Reserve experiences from main exchanges Gate and Bybit paint a transparent image of deteriorating danger urge for food, as merchants flee risky cryptocurrencies in favor of stablecoins.

Person holdings of Bitcoin and Ethereum on Bybit declined sharply in October, whereas USDT balances surged by almost 28%, as expectations for a price reduce pale and market volatility intensified.

Bybit’s newest Proof of Reserves snapshot, dated October 22, reveals person BTC holdings at roughly 64,000 cash, down 3.13% or 2,068 BTC from September’s rely.

Ethereum holdings declined much more steeply, falling 5% to 542,200 ETH, a lack of 28,549 cash.

In the meantime, person USDT balances elevated by 27.89% to roughly 6.389 billion, an increase of 1.393 billion.

The exodus from danger belongings got here as Bitcoin hovered close to $108,000 and Federal Reserve Chair Jerome Powell indicated a slower path to coverage reduction.

Exchanges Keep Sturdy Reserve Ratios Regardless of Asset Shift

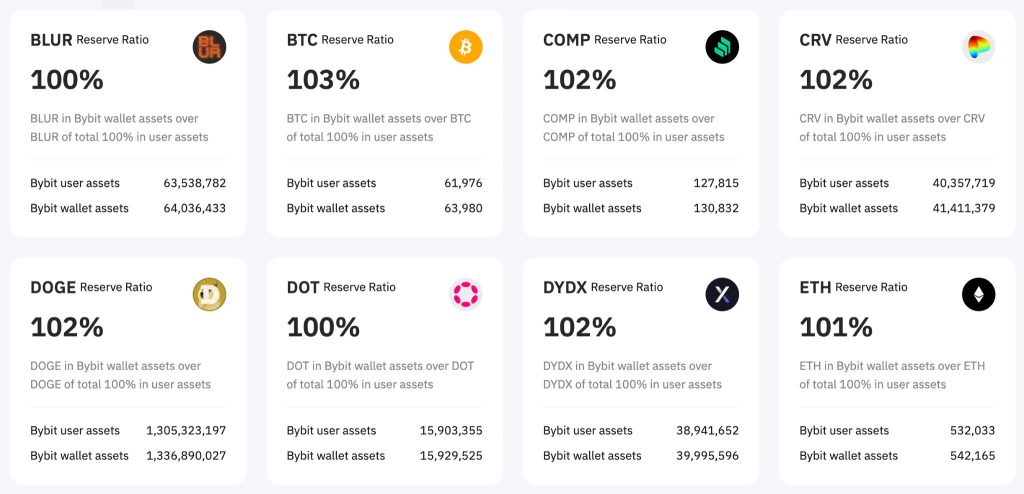

Each platforms reported wholesome reserve protection regardless of the modifications in person holdings’ composition.

Bybit maintained a 103% reserve ratio for Bitcoin and a 101% reserve ratio for Ethereum, making certain pockets balances exceeded person liabilities throughout all main tokens.

USDT reserves reached 110%, reflecting the platform’s potential to accommodate surging stablecoin demand throughout the flight to security.

Gate launched figures as of October 28 displaying whole reserves of $11.676 billion with an total reserve ratio of 124%.

BTC reserves stood at 24,833 cash towards person balances of 18,537, pushing the surplus reserve ratio from 33.48% to 33.96%.

ETH reserves climbed to 419,096 tokens, lifting the surplus ratio from 23.58% to 25.93%. USDT reserves grew to roughly 1.58 billion, masking person holdings of round 1.33 billion with an 18.74% buffer.

Reserve ratios for altcoins, together with GT, DOGE, and XRP, all exceeded 100%, reaching 150.98%, 108.12%, and 116.66% respectively.

Gate’s reserves now cowl almost 500 kinds of person belongings, the corporate mentioned, utilizing a Merkle Tree and zk-SNARKs algorithm for verification.

Market Stress Mounts as Whales Transfer Cash and Retail Fades

Bitcoin slipped under $108,000 early Monday, extending a danger reset that accelerated late final week.

The pullback snapped October’s “Uptober” narrative, which merchants now reframe as “Purple October” as they head into November.

Ether fell 3.8% to $3,737 whereas XRP dropped 3.1% to $2.43, dragging whole crypto market capitalization down 3.1% to $3.69 trillion.

Skinny vacation buying and selling, with Tokyo closed for a public vacation, amplified intraday swings throughout the early Asian hours, based on a Cryptonews report.

Bitcoin slipped under $108K in early Asia commerce as fading Fed rate-cut hopes and Powell’s warning over a December transfer ended its “Uptober” streak, conserving merchants on edge.#bitcoin #CryptoMarket https://t.co/5jdPnMu9ZA

— Cryptonews.com (@cryptonews) November 3, 2025

Elevated leverage constructed by means of October left lengthy positions susceptible, and as costs slipped, pressured liquidations pushed spot ranges decrease.

Merchants cited fading confidence in a quicker easing cycle and a stronger greenback because the speedy catalysts for the selloff.

Giant holders added to the promoting strain.

In response to a modern Cryptonew report, on-chain information from Lookonchain reveals that the pseudonymous whale BitcoinOG deposited roughly 13,000 BTC, price $1.48 billion, to Kraken since October 1, together with 500 BTC on November 2.

Early adopter Owen Gunden transferred 3,265 BTC, valued at $364.5 million, to Kraken since October 21, reactivating wallets that had been dormant for years.

One other Bitcoin OG, identified for shorting Bitcoin throughout main swings, reportedly earned almost $197 million by timing the October 11 crash.

Retail participation continued its steep decline. CryptoQuant information reveals day by day inflows from small holders to Binance have collapsed from round 552 BTC in early 2023 to only 92 BTC at present, a drop of greater than 80%.

The 90-day shifting common has declined by over 5 instances since spot ETFs had been launched in January 2024, as retail traders shifted to ETF merchandise or moved into long-term holdings, leaving institutional gamers and company treasury methods to dominate market flows.

But, even institutional urge for food seems selective as they face sustainability challenges. “When digital asset treasury firms commerce under NAV, that’s not a bubble bursting, that’s the market’s lack of ability to cost infrastructure throughout a section transition,” mentioned Eva Oberholzer, Chief Funding Officer at Ajna Capital.

“That is precisely what occurred with web infrastructure firms in 2001.” She famous that public fairness markets are pricing digital asset treasury firms primarily based on present money flows.

She added that strategic consumers worth them primarily based on future utility worth, creating systematic undervaluation at present, a sample paying homage to PayPal buying and selling under its money worth in 2002 earlier than surging 400% inside eighteen months.

The submit Gate.io and Bybit Information Reveals Merchants Are Performed With Danger Belongings for Now appeared first on Cryptonews.