Bitcoin (BTC) stays caught in a good vary, with choices information and on-chain exercise exhibiting a shift in how the market is positioned.

Vacation circumstances have thinned liquidity, and up to date information factors to cautious buying and selling in derivatives whereas long-term holders proceed so as to add.

Choices Knowledge Exhibits Shift in Market Positioning

CME choices information reveals that Bitcoin name choice open curiosity peaked in December 2024, near current value highs above $90,000. Since then, name curiosity has declined steadily and is now close to cycle lows. This sample follows historic conduct, the place name curiosity usually falls after robust value rallies fade. Crypto analyst CW mentioned,

“$BTC CME choices open curiosity signifies a backside in shopping for stress.”

Decrease name positioning reveals that merchants are not pricing in a near-term transfer increased. In the meantime, put choice open curiosity has risen, pointing to elevated demand for draw back cowl somewhat than recent upside publicity.

Furthermore, rising put choice exercise usually seems during times of uncertainty. Whereas it could actually mirror draw back threat, related circumstances have additionally shaped throughout value stabilization phases. CW famous that “a rise in put choices may sign a possible market reversal,” particularly when positioning turns into crowded on one facet.

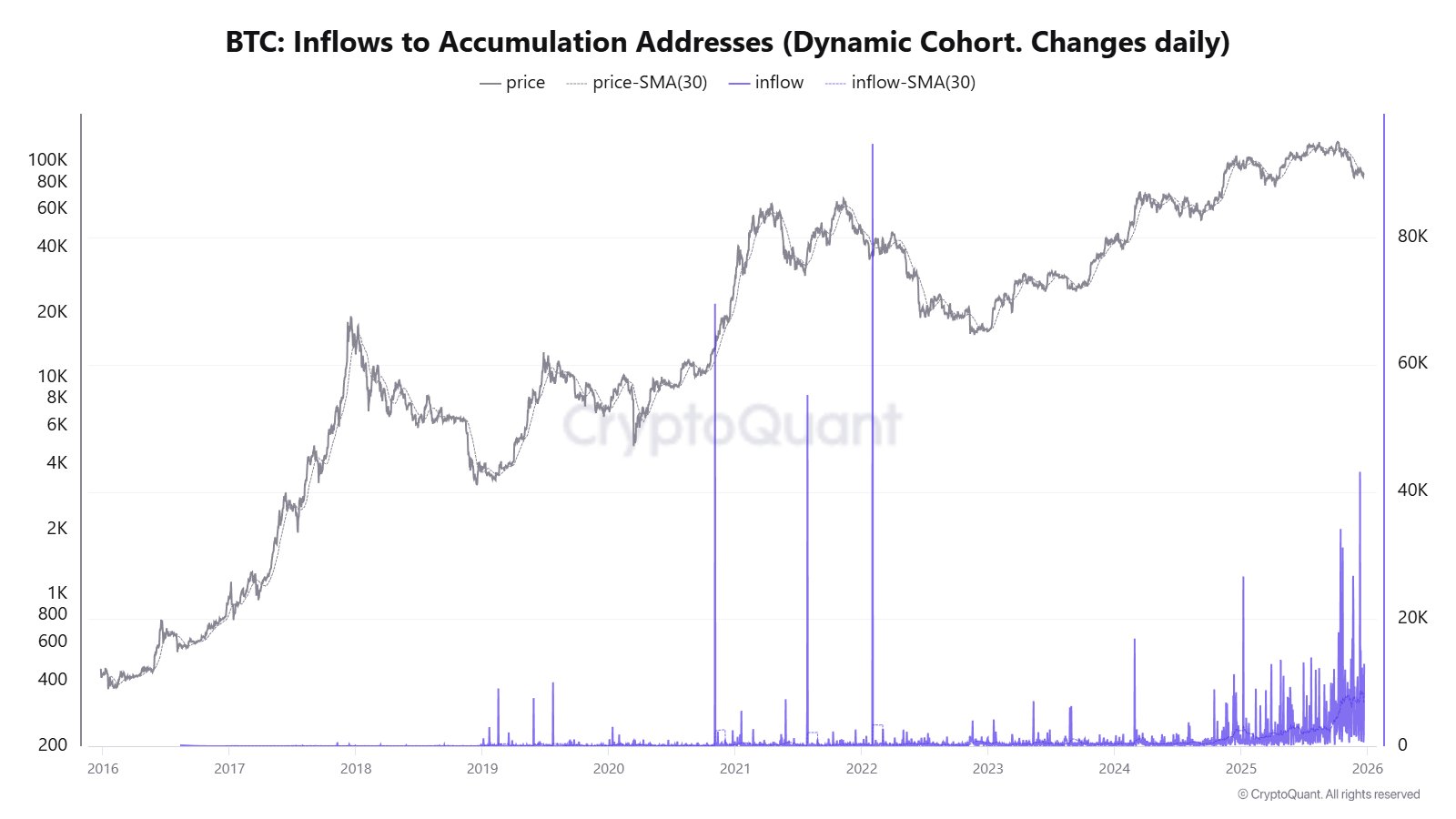

On-chain information reveals a unique pattern. Bitcoin inflows to accumulation addresses have elevated, with a number of massive spikes recorded whereas the value trades under current highs. These wallets have a tendency to carry for lengthy durations and infrequently transfer funds, which factors to massive holders rising positions somewhat than promoting.

Bitcoin Value Trades Between Key Assist and Resistance

Bitcoin trades close to $87,000 at press time, down just below 1% over the previous day and barely increased on the week. Earlier within the week, the asset dropped from above $90,000 to under $86,500 earlier than patrons stepped in and lifted it again up. Exercise slowed over the weekend, adopted by one other failed push close to $90,400.

On the 4-hour chart, BTC continues to maneuver sideways with little follow-through. The $86,500 space has held as help after a number of assessments, whereas promoting stress close to $88,000 has saved value contained. Michaël van de Poppe mentioned that “there’s just a few chop going down on the markets,” including {that a} break above $88,000 would enhance short-term construction.

Elsewhere, liquidity information reveals heavy promote curiosity between $90,000 and $95,000, with robust purchase curiosity sitting between $83,000 and $85,000. Merlijn The Dealer said that “huge promote partitions” stay above present value, whereas patrons proceed to step in on dips.

The submit Is Bitcoin’s Cycle Prime Already In? Key Metric Hits Alarming Low appeared first on CryptoPotato.