Ethereum co-founder Vitalik Buterin has defended prediction markets towards critics who view betting on real-world occasions as morally questionable, arguing that these platforms supply superior truth-seeking mechanisms to social media whereas addressing issues about their potential to incentivize hurt.

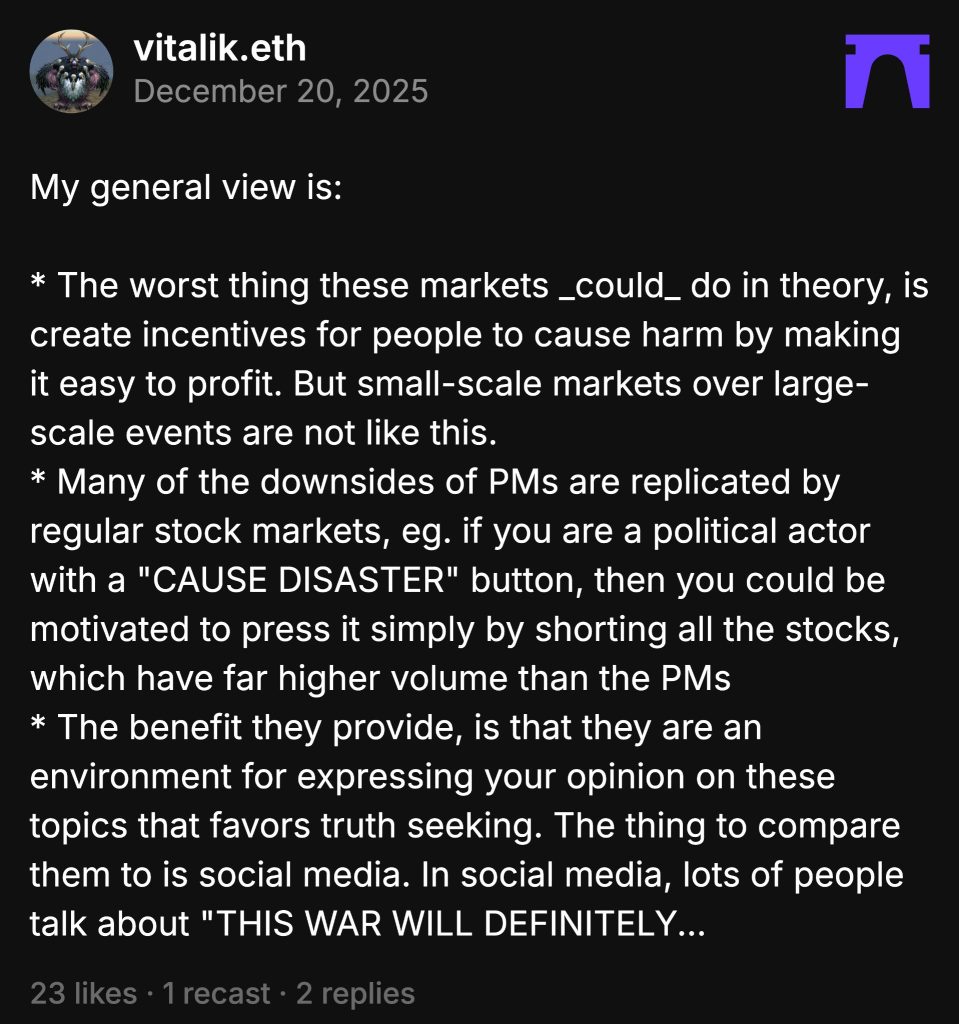

Writing on Farcaster, Buterin acknowledged prediction markets might theoretically create incentives for dangerous actions however dismissed this threat for small-scale markets protecting giant occasions.

He famous that common inventory markets pose related issues, declaring that political actors might revenue from disasters just by shorting shares with far greater volumes than these on prediction platforms.

Fact-In search of Versus Social Media Sensationalism

Buterin positioned prediction markets as options to social media’s elementary accountability hole.

“The factor to check them to is social media,” he wrote, explaining how platforms reward sensationalism over accuracy.

“In social media, a lot of individuals speak about ‘THIS WAR WILL DEFINITELY HAPPEN’ and scare individuals, and there’s no actual accountability: you achieve clout within the second (and that clout is commonly very monetizable clout!), and no accountability after the very fact.“

He contrasted this with prediction markets the place monetary stakes implement truth-seeking.

“With prediction markets, in case you make a dumb guess, you lose, and the system (i) over time turns into extra truth-seeking, and (ii) reveals chances that replicate real uncertainty on this planet far more faithfully than these different programs,” Buterin defined.

The Ethereum founder shared private experiences utilizing prediction markets to confirm alarming information.

“I can personally report just a few instances studying a information headline, feeling scared, then checking polymarket costs and feeling calmer – the individuals who have expertise on that matter know what’s happening and the chance of something uncommon occurring is simply 4%,” he wrote.

Buterin additionally defended prediction markets towards comparisons with monetary markets.

“I truly discover prediction markets to be more healthy to take part in than common markets,” he acknowledged, explaining that “costs are bounded between 0 and 1, so they’re much much less dominated by reflexivity results, ‘larger idiot idea’, pump-and-dumps, and many others.“

Fierce Moral Debate Divides Business

Buterin’s protection sparked heated exchanges with critics led by Quilibrium founder Cassie Coronary heart, who argued that betting on deaths explains mainstream hatred towards crypto.

“I don’t know fam however in case you ask me the thought of playing on whether or not a bunch of persons are going to die is why this business is hated by the bulk,” Coronary heart wrote on Farcaster.

Coronary heart escalated her criticism with provocative situations. “Possibly they’ll begin slapping sponsor labels on missiles whereas we’re at it,” she prompt, including,

“These kids have been slaughtered because of the nice bidders at Polymarket and Kalshi. Thanks Coinbase!“

When Buterin offered prediction markets as info instruments, Coronary heart challenged the framing straight.

“Okay, so right here’s my counter: a prediction marketplace for whether or not or not somebody will get killed to be able to affect a prediction market end result,” she posed, questioning whether or not Buterin accepted such outcomes.

Different commenters supplied historic context supporting the usage of prediction markets.

One person referenced “Superforecasting,” noting that the NSA beneath Bush and Obama ran personal prediction markets through which contributors performing as info gatherers outperformed CIA and NSA operatives.

“We are able to have ethical arguments about this however the quick and candy is governments and other people have been doing financializing warfare swaps for the reason that Dutch East India firm,” the person defined, arguing democratization merely expanded entry past elite bankers.

Coronary heart rejected this protection outright. “Oh good, let’s democratize being profitable on killing individuals, that’s significantly better,” she responded.

Speedy Mainstream Adoption Continues

Regardless of ethical objections, prediction markets proceed their explosive enlargement into conventional finance.

Google Finance just lately built-in reside knowledge from Polymarket and Kalshi, permitting customers to question future occasions and think about market chances alongside historic sentiment shifts.

Competitors can also be intensifying as main exchanges rush into the sector.

Simply final week, Coinbase filed lawsuits towards Michigan, Illinois, and Connecticut to problem state authority over prediction markets, arguing that they fall beneath the unique jurisdiction of the CFTC forward of its January 2026 launch with Kalshi.

@Coinbase has filed lawsuits towards the US states of Michigan, Illinois, and Connecticut, escalating a rising authorized struggle.#Coinbase #Cryptohttps://t.co/hTmVsGS8yu

— Cryptonews.com (@cryptonews) December 19, 2025

Chief Authorized Officer Paul Grewal acknowledged, “Prediction markets fall squarely beneath the jurisdiction of the CFTC, not any particular person state gaming regulator.“

Regulatory readability has additionally emerged when the CFTC granted no-action reduction to Polymarket US, LedgerX, PredictIt, and Gemini Titan early this month, lowering enforcement stress whereas requiring full collateralization and clear transaction knowledge.

The put up Prediction Markets Beat Social Media at Discovering Fact, Says Vitalik Buterin appeared first on Cryptonews.