The Optimism Basis introduced plans to dedicate 50% of incoming Superchain income to month-to-month OP token buybacks beginning February 2026, marking a elementary shift within the community’s tokenomics technique.

The proposal transforms OP from a pure governance token into one immediately aligned with the Superchain’s development, the place the community captured 61.4% of the Layer-2 charge market and processes 13% of all crypto transactions.

The buyback mechanism would function on collected sequencer income from chains together with Base, Unichain, Ink, World Chain, Soneium, and OP Mainnet, which contributed 5,868 ETH over the previous twelve months to a treasury managed by Optimism governance.

Based mostly on comparable allocations from final 12 months’s income, this system would deploy roughly 2.7k ETH, or roughly $8 million, in OP purchases at present costs, with the governance vote scheduled for January 22.

A proposal for the subsequent chapter of Optimism

The Optimism Basis is placing ahead a proposal to align the OP token with rising Superchain demand by directing 50% of incoming Superchain income to common OP buybacks https://t.co/VSDazlbRdX pic.twitter.com/jBQoJyxDCF— Optimism (@Optimism) January 8, 2026

Income-Pushed Token Evolution

The Basis plans to companion with an OTC supplier to execute month-to-month conversions of ETH to OP, starting with January’s income in February.

Conversions will happen inside predetermined home windows no matter worth, although this system pauses if month-to-month income falls under $200,000 or if the OTC supplier can’t execute underneath the utmost allowable charge spreads.

Bought tokens will circulation again into the collective treasury, the place they could ultimately be burned, distributed as staking rewards, or deployed for ecosystem enlargement because the platform evolves.

The mechanism begins small however scales with Superchain enlargement, the place each transaction throughout taking part chains expands the buyback base and creates structural demand for OP tokens.

The proposal additionally grants the Basis discretion to handle the remaining ETH treasury belongings to generate yield and assist ecosystem development, thereby decreasing governance overhead that traditionally restricted lively treasury administration.

Whereas governance retains oversight over capital allocation parameters, this flexibility seeks to maintain the Superchain aggressive with friends that deploy capital extra adaptively.

Superchain Dominance Fuels Development Technique

The buyback initiative comes because the Layer-2 panorama consolidates dramatically round Base, Arbitrum, and Optimism, which collectively course of practically 90% of all L2 transactions.

Base alone surpassed 60% market share by late 2025, whereas exercise throughout smaller rollups dropped 61% since June, with many working as “zombie chains” with minimal person exercise.

Regardless of aggressive charge wars triggered by the Dencun improve’s 90% charge discount, pushing most rollups into losses, Base generated roughly $55 million in revenue throughout 2025.

Most Ethereum L2s are susceptible to collapse in 2026 as exercise concentrates overwhelmingly on Base, Arbitrum, and Optimism.#Ethereum #L2shttps://t.co/luFyL8YWFB

— Cryptonews.com (@cryptonews) December 11, 2025

The Superchain mannequin leverages this focus, the place member chains contribute parts of sequencer income again to Optimism, making a flywheel the place utilization generates income, income funds improvement, and improvement drives further utilization.

In the meantime, Optimism continues constructing infrastructure for long-term sustainability, having chosen Ether.fi as its strategic liquid staking companion on OP Mainnet in December, following a complete RFP course of.

The collective has earned 80.03 ETH in yield by means of staking operations, with the partnership designed to strengthen OP Mainnet’s place as a safe, liquid, and institutionally trusted DeFi setting.

Governance Debate and Implementation Timeline

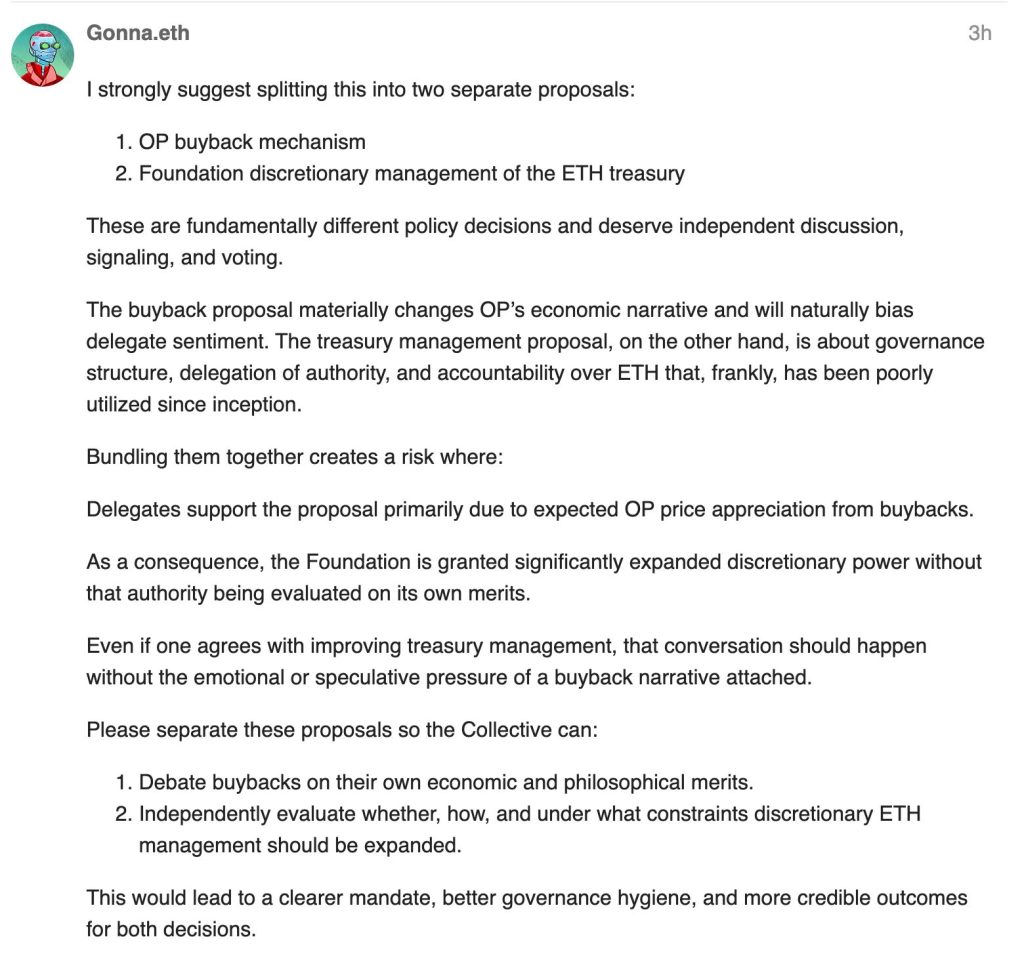

The proposal is going through some scrutiny from delegates involved about bundling two distinct coverage choices right into a single vote.

Neighborhood member Gonna.eth urged splitting the buyback mechanism from Basis treasury discretion, arguing that bundling creates dangers through which delegates approve expanded discretionary energy primarily due to anticipated OP worth appreciation fairly than evaluating treasury administration authority by itself deserves.

The governance proposal strikes to vote in Particular Voting Cycle #47, requiring Joint Home approval at a 60% threshold.

If accepted, the Basis will promptly enter into agreements with an OTC supplier and publish an execution dashboard monitoring fills, pacing, pricing, and balances for month-to-month conversions.

This system will proceed for twelve months earlier than re-evaluation, with preliminary operations executed by the Basis underneath predetermined parameters, eliminating discretion.

Over time, the mechanism could transfer more and more on-chain by means of Protocol Improve 18, which ensures all sequencer income from OP Chains will get collected on-chain with out Basis involvement.

On the time of publication, OP trades at $0.31, down 1% up to now 24 hours.

The submit Optimism Proposes Utilizing Half Its Income to Purchase Again OP Tokens appeared first on Cryptonews.