A New York chapter court docket has granted provisional reduction to Singapore-based liquidators overseeing the collapse of Multichain Basis Ltd., directing stablecoin issuer Circle to maintain wallets holding tens of millions of {dollars} in stolen USD Coin (USDC) frozen.

Choose David S. Jones of the U.S. Chapter Court docket for the Southern District of New York issued the order on Thursday, extending the freeze on three Ethereum wallets tied to the July 2023 Multichain hack.

The ruling requires Circle to keep up the addresses on its blacklist, successfully blocking any motion of the roughly $63 million in stolen USDC till additional discover.

The court docket’s choice marks a significant step within the cross-border effort to get well belongings drained from Multichain’s cross-chain bridge protocol, which misplaced greater than $210 million in one in every of 2023’s largest DeFi exploits.

Contained in the Multichain Case: How Liquidators Win by Freezing USDC

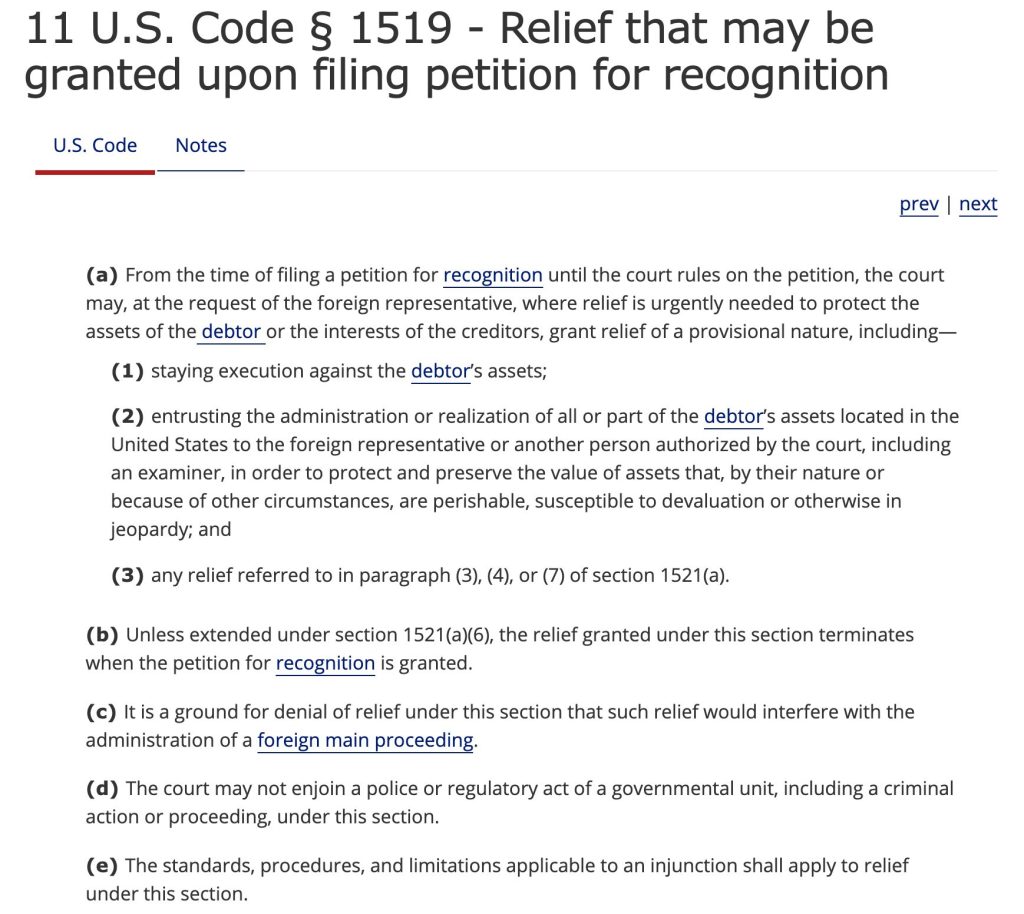

The order, issued beneath Part 1519 of the U.S. Chapter Code, permits momentary reduction earlier than a overseas case receives formal recognition beneath Chapter 15, the framework that governs cooperation between U.S. courts and overseas insolvency proceedings.

Liquidators appointed in Singapore, from KPMG Companies Pte. Ltd., filed for provisional reduction on October 23, arguing that lifting Circle’s freeze might trigger “fast and irreparable hurt” by permitting stolen belongings to maneuver past restoration.

The request sought to protect the funds till the U.S. court docket determines whether or not to acknowledge the Singapore case as a “overseas principal continuing,” a designation that may enable the liquidators to pursue restoration efforts throughout jurisdictions.

Circle, which points the U.S. greenback–pegged USDC stablecoin, sometimes enforces freezes by blacklisting addresses immediately via the token’s good contract, a function that blocks any transfers involving these wallets.

The corporate first froze the three hacker-linked addresses in October 2023 on the route of the U.S. Division of Justice (DOJ), which obtained a seizure warrant shortly after the exploit.

The DOJ later lifted the warrant after failing to determine the hackers, leaving Circle with no authorized foundation to maintain the wallets locked. The newest order restores that authority.

Multichain Breach Forces Circle to Freeze $63 Million in USDC#USD Coin issuer @circle has frozen $63 million belonging to a few pockets addresses related to the hack of the cross-chain bridge platform Multichain.#CryptoNews #USDChttps://t.co/HCQz1113j6

— Cryptonews.com (@cryptonews) July 8, 2023

In response to the court docket submitting, the freeze is important to forestall competing claims over the identical funds. A gaggle of U.S. buyers had filed a separate class motion lawsuit in opposition to Circle in New York State court docket, in search of management of the stolen USDC.

That case has now been paused following the federal court docket’s ruling. Circle moved the matter to the Southern District of New York beneath the Class Motion Equity Act, which permits massive, multi-jurisdictional class actions to be heard in federal court docket.

After the $125M Hack, Multichain Faces Its Remaining Chapter in Court docket

The Multichain collapse, one of the high-profile failures within the decentralized finance sector, stemmed from an exploit found in July 2023.

Unidentified attackers drained over $125 million from Multichain’s bridge contracts on Fantom, Moonriver, and Dogechain, transferring funds to unknown addresses.

Multichain Bridge Exploit: Dealer’s $280K Turns into $1.9 M Windfall

A pockets deal with has reworked almost 1.9 million #Fantom tokens, initially price $280,000, into $1.9 million after the long-frozen Multichain Bridge momentarily opened.#CryptoNewshttps://t.co/rvcu4Q4FtI— Cryptonews.com (@cryptonews) November 2, 2023

Multichain, previously generally known as Anyswap, operated as one of many largest cross-chain bridge protocols, permitting customers to maneuver belongings throughout blockchains like Ethereum, BNB Chain, Avalanche, and Polygon.

The platform had a complete worth locked of about $9.2 billion in early 2022, based on knowledge from DeFiLlama, earlier than its troubles started in mid-2023.

Studies later surfaced that the corporate’s CEO, generally known as Zhaojun, had been detained in China, leaving the venture in disarray.

Following the hack, affected tasks, together with the Fantom Basis, launched authorized actions in Singapore. In March 2024, the Excessive Court docket of Singapore issued a default judgment in Fantom’s favor, discovering that Multichain had breached contractual obligations.

The Excessive Court docket of Singapore has dominated in favor of the Fantom Basis, ordering the Multichain Basis to pay $2.1 million.#Singapore #Fantomhttps://t.co/N8phLTwyor

— Cryptonews.com (@cryptonews) July 9, 2024

By Could 2025, the identical court docket accepted a winding-up order in opposition to Multichain Basis Ltd., appointing KPMG’s Bob Yap Cheng Ghee, Toh Ai Ling, and Tan Yen Chiaw as joint liquidators to supervise asset restoration and dissolution.

The frozen $63 million in USDC represents a portion of the overall $210 million stolen from Multichain. The liquidators are in search of to get well these belongings as a part of the broader winding-up course of.

Of their U.S. submitting, they described the New York court docket’s provisional reduction as “an efficient mechanism to implement Chapter 15’s insurance policies of selling cooperation between courts of the USA and overseas courts concerned in cross-border restructuring circumstances.”

The submit Multichain Liquidators Win Key Ruling as New York Court docket Extends Freeze on Stolen USDC appeared first on Cryptonews.