatility – What It Means for BTC Worth appeared first on Cryptonews.