The beginning of 2025 has been considerably brutal for stablecoins. First, the EU’s MiCA regulation led to a raft of European exchanges delisting Tether’s USDT—and different non-compliant stablecoins—for not following the EU’s mandates, which embrace protecting no less than 60% of reserves in European banks. Then, the U.S. GENIUS Act, introduced in February, with its personal set of stringent guidelines for issuers.

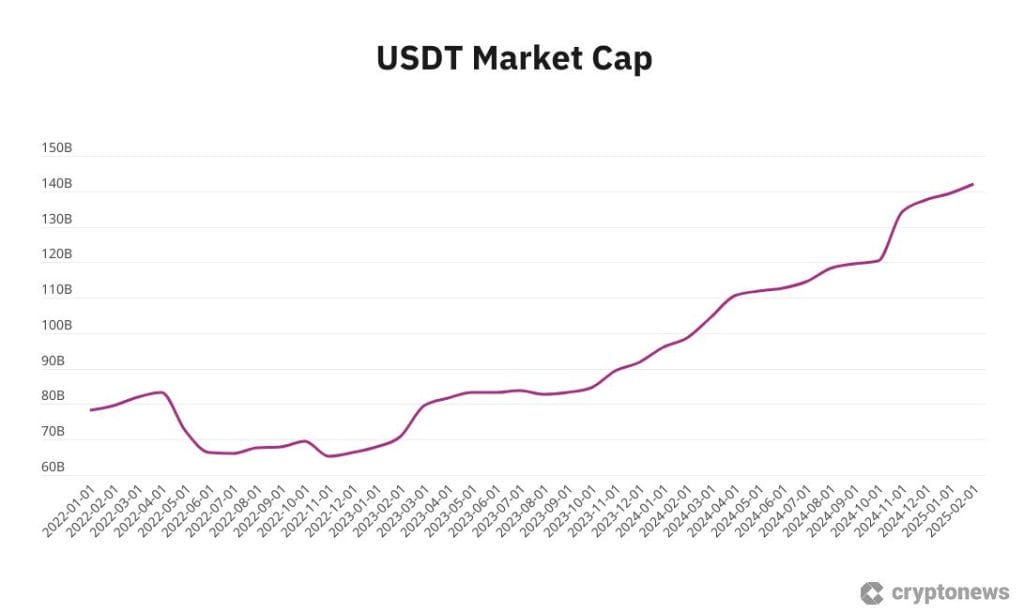

It’s secure to say that other than USDC – which all the time follows the merest legislative suggestion to a T – stablecoins discover themselves below intense scrutiny. All of us fake this regulatory strain doesn’t matter. We select USDT over USDC for our idle property as a result of we desire crypto collateral over authorities backing, and we expect we’re true champions of decentralized finance. The truth is, the market cap of USDT is at an all-time excessive of $141.7 billion, greater than doubled from the lows of November 2022 – as if it wasn’t going through existential threats in each Europe and the U.S.

The truth is, although, that none of us truly know what’s in Tether’s reserves (that is what has the regulators so riled up). We have no idea how lengthy Tether can keep away from bowing to regulatory strain, like USDC. For instance, JP Morgan has insinuated that Tether might must promote its Bitcoin reserves for T-bills to adjust to U.S. laws.

USDC, in the meantime, solely simply managed to achieve the identical market cap it had in 2022 (presently sitting at round $56 billion). Because the partitions seem like closing in, it’s time for us to cease merely selecting the lesser of two evils and contemplate a very decentralized different.

Tried, Examined, and Decentralized?

After the crash of Terra Luna in 2022, stablecoins backed by something aside from U.S. Treasuries or arduous U.S. greenback paper grew to become form of taboo for some time. That was, after all, justified once we suppose again to that horrific time when $60 billion was misplaced in a single day after hundreds of thousands of individuals – together with a number of the greatest exchanges, platforms, and hedge funds within the trade – put their religion in a stablecoin that was backed by nothing a couple of man’s ego.

Nonetheless, ever since that crash, the crypto trade has been engaged in a round dialog about the necessity to transfer away from the U.S. greenback as collateral for stablecoins. It’s clear that to create a reliable crypto asset, we have to give you a greater thought.

What nobody has mentioned but is that the reply lies in a monetary technique that has already been tried and examined within the conventional monetary world: the Delta Impartial strategy. In a nutshell, it is a technique that balances lengthy and quick positions in a portfolio in such a means that it offsets the directional danger of value actions. In such a technique, the delta – the sensitivity of the portfolio to cost actions – is as near zero as doable.

The Better of TradFi, in DeFi

In conventional finance, Delta Impartial methods date again many years, used broadly by hedge funds for danger administration, arbitrage and volatility buying and selling. In crypto, although, Delta Impartial methods are a nascent idea. Nonetheless, it’s arduous to not see how completely this strategy aligns with the stablecoin idea: an asset with very restricted volatility.

By taking lengthy and quick positions in a digital asset – like ETH, for instance – such a technique replaces the standard stablecoin mannequin, backed by arduous {dollars} and authorities paper, with out the sudden and unintelligible dangers related to algorithmic stablecoins like Terra’s UST. It’s a easy and chic resolution that ensures the worth of the general property stays as secure as doable.

And, crucially, such stablecoins might be each utterly decentralized and totally clear. The mechanism is so easy that there’s no want for secrecy or confusion. It’s the proper different to stablecoins like USDT – an artificial greenback that may technologically by no means go to zero. An asset match for a mature decentralized finance market that has discovered arduous classes from 2022.

Artificial and Safe

The fantastic thing about this artificial asset is it’s not reinventing the wheel. It has all been achieved earlier than. Certainly, the primary Delta Impartial technique dates all the best way again to the early twentieth century. It isn’t notably financially superior or difficult to implement. And, I dare say, it’s way more dependable than an asset backed by holdings in a financial institution that might disappear any day with little or no warning – I’m certain we are going to always remember the banking collapse of March 2023 in a rush.

We’ve the expertise, and we have already got such property accessible. The one lacking ingredient is the need—the need to experiment and take a look at new issues, or quite previous issues in new clothes. It’s crucial that, if we really need to transfer ahead in crypto, we be taught from the errors of the previous and create new merchandise that drive progress. We should problem the incumbents and construct a decentralized monetary system from the ashes of Terra Luna.

As the way forward for a number of the most established stablecoins is questioned, it’s a cue for these of us nonetheless constructing within the DeFi market to place ahead the options. We have to maintain pushing the boundaries to create a greater, fairer ecosystem that really follows the ideas of decentralization. It’s not an institutional proxy, however DeFi the best way it was all the time imagined to be: with out banks, with out the U.S. greenback, and with out BlackRock’s billions.

Disclaimer: The opinions on this article are the author’s personal and don’t essentially characterize the views of Cryptonews.com. This text is supposed to supply a broad perspective on its matter and shouldn’t be taken as skilled recommendation.

The put up Opinion: It’s Time to Embrace Decentralized Options to Stablecoins appeared first on Cryptonews.