[PRESS RELEASE – Singapore, Singapore, March 29th, 2025]

Scallop, a lending and borrowing protocol on the Sui blockchain, has recorded a powerful income of $79,920 over the previous 24 hours, in response to current knowledge from DeFiLlama. This achievement locations Scallop second amongst all decentralized finance (DeFi) lending protocols, trailing solely Aave, a well-established identify within the sector. The milestone underscores Scallop’s rising prominence throughout the Sui ecosystem and the broader DeFi panorama.

The Sui Ecosystem: A Basis for Innovation

Sui, a high-performance Layer 1 blockchain launched in Might 2023, has shortly emerged as a hub for scalable and environment friendly DeFi purposes. Designed with a singular object-centric knowledge mannequin and powered by the Transfer programming language, Sui provides low transaction charges, excessive throughput, and sturdy safety. These attributes have fueled important progress in its DeFi ecosystem, with Whole Worth Locked (TVL) surpassing $2 billion in early 2025, as reported by DeFiLlama. The blockchain’s capability to course of transactions in parallel and obtain immediate finality has attracted builders and customers alike, positioning Sui as a aggressive participant alongside established networks like Ethereum and Solana.

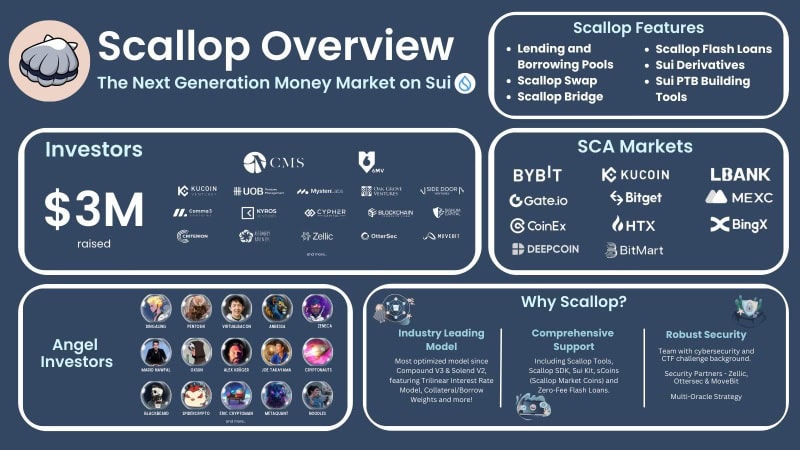

The Sui Basis, the group driving the blockchain’s growth, has performed a pivotal function in nurturing progressive tasks. Scallop stands out as the primary DeFi protocol to obtain an official grant from the Sui Basis, a testomony to its strategic significance throughout the ecosystem. This assist, mixed with backing from distinguished business gamers corresponding to CMS Holdings, sixth Man Ventures (6MV), UOB Enterprise Administration, and notable people like Dingaling, Pentoshi, and Digital Beacon, has offered Scallop with a robust basis for progress.

Scallop Protocol: Redefining Lending on Sui

Scallop Lend is a peer-to-peer cash market protocol constructed on Sui, providing customers a platform to lend and borrow digital belongings with institutional-grade options. Since its token era occasion (TGE) a 12 months in the past, Scallop has established itself as the highest lending and borrowing protocol on Sui, boasting a TVL of roughly $130.27 million as of March 29, 2025. This determine displays a notable 34% improve over the previous seven days, highlighting sustained consumer confidence and adoption. The protocol’s whole deposits and collateral at the moment stand at $187 million, with cumulative income reaching $3.94 million.

Scallop’s design emphasizes accessibility, safety, and consumer expertise. It separates lent belongings from collateral to reinforce resilience and employs a vote-escrow (ve) mannequin to incentivize borrowing exercise. Underneath this mannequin, customers who stake Scallop’s native token, $SCA, can entry increased yield rewards. So far, the group has locked greater than 27 million $SCA tokens—over 10% of the overall provide—for a mean length of three.72 years, signaling robust long-term dedication to the protocol.

Prior to now three days, Scallop has expanded its choices by itemizing the Walrus token and partnering with Binance Pockets to host a yield-focused exercise. These developments replicate Scallop’s ongoing efforts to diversify its ecosystem and improve worth for customers.

A Aggressive Drive in DeFi Lending

Scallop’s current 24-hour income of $79,920 positions it as a formidable contender within the DeFi lending area, trailing solely Aave, a protocol with a long-standing presence on Ethereum and different chains. With a give attention to scalability and innovation, Scallop leverages Sui’s technical benefits to ship a seamless expertise for lenders and debtors. Its open-source framework has additionally enabled different tasks throughout the Sui ecosystem to construct on its infrastructure, additional amplifying its affect.

Because the Sui ecosystem continues to mature, Scallop’s efficiency suggests it’s well-positioned to take care of its management in lending and borrowing. The protocol’s mixture of strategic partnerships, group engagement, and sturdy metrics underscores its potential to form the way forward for DeFi on Sui and past.

About Scallop

Scallop is the pioneering Subsequent Era peer-to-peer Cash Marketplace for the Sui ecosystem and can be the primary DeFi protocol to obtain an official grant from the Sui Basis.

The protocol provides a spread of economic companies, together with high-interest lending, low-fee borrowing, asset administration, and automatic market-making (AMM) instruments, all on a single platform. Moreover, Scallop offers a software program growth equipment (SDK) that permits skilled merchants to implement advanced trades, together with zero-interest loans simply. By emphasizing safety and adhering to greatest practices, Scallop goals to cut back the danger of malicious conduct within the DeFi area, offering customers with a reliable and dependable platform.

The submit Scallop Protocol on Sui Hits Report Income, Solidifying Management in DeFi Lending appeared first on CryptoPotato.