Solana (SOL) fell by 8% on Thursday to $115 after former President Donald Trump’s tariff announcement despatched the broader crypto market decrease.

SOL ranked among the many weakest performers within the prime 10 cryptocurrencies, with a year-to-date lack of 39.3%.

The so-called meme coin winter has weighed down each Solana’s token costs and its on-chain exercise.

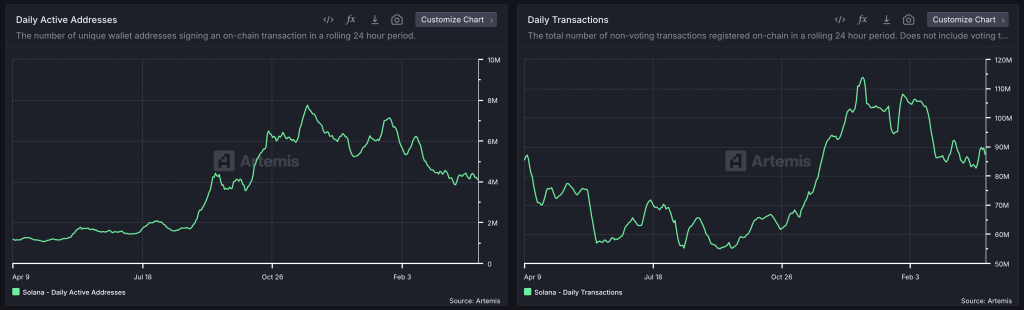

Each day transactions (DT) and each day energetic addresses (DAA) have each declined sharply.

Knowledge from Artemis reveals that the 7-day easy transferring common for DAA dropped from 7.8 million in December to 4.1 million on the time of writing.

Each day transactions additionally fell, with the 7-day SMA sliding from a peak of 113 million to 87.5 million, as meme cash proceed to dominate Solana’s on-chain exercise.

Nonetheless, the Solana community’s ecosystem has expanded. Stablecoin balances on Solana have elevated by greater than 300% over the previous 12 months.

On the identical time, decentralized change (DEX) volumes have remained regular in comparison with March final yr, with purposes like Jupiter, Raydium, and Pump.enjoyable sustaining regular utilization regardless of the market downturn.

Solana’s rising ecosystem suggests it might be positioned to climate present market pressures.

Solana Nears Key Assist Zone as Market Strain Builds

Solana seems near testing a key assist zone between $109 and $111, which has served as a flooring a number of occasions over the previous 10 months.

Traditionally, rebounds from this vary have led to notable recoveries for SOL, making it a degree price watching.

Market sentiment stays weak, however with the tariff information already public, a reversal might comply with if merchants imagine the worst has handed.

If SOL holds this assist and rebounds, it might climb again to the excessive $130s. A bearish breakdown, nevertheless, might see the token fall towards $100 within the coming days.

Technical indicators level to continued weak spot. The Relative Energy Index (RSI) has triggered a promote sign, and the MACD histogram has turned detrimental for the primary time since March 13.

The Solana community has beforehand struggled to deal with peak utilization. As its ecosystem grows, a layer-two scaling answer like Solaxy (SOLX) could assist cut back transaction delays and errors.

Solaxy (SOLX) Raises Practically $29M to Launch its L2 for Solana

Again in January when Official Trump (TRUMP) was launched, Solana struggled to maintain up with a spike in transaction volumes.

Solaxy (SOLX) would have helped on this state of affairs as its layer-two scaling protocol is designed to bundle transactions offline in a facet chain earlier than sending them to the mainnet.

Even when every little thing's on fireplace $SOLX has obtained your again.

Dive into the way forward for Solana underhttps://t.co/mdaTX9aVVx pic.twitter.com/YsoAikea3D

— SOLAXY (@SOLAXYTOKEN) April 3, 2025

Builders have already made important progress in releasing this rollup. They partnered with Hyperlane and Sovereign to carry out asset switch assessments on the Solana devnet and have reported again passable outcomes.

$SOLX, the L2’s utility token, will see its demand rise as soon as prime wallets and exchanges embrace Solaxy.

Solana continues to be the strongest competitor to Ethereum amid its low charges and quick transaction speeds. Therefore, the way forward for this L2 is sort of promising.

To purchase $SOLX, merely head to the Solaxy web site and join your pockets (e.g. Greatest Pockets). You’ll be able to both swap SOL, USDT, or ETH for this token or use a financial institution card to make your funding.

The submit Solana Slips Beneath $130, However One thing Larger Would possibly Be Brewing appeared first on Cryptonews.