Ripple stays among the many most talked-about crypto matters as the corporate continues to develop globally and ink strategic partnerships.

Its native token, XRP, has missed the market-wide rally thus far, however quite a few analysts consider it’s about to surge within the close to future.

Ripple and Europe

On account of regulatory challenges within the US over the previous a number of years, the corporate shifted its focus overseas, with Europe rising as a key area. Earlier this week, it acquired preliminary approval for an Digital Cash Establishment license from the Fee de Surveillance du Secteur Financier (CSSF) in Luxembourg.

As soon as totally granted, the allow will allow Ripple to subject digital money and supply providers similar to digital wallets, cost processing, cash transfers, and pay as you go playing cards throughout CSSF-regulated jurisdictions.

Previous to that, Ripple Markets UK Ltd (the agency’s subsidiary in the UK) secured registration with the Monetary Conduct Authority (FCA), thereby confirming its compliance with native anti-money-laundering laws and counter-terrorist financing guidelines.

Different European nations the place Ripple has demonstrated a robust presence embrace Switzerland, Eire, Spain, and others.

The Newest Collaboration

Earlier in the present day (January 15), LMAX Group (a worldwide fintech firm headquartered in London) introduced a partnership with Ripple “to speed up institutional stablecoin adoption and cross-asset mobility.”

Based on the settlement, the previous will combine RLUSD (Ripple’s stablecoin) into its institutional buying and selling infrastructure, thereby enabling shoppers to entry a number of buying and selling choices.

The product, pegged 1:1 with the US greenback, noticed the sunshine of day in direction of the tip of 2024 and gained backing from many exchanges and well-known banking establishments. As an illustration, the oldest American financial institution, BNY Mellon, serves as a custodian for RLUSD.

The asset has been regularly climbing the crypto ladder and is presently the 81st-largest digital asset, with a market capitalization of virtually $1.4 billion.

One other Inexperienced Day for the ETFs

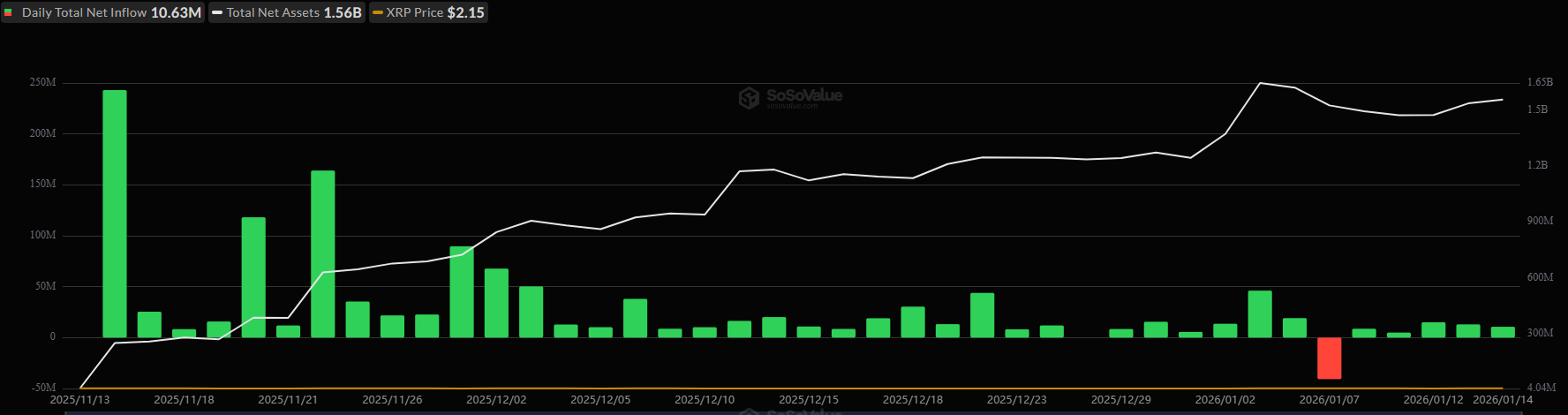

Canary Capital made historical past in November final 12 months, turning into the primary firm to launch a spot XRP ETF within the US, which has 100% publicity to the token. Shortly after, famend names similar to Bitwise, Franklin Templeton, Grayscale, and 21Shares adopted go well with, and curiosity from buyers has been important.

Based on information from SoSoValue, these monetary automobiles have generated a cumulative internet influx of $1.26 billion thus far, and the one day on which outflows have surpassed inflows was January 7. The overall internet inflows for the previous 24 hours stood at roughly $10.6 million.

XRP Worth Outlook

As of this writing, the asset trades at round $2.12, representing a mere 0.6% improve on a weekly scale. This contrasts with the double-digit worth spikes that different altcoins, similar to Monero (XMR) and Web Pc (ICP), have posted throughout the identical interval.

Regardless of the consolidation, many business members argue that XRP could possibly be on the verge of a significant bull run. X consumer Amonyx predicted a pump above $18, advising buyers that “endurance is essential.” LEB CRYPTO can be very bullish, envisioning an explosion to virtually $60 within the following years.

Nevertheless, there are some warnings of a pullback, with X consumer EGRAG CRYPTO describing a possible crash to $1.40-$1.20 as “the worst-case zone.”

The publish Ripple (XRP) Information Right this moment: January fifteenth appeared first on CryptoPotato.