Key Takeaways:

- The court docket order towards Genius Group is a part of the rising pressure between decentralized monetary methods and centralized authorized programs.

- Pressured Bitcoin liquidation reveals vulnerabilities in company crypto reserves, difficult the viability of Bitcoin-first treasury methods amid regulatory uncertainties.

- This case highlights the dangers of cross-jurisdictional authorized conflicts, the place U.S. court docket actions threaten overseas firms’ capacity to adjust to native legal guidelines and governance buildings.

A New York court docket barred Genius Group from promoting shares, elevating funds, or utilizing investor cash to purchase Bitcoin on April 3, forcing the corporate to liquidate components of its Bitcoin Treasury to maintain operations.

The ruling, issued by america District Court docket for the Southern District of New York (SDNY), follows an ongoing authorized dispute involving the schooling and AI-focused firm.

Court docket Blocks Genius Group from Elevating Funds, Forces Bitcoin Treasury Sale

Genius Group, which trades on the NYSE American underneath the ticker GNS, has been entangled in authorized battles stemming from its try and terminate an asset buy settlement with Fatbrain AI (LZGI).

The dispute escalated when LZGI shareholders filed lawsuits alleging fraud towards the corporate’s executives, Michael Moe and Peter Ritz. The SEC additionally launched a case associated to shareholder fraud.

On February 14, 2025, Moe and Ritz sought a short lived restraining order and a preliminary injunction to forestall Genius from promoting shares or utilizing funds from its $150 million at-the-market (ATM) providing to purchase Bitcoin.

Genius Group has been blocked by the US District Court docket Southern District of New York from promoting shares or elevating funds, and particularly banned from shopping for Bitcoin, in direct opposition to the desires and approvals of the Firm's board and shareholders.

We’ll maintain preventing… pic.twitter.com/Lk6uXzfCx6— Roger James Hamilton (@rogerhamilton) April 3, 2025

The court docket granted the injunction on March 13, successfully freezing the corporate’s capacity to subject shares and lift capital.

In response, Genius Group has filed a number of motions contesting the ruling, arguing that the injunction disrupts the established order and was secured by means of false claims.

The corporate additionally submitted a transcript of a gathering with Ritz, recorded in New York on February 27, by which he allegedly described a technique to take advantage of the authorized course of to extract cash from Genius.

The transcript hasbeen included in a separate lawsuit towards LZGI and its executives in a Florida court docket as effectively.

Because of the court docket order, Genius Group has been pressured to promote parts of its Bitcoin holdings, lowering its treasury from 440 BTC to 430 BTC.

The corporate has warned that additional gross sales could also be essential if the injunction stays in place. The restrictions have additionally prevented Genius from issuing share-based compensation to workers, placing it at odds with Singaporean employment legal guidelines.

The corporate has filed an emergency enchantment with america Court docket of Appeals for the Second Circuit, looking for to overturn the injunction.

On the similar time, it’s restructuring operations, chopping advertising and marketing bills, closing divisions, and canceling occasion sponsorships to preserve sources.

CEO Roger James Hamilton criticized the court docket’s intervention, stating, “We by no means dreamed {that a} U.S. court docket may block the corporate from issuing shares, elevating funds, or shopping for Bitcoin—choices that ought to be made by shareholders or the board, not the courts.”

Genius Group’s Market Cap Falls Beneath Bitcoin Holdings Amid Court docket Battle

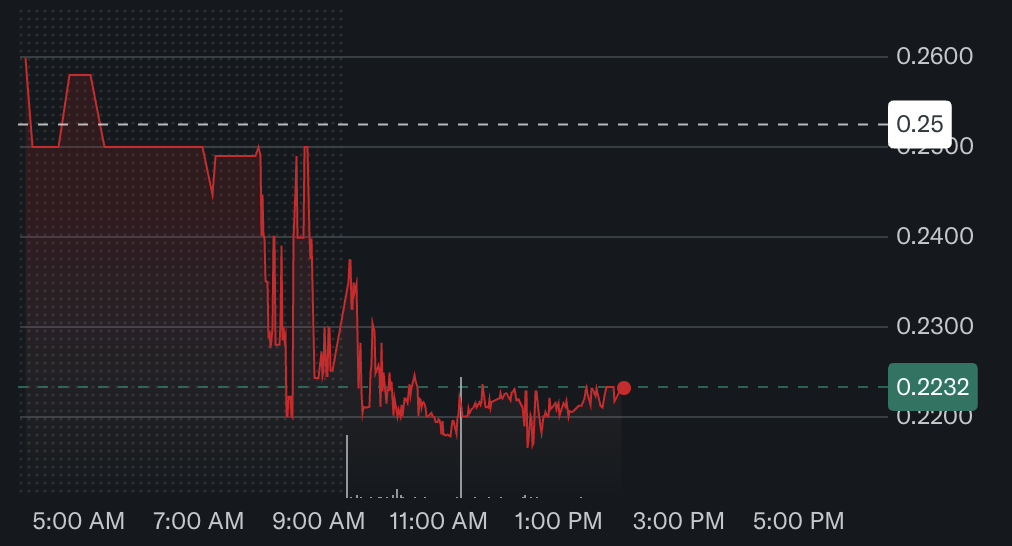

For the reason that non permanent restraining order was issued in February, Genius Group’s inventory worth has dropped 53%, from $0.47 to $0.22. The corporate’s market capitalization now stands at simply 40% of the worth of its Bitcoin holdings, elevating considerations about its capacity to proceed operations.

In the meantime, Hamilton reaffirmed the corporate’s dedication to Bitcoin, stating, “We’ll proceed to fly the flag for Bitcoin, even when legally banned from constructing our Bitcoin Treasury.”

Regardless of the court docket banning Genius Group from buying and selling shares and holding Bitcoin, the Singapore-based AI and schooling agency has been aggressively accumulating BTC.

The corporate now holds 430BTC, value $46 million, whereas its market cap is $33.1 million.

Genius has spent $42 million buying Bitcoin, mirroring MicroStrategy’s treasury technique. In simply 4 months, it has allotted $40 million to BTC and plans to push that to $120 million utilizing reserves, loans, and an ATM facility.

Because it stands now, with regulatory stress mounting, the corporate’s Bitcoin-first strategy faces an unsure future.

Regularly Requested Questions (FAQs)

How does the court docket ruling spotlight dangers for overseas firms listed within the U.S.?

It reveals the vulnerability of worldwide corporations to U.S. authorized actions, the place court docket rulings can severely disrupt firm operations no matter home-country governance.

May this case remodel company treasury methods?

Sure, it could push firms to diversify reserves past Bitcoin, balancing liquidity and regulatory dangers to safeguard operational stability.

What does this imply for Bitcoin’s function in company finance?

The pressured liquidation demonstrates how exterior authorized pressures can compromise Bitcoin-first methods, elevating questions on its reliability as a major reserve asset.

What classes can different crypto-focused corporations be taught from this example?

They need to prioritize strong authorized frameworks and contingency plans to mitigate dangers from regulatory and judicial interventions.

The put up New York Court docket Bans Genius Group from Buying and selling Shares and Holding Bitcoin appeared first on Cryptonews.