Silver and Bitcoin have spent a lot of the previous decade being mentioned in the identical breath, typically framed as parallel options to fiat cash and beneficiaries of macro stress.

That story is presently being put to the check, as the 2 belongings are drifting in wildly totally different instructions in late January 2026, indicating how buyers are actually valuing them as a vastly totally different commerce in a tightening monetary surroundings.

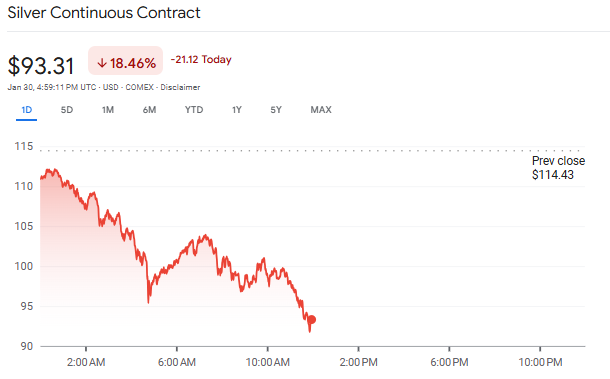

Silver shot to a recent all-time excessive on Thursday and briefly hit over $121 per ounce, solely to be violently pulled again, falling over 15% on Friday to about $97.

Bitcoin, then again, has been on a downward pattern on Friday, buying and selling round $82,800, roughly 2.2% in 24 hours after touching an intraday low close to $81,300.

There have been losses over time durations, with Bitcoin falling by nearly 7% within the final week, over 13% within the final two weeks, and about 22% compared to a 12 months in the past.

The cryptocurrency now trades over 34% beneath its file in October of over $126,000, which occurred amid an institutionally fueled run-up associated to inflows of spot ETFs.

Nonetheless, the value of silver stays roughly 25% up within the final month, practically 150% greater within the final six months, and greater than 200% up within the final 12 months, after having shot up in a large surge that began in 2025.

Silver Worth Surge because it Breaks Greater on Industrial Demand

The divergence has grow to be extra pronounced over the previous a number of months. In 2025, silver completed the 12 months up greater than 140%, whereas Bitcoin ended barely decrease.

Throughout components of late 2025, silver gained near 190% relative to Bitcoin over a four-month window, exhibiting how in a different way the 2 belongings responded to tightening monetary situations.

Knowledge exhibits that in January alone, silver surged about 39% earlier than struggling a pointy correction. Even with the pullback, the transfer has been historic: silver climbed roughly 158% from an October 28 low close to $45.51 to a late-January peak above $117, pushed partly by considerations round China’s export licensing and world provide constraints.

Moreover, COMEX silver inventories falling from about 532 million ounces in early October to roughly 418 million ounces, a drawdown of 114 million ounces, evidenced the narrative that the rally has been supported by actual provide dynamics quite than purely speculative flows.

Volatility patterns additionally flipped, as in December, silver’s realized volatility rose into the mid-50% vary, exceeding bitcoin’s, which compressed into the mid-40s as crypto markets entered a post-leverage unwind part.

Market contributors level to essentially totally different drivers with silver’s rally, which has been anchored in bodily provide tightness and industrial demand.

The steel has been working at a structural provide deficit over the previous few years, with the output of the mining sector failing to match the consumption.

Roughly half of the demand for silver is in industrial functions, equivalent to photo voltaic panels, electrical autos, and information facilities, which continue to grow at a really speedy tempo.

That backdrop has turned silver into what merchants more and more describe as a scarcity story.

Even this week’s sharp correction adopted a parabolic advance, with profit-taking and better margin necessities triggering abrupt sell-offs quite than a shift in longer-term demand tendencies.

Bitcoin Slips as Macro Fears and Tight Liquidity Hit Threat Urge for food

Bitcoin’s decline, in the meantime, has been intently tied to macro and liquidity situations.

Analysts have linked the most recent leg decrease to fears of a tighter U.S. coverage surroundings, together with hypothesis {that a} extra hawkish Federal Reserve management might maintain rates of interest greater for longer and preserve stability sheet restraint.

These considerations have weighed on danger belongings broadly, from equities to crypto, lowering urge for food for leveraged publicity.

Bitcoin has slipped beneath $89,000 as a hawkish-leaning Federal Reserve and Center East tensions sap danger urge for food.#Bitcoin #Cryptohttps://t.co/4mmQhy93nE

— Cryptonews.com (@cryptonews) January 29, 2026

Analysts have pointed to a tech-led selloff on Thursday, and in addition world markets weakened after Microsoft shares fell sharply following bulletins associated to synthetic intelligence funding, resulting in a drop in Bitcoin’s worth.

Crypto markets dropped alongside equities, with whole market capitalization falling by roughly $200 billion in a single session.

Liquidations exceeded $1 billion over 24 hours, with bitcoin longs accounting for a significant share.

CryptoQuant analysts famous that even a comparatively modest pullback in Bitcoin in contrast with metals was sufficient to set off practically $300 million in lengthy liquidations inside hours.

The distinction has reframed how buyers are viewing the 2 belongings, with analysts noting silver is behaving like a commodity below bodily stress, amplified by speculative momentum.

Bitcoin, regardless of its “digital gold” narrative, is buying and selling extra like a macro beta asset, rising and falling with liquidity expectations, ETF flows, and coverage indicators.

The put up Silver Is Buying and selling Like a Scarcity Story – Bitcoin Like a Macro Beta Commerce appeared first on Cryptonews.