Considered one of America’s largest banks, Morgan Stanley, introduced that they are going to be launching a SOL-linked exchange-traded fund (ETF), favoring a bullish Solana worth prediction as Wall Avenue’s urge for food for cryptos retains rising.

The monetary establishment filed the required paperwork to record each Solana and Bitcoin ETFs on Tuesday. These are the primary crypto-related merchandise of this sort that they’ll convey to the U.S. market.

Solana ETFs have attracted $801 million simply 6 months after the primary of those funds was launched nation.

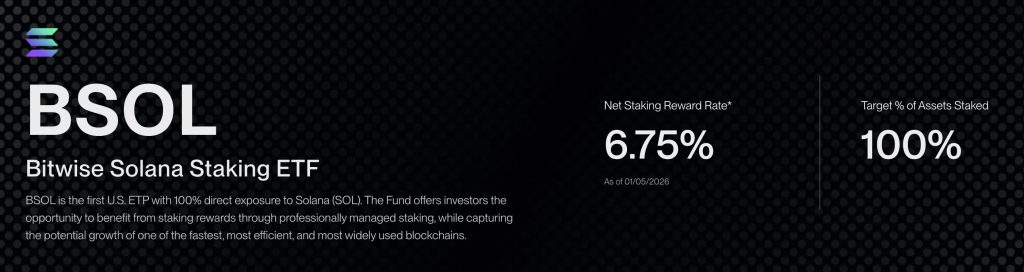

The most important of those ETFs by way of belongings below administration (AUM) continues to be Bitwise’s BSOL ETF with $730 million.

Staking rewards are a pretty function for traders. On the time of writing, BSOL’s staking yield sits at 6.75%. These rewards are added to the fund’s belongings every day and will increase the value of the ETF in the long term.

Solana Value Prediction: SOL Eyes $230 as Constructive Momentum Accelerates

Morgan Stanley’s choice to launch a Solana ETF offers this altcoin a powerful credibility increase. It additionally supplies additional affirmation of Wall Avenue’s sturdy curiosity in tokens past Bitcoin.

Prior to now week, SOL has gained 9% and at the moment sits at $138. In the meantime, buying and selling volumes stand at $5.5 billion, accounting for 7% of the asset’s market cap.

The every day worth motion reveals that SOL broke out of a falling wedge sample. This can be a bullish setup that, as soon as damaged, generally confirms a pattern reversal.

The near-term goal for the token could be the $160 stage, because the market will seemingly retest the 200-day exponential transferring common (EMA).

In the meantime, if SOL surpasses its 200-day EMA, it might attain $200 shortly, aided by rising institutional demand on Wall Avenue.

As curiosity within the Solana ecosystem retains rising, high crypto presales like Bitcoin Hyper ($HYPER) may ultimately draw Wall Avenue’s consideration as nicely. This can be a highly effective Solana-based Bitcoin L2 that may make it simpler for BTC traders to earn passive revenue on their belongings.

Bitcoin Hyper ($HYPER) Leverages Solana’s Effectivity to Increase Bitcoin’s DeFi Ecosystem

Bitcoin Hyper ($HYPER) brings actual utility to Bitcoin by unlocking quick, low-cost DeFi by way of Solana’s high-speed infrastructure.

With the Hyper Bridge, BTC holders can faucet into the Hyper Layer 2 straight from the Bitcoin community, with out ever giving up custody.

Which means lending, staking, and incomes yield on BTC for the primary time.

As extra Bitcoin flows into the Hyper L2, demand for $HYPER is ready to surge.

Buyers have already poured in over $30 million, recognizing the potential to revive Bitcoin’s ecosystem and open the door to true on-chain utility.

To purchase $HYPER earlier than its presale ends, merely head to the official Bitcoin Hyper web site and hyperlink up a suitable pockets like Finest Pockets.

You possibly can both swap USDT or SOL for this token or use a standard financial institution card to finish your buy.

Go to the Official Bitcoin Hyper Web site Right here

The put up Solana Value Prediction: Morgan Stanley Simply Filed for a SOL ETF – Is This the Starting of Wall Avenue’s Subsequent Crypto Obsession? appeared first on Cryptonews.