[PRESS RELEASE – Singapore, Singapore, April 2nd, 2025]

StaFi has introduced the subsequent section of its growth technique with the launch of Revamp Wave 2, introducing “Staking AI Finance” as a part of the protocol’s ongoing evolution from liquid staking infrastructure to AI-integrated providers.

Transition to Staking AI Finance

This section represents a strategic growth of StaFi’s service providing, shifting from its preliminary concentrate on Staking Finance to incorporating synthetic intelligence into its liquid staking structure. This growth builds on StaFi’s core infrastructure and is meant to assist AI-native purposes inside the staking ecosystem.

Protocol Background and Achievements

Since inception, StaFi has targeted on addressing liquidity challenges in proof-of-stake (PoS) networks by way of liquid staking tokens (LSTs). To this point, the protocol has launched a number of LSTs—together with rETH, rMATIC, rBNB, and rATOM—designed to supply staking utility whereas retaining liquidity.

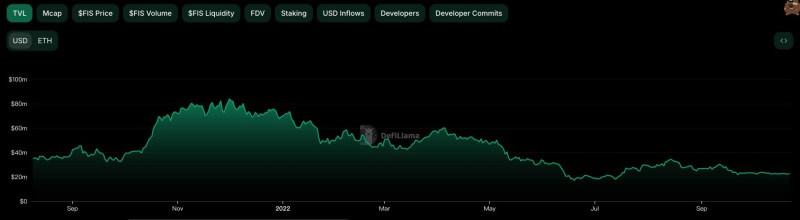

Key efficiency highlights embrace:

- Peaking at roughly $34 million in staked ETH by way of the rETH product.

- Managing 554 validators by way of its validator matching system.

- Attaining a complete worth locked (TVL) of $100 million throughout the ecosystem.

StaFi 2.0 and LSaaS

The StaFi 2.0 improve launched Liquid Staking as a Service (LSaaS), a framework that allows builders to create customized LSTs and Liquid Re-staking Tokens (LRTs). This infrastructure gives instruments throughout varied blockchain ecosystems, together with:

- ETH LSD Stack

- EVM-based networks (SEI, BNB)

- LRT platforms (EigenLayer, Karak)

- BTC-based LSD (Babylon)

- Cosmos and Solana ecosystems

Ecosystem Collaborations

To reinforce interoperability and growth capabilities, StaFi has partnered with:

- Chainlink, for CCIP integration

- Everclear, for cross-chain interoperability

- zkMe, for zero-knowledge proof purposes

- Vouch, for vPLS deployment on the ETH LSD stack

These partnerships purpose to increase StaFi’s position in creating cross-functional instruments for staking infrastructure.

AI Integration Initiatives

As a part of its transition to Staking AI Finance, StaFi is creating a number of AI-focused purposes. Notable tasks embrace:

- Staking Code Agent: A software designed to generate blockchain code utilizing pure language, based mostly on StaFi’s current LSaaS structure.

- Staking Assistant Agent: A language-based interface that facilitates yield optimization and staking execution by way of conversational enter.

Each instruments make the most of giant language fashions (LLMs) to cut back technical boundaries for builders and end-users, supporting broader adoption of staking applied sciences.

Outlook

StaFi’s strategic path displays a broader pattern towards incorporating AI capabilities into blockchain protocols. Additional updates on the event and deployment of StaFi’s AI brokers are anticipated within the coming weeks.

About StaFi Protocol

StaFi is a protocol providing Liquid Staking as a Service (LSaaS) for PoS networks. It permits the creation of Liquid Staking Tokens (LSTs) and Liquid Re-staking Tokens (LRTs) for ecosystems together with Ethereum, EVM-compatible chains, Bitcoin, Cosmos, and Solana. The protocol points rTokens (e.g., rETH, rBNB) to offer staking rewards whereas preserving asset liquidity.

For added data, customers can go to:

Web site | rToken App | LSaaS | X | Telegram | Discord | Medium | Discussion board | Mirror

The submit StaFi Revamp Wave #2 – From Staking Finance to Staking AI Finance appeared first on CryptoPotato.