The Russian Far East may turn out to be the nation’s latest crypto mining hub, with new and idle energy facilities ordered to begin powering Bitcoin mining rigs.

Yuri Trutnev, Russia’s Deputy Prime Minister and Presidential Envoy to the Far Jap Federal District (FEFD), thinks this may resolve the electrical energy surplus downside within the area, Amurskoye Oblastnoe Televidenie reported.

Trutnev claimed that “protecting” power reserves is “costly.” And, he defined, utilizing them to energy crypto miners may assist to “offset prices.”

Russian Far East Able to Flip to Crypto?

The Deputy Prime Minister made the feedback at a gathering on the event of the electrical energy business within the FEFD.

Trutnev claimed that the variety of funding tasks within the area was set to “develop,” and that the area ought to create “a reserve of capacities for them prematurely.”

To cease these from “sit idly,” he mentioned, “they need to be used for cryptocurrency mining.”

“We’re assured that we are going to quickly see an uptick in funding tasks within the Far Jap Federal District. Subsequently, it might be a good suggestion to create a reserve of capability. And, if there’s a surplus of electrical energy, we should always set it apart for [crypto] mining, as a result of merely protecting it in reserve is dear. Whether it is used for mining, we is not going to incur any prices.”

Yuri Trutnev, Russia’s Deputy Prime Minister and Presidential Envoy to the Far Jap Federal District

Trutnev added that the inducement must be carried out in “all” of the Russian Far East’s areas.

The Deputy PM has already adopted up by ordering Far Jap areas to “submit knowledge on their electrical energy wants.”

He additionally needs to find out about their plans for “the development of energy producing amenities.”

Russia seems to have overcome for now a deficit of yuan that led to a spike in short-term borrowing prices after the US threatened to penalize lenders for processing cross-border funds https://t.co/rPYsOTGB7c

— Bloomberg Economics (@economics) February 2, 2025

Crypto Pivot

Russia’s pivot to crypto is gathering tempo, marking an virtually unprecedented U-turn from Moscow.

Late final month, the nation’s energy grid supplier Rosseti mentioned it needed to assist decide the situation of latest crypto mining facilities in Russia.

It provided to “take accountability” for coordinating mining amenities nationwide in an effort to “load up” unused and low-usage energy facilities.

The power firm runs over 80% of all of the nation’s electrical energy networks. Different power giants, such because the oil and fuel behemoth Gazprom, have launched crypto mining subsidies.

And the nation’s greatest crypto mining participant BitRiver has unveiled plans to work with the Russian state to construct crypto mining knowledge facilities in fellow BRICS nations.

The Laws Issue

In the meantime, RBC reported that the federal government’s current crypto laws has solely made minor variations to the way in which miners function.

Moscow final 12 months “legalized” crypto mining, formally recognizing it as a type of entrepreneurship.

The foundations imply that the majority non-public miners can proceed to mine cash, offered they don’t exceed a threshold of 6,000 kWh of power per 30 days.

In accordance with a survey performed by BitRiver rival Intelion Information Methods, 21% of Russian crypto miners “really feel that their work has turn out to be simplified” with “improved circumstances for doing enterprise.”

Nevertheless, 57% of the survey respondents mentioned they “don’t but perceive the total affect of the brand new legal guidelines.”

The agency spoke to about 400 individuals, together with its personal shoppers and “different market individuals.”

Russian Miners Rising Eager on ETH?

Intelion Information Methods additionally mentioned that 33% of the respondents “plan to extend their funding in crypto mining gear.

Nevertheless, 42% mentioned they would favor to maintain their powder dry. This group defined that they had been “nonetheless analyzing present developments” to “decide the perfect time to develop” their investments.

The respondents additionally had their say on the way forward for the crypto markets, with 41% of respondents predicting a “reasonable development” of 10-20% in Bitcoin (BTC) costs “within the first half of 2025.”

One other 22% mentioned they consider BTC will see a interval of “robust development, exceeding expectations.”

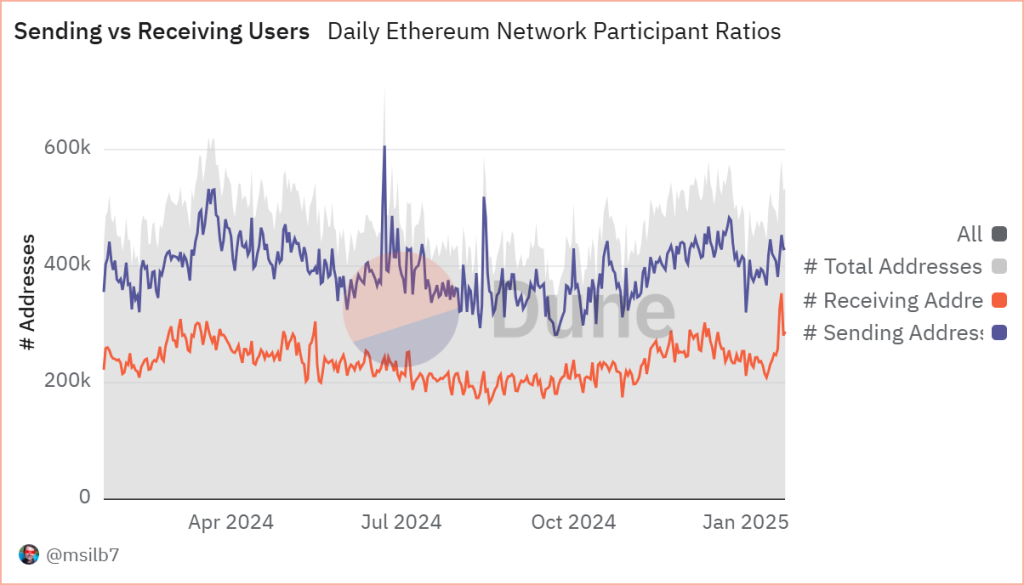

And Intelion added that many gamers are “keen on” diversifying their funding, with 43% calling Ethereum (ETH) their “most popular various to Bitcoin.”

The agency mentioned the rising curiosity in Ethereum was a results of the expansion of the sensible contract ecosystem and “the alternatives it opens up for decentralized monetary (DeFi) tasks.”

The submit Moscow Plans to Flip Russian Far East into Crypto Mining Hub appeared first on Cryptonews.