A former loans manager at South Korea’s NH Bank (NongHyup) who has been accused of stealing company funds to buy crypto says they “lost everything.”

Per the broadcaster JTBC, NH thinks that a manager surnamed Kim embezzled a total of $12.5 million worth of loans.

NH Bank Staffer ‘Stole Loan Funds to Spend on Crypto’

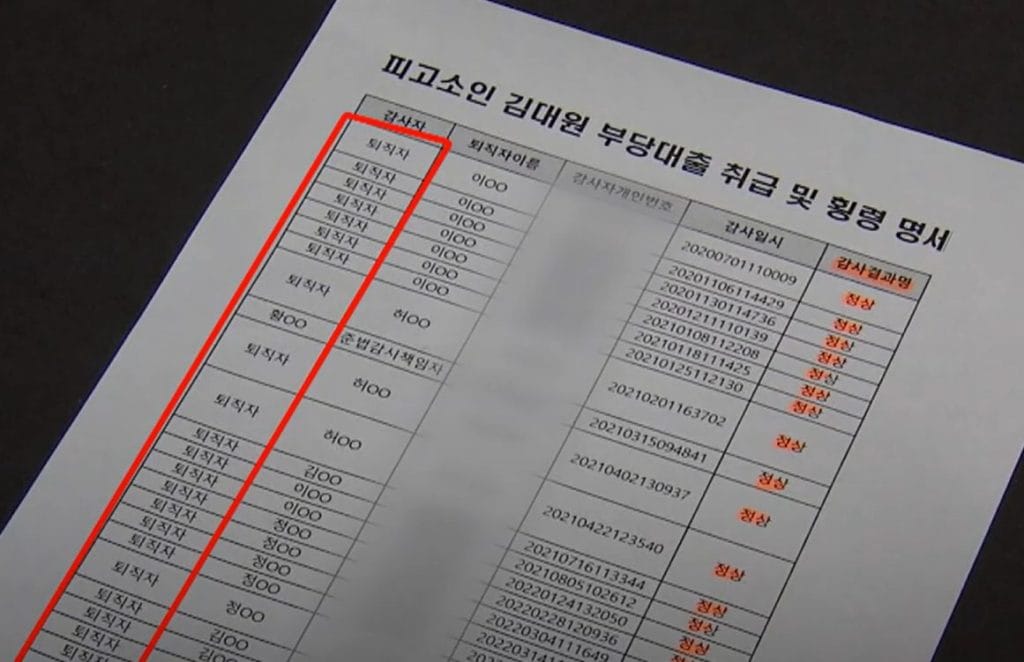

The bank found evidence of irregularities during an audit in August this year. NH reportedly thinks Kim stole money “on 106 occasions over four years,” from “June 2020 to August 2024.”

JTBC said it had seen the audit, commissioned by NH headquarters, detailing “a suspicious flow of loans at a branch” in the capital Seoul.

The internal audit also concluded that a loan worth over $7.3 million won “had been made using non-existent real estate as collateral.”

Kim reportedly arranged the loans using the names of “acquaintances and other people.” And Kim was quoted as stating:

“I took out loans using non-existent real estate as collateral. I invested in crypto. But I lost everything, so I don’t have any money.”

The media outlet said Kim secured loans by “forging documents,” including creating “bogus real estate registry certificates.”

NH Bank has reportedly already determined that $8.8 million of the $12.5 million total was embezzled using “illegal lending” methods.

The bank said its probe is still underway and added that it is “currently investigating more” of its “employees.”

“We will resolve all problematic issues involved in this case. We will continue to improve our system to prevent a recurrence.”

NH Nonghyup Bank spokesperson

Crypto-keen Bankers

The media outlet noted that a decade ago, NH launched a network of roving auditors who are supposed to perform spot checks at its branches.

However, the outlet pointed out that all 369 of the bank’s roving auditors “are former Nonghyup Bank employees.”

Kang Jun-hyun, a lawmaker and a member of the National Assembly’s Political Affairs Committee Member, said that the roving auditor system needed more impartiality.

“Financial accidents continue to occur. So the National Assembly will carefully examine the matter to ensure that internal control systems are in place.”

South Korean Lawmaker Kang Jun-hyun

Trading in South Korean bonds via accounts set up for foreign investors hit 4.5 trillion won ($3.3 billion) in early October https://t.co/qcHaIVpRKz

— Bloomberg (@business) October 17, 2024

The NH rival Woori appears to have suffered a similar breach earlier this year.

One of Woori’s former Gimhae-based loan managers has also been accused of stealing money to spend on crypto purchases.

In June, the ex-Woori staffer confessed to stealing some $7.3 million worth of the bank’s funds to “mostly spend on crypto investments.”

The man claimed in June this year that most of his subsequent crypto investments had “resulted in failure.”

The post NH Bank Staffer Who ‘Stole Money to Buy Crypto’ Says: ‘I Lost Everything’ appeared first on Cryptonews.