Tokyo-listed Metaplanet Inc. has accepted the issuance of newly created Class B shares by way of a third-party allotment, marking a serious step within the firm’s long-term capital technique following its transition into a worldwide Bitcoin treasury enterprise.

*Discover Concerning Issuance of Class B Most popular Shares by way of Third-Celebration Allotment* pic.twitter.com/AmzR3wJtzd

— Metaplanet Inc. (@Metaplanet) November 20, 2025

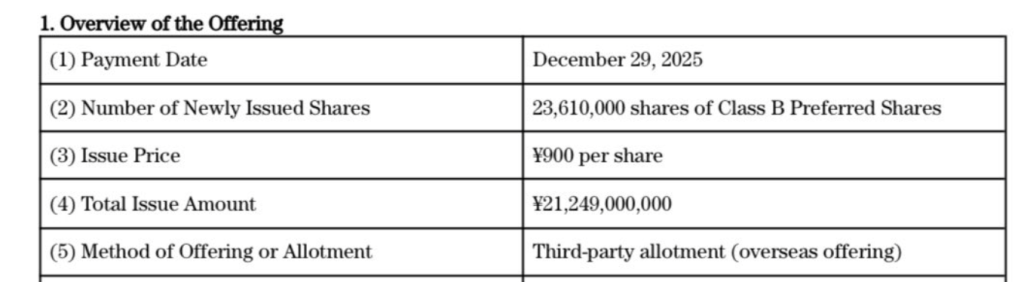

The issuance, scheduled for December 29, will present the corporate with as much as ¥21.2 billion (approx. $142 million) in new funds to speed up its funding and Bitcoin acquisition applications.

The announcement was made following a board assembly on November 20, the place administrators additionally accepted associated amendments to capital and capital reserve allocations.

The corporate intends to increase its Bitcoin holdings and company worth by way of a structured issuance designed to draw long-term institutional participation.

Issuance Particulars and Construction

The deliberate providing will encompass 23.61 million Class B shares at a difficulty worth of ¥900 per share, for complete proceeds of ¥21.249 billion. The shares can be allotted to designated buyers below a third-party allotment framework.

The corporate burdened that every one funds should be accomplished by December 29, 2025, with shares issued by way of abroad settlement mechanisms.

The Class B construction—launched to assist Metaplanet’s transition right into a Bitcoin-focused company technique—supplies differentiated rights that preserve alignment between long-term buyers and the corporate’s Bitcoin-treasury goals.

The issuance follows the expiration or cancellation of beforehand deliberate inventory acquisition rights, together with the 2025 EVO FUND-linked warrants, clearing the trail for this new capital-raising initiative.

Strategic Rationale: Strengthening the Bitcoin Treasury Mannequin

Since 2024, Metaplanet has redefined itself as a “Bitcoin treasury enterprise,” committing its company reserves to long-term Bitcoin accumulation. The corporate launched its “21 Million Plan” and subsequent “555 Million Plan,” reflecting its ambition to scale BTC holdings as a core asset.

Market volatility and exterior pressures, together with shifts in international Bitcoin miner-linked equities, prompted the corporate to re-evaluate its capital construction. With the corporate’s MNAV (market worth of Bitcoin-adjusted internet asset worth) fluctuating under parity at occasions, administration decided that strengthening capital reserves was important to guard shareholder worth.

Metaplanet concluded that issuing preferred-like Class B shares—somewhat than counting on conventional debt or additional dilution by way of frequent shares—was the best technique to safe strategic funding, deepen the market’s understanding of its valuation mannequin, and enhance long-term worth discovery.

Use of Proceeds and Future Outlook

Funds raised can be allotted towards the growth of Bitcoin holdings, company investments, and broader Bitcoin infrastructure initiatives aligned with the corporate’s treasury technique.

The issuance additionally prepares Metaplanet for a future public providing of Class B shares, with administration noting that extra itemizing preparations will observe as soon as market circumstances are acceptable.

Metaplanet mentioned the brand new capital will allow sustainable execution of its Bitcoin acquisition technique, improve monetary stability, and place the corporate for long-term progress in Japan and international markets.

The submit Metaplanet to Problem Class B Shares by way of Third-Celebration Allotment appeared first on Cryptonews.