Stablecoins have already gained a sure stage of acceptance inside the cryptocurrency market. Nevertheless, upon the election of Donald Trump as president, this “obvious” acceptance transitioned into full-blown rules. Any discuss of a Central Financial institution Digital Forex that would have weaponized blockchain to create a centralized financial system was pushed apart, giving means for stablecoins to prosper.

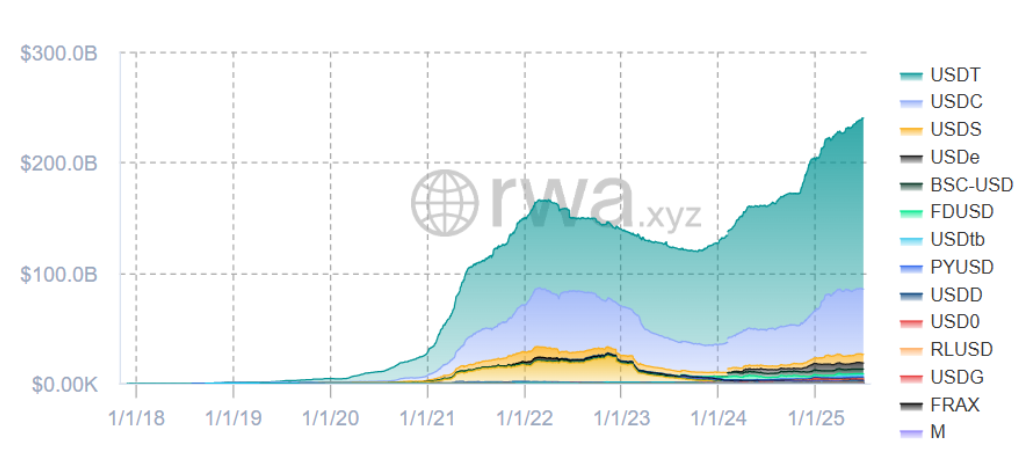

This shift in notion prompted main adjustments to key information factors. The stablecoin market cap stood at roughly 202 billion {dollars} by the tip of 2024, marking a 64.3% leap from the earlier yr. The identical applies to development in transaction quantity, which rose from $750 billion to over $4 trillion.

What spurred this development? The reply is straightforward: a mixture of risk-averse sentiment and a want to interact with blockchain belongings which have an underlying secure core, which stablecoins present.

Past the Quantity: Digital Wallets Getting Extra Traction

It isn’t solely the transaction quantity that’s thrilling. What additionally issues is that stablecoins at the moment are saved in over 100 million digital wallets. With month-to-month energetic customers upwards of 25 million, the expansion of those wallets represents a development: buyers at the moment are in search of methods to realize management of their asset safety as an alternative of counting on change wallets.

MetaMask and TrustWallet are getting a whole lot of consideration, with Straits Analysis displaying that the crypto pockets market has additionally grown previous the $12.6 billion stage. And in 2025, the expansion will possible surpass the $19 billion mark.

The expansion isn’t restricted to digital wallets, as {hardware} wallets have seen related traction. Projections say that the {hardware} pockets market will develop to $2 billion by 2030.

What does it imply?

Customers wish to take a extra energetic position and now not want to depend on third events for the safety of their belongings.

Now, how does the expansion of stablecoins translate to the expansion of crypto wallets?

The main focus is straightforward. Extra demand for stablecoins means buyers search extra secure belongings to work together with the cryptocurrency market. And to retailer these secure belongings, they want a way of safety. That sense of safety is finest supplied by digital wallets that give customers full management of their belongings.

The Rise of {Hardware} Wallets: Greater Safety Turns into Extra Accessible

There was a time when novices caught with digital wallets, whereas {hardware} wallets had been the area of specialists. Nevertheless, occasions have modified, particularly following a number of key occasions.

First, there was the FTX collapse of 2022, which shattered folks’s belief in centralized exchanges. Then got here KuCoin’s settlement with the US Division of Justice, which pressured the change to go away the nation. Extra not too long ago, Bybit needed to grapple with a critical hacking incident.

All of those points have led folks to think about one factor: “Safety is simply attainable if my belongings are inside my very own management.”

This shift in mindset has fueled development within the {hardware} pockets sector. Ledger achieved double-digit development. Trezor took steps to make its consumer expertise extra beginner-friendly.

All of those {hardware} options are safe, however new customers need extra. That’s why choices like D’CENT Pockets have emerged with distinctive and sensible options.

With D’CENT, customers acquire entry to a structured method to Web3 participation. It acts as a information for brand new customers, serving as greater than only a pockets to safe belongings. It features as a digital assist instrument that helps customers make higher funding choices.

Serving to Customers Determine What to Do with Property: D’CENT’s New Mantra

D’CENT has all the time been on the forefront of introducing security-based improvements and has made constant efforts to strengthen the ecosystem. Nevertheless, this time, its updates deal with one thing much more priceless: decision-making.

What ought to customers do with a specific asset? Is it the proper time to behave? One wouldn’t usually count on a {hardware} pockets to assist reply these questions, however D’CENT does.

Past storage and switch, which could be managed via the D’CENT cell app, the newest additions introduce a number of distinctive options.

Funding Insights

With D’CENT, customers acquire entry to funding insights. They will view trending tokens by checking the top-ranked belongings on CoinGecko and CoinMarketCap to trace market actions. Actual-time insights are additionally out there, permitting customers to transform data into instant motion.

A serious replace consists of an on-chain perception function, which permits customers to evaluate a token’s exercise throughout a number of chains.

One other distinctive function alerts customers when main tokens enter the “Pattern 7” zones. When this happens, the app notifies customers, giving them the chance to behave on essential moments, reminiscent of short-term buying and selling or getting into a futures place.

Discovery Instruments

D’CENT is carving out its area of interest as an all-in-one discovery instrument. It permits customers to discover decentralized functions, DeFi, NFTs, and DAOs with ease, all whereas incomes rewards. Getting began is straightforward. It’s only a matter of connecting the pockets to a PC and interacting with distinctive Web3 providers.

Enhancing the Core Performance to Meet the Market’s Wants

The cryptocurrency market isn’t the identical anymore. Lots of its shortcomings have been uncovered, and its alternatives should now be seized by all. In consequence, wallets are present process their very own revolution. They’ve developed past mere storage options and now supply decision-making instruments that problem current paradigms and faucet into market flows.

The put up Stablecoins Have Redefined Crypto Wallets – Right here’s How appeared first on Cryptonews.