Galaxy Digital is exploring the opportunity of tokenizing its publicly traded shares as a part of a broader push into blockchain-based finance, the corporate disclosed in a brand new submitting with the U.S. Securities and Alternate Fee (SEC).

The transfer comes simply weeks after the agency accomplished its long-awaited itemizing on the Nasdaq underneath the ticker GLXY.

Galaxy Strikes Towards Tokenized Equities however Warns Market Nonetheless Nascent

Within the submitting, Galaxy said that it’s “evaluating the feasibility of tokenizing our Class A typical inventory” and has entered right into a digital switch company settlement with Superstate Providers, an SEC-registered agent centered on tokenized securities.

In keeping with the corporate, this initiative may present buyers with another option to maintain and commerce GLXY shares utilizing blockchain rails.

“If carried out, tokenized GLXY would offer a further mechanism for buyers to carry and commerce shares within the firm,” Galaxy mentioned.

Galaxy’s Q2 2025 outcomes are in. pic.twitter.com/xDRzhaxShY

— Galaxy (@galaxyhq) August 5, 2025

The corporate’s curiosity in tokenized equities isn’t new. In Might, Galaxy CEO Mike Novogratz spoke publicly about plans to show GLXY shares into tokens to be used in decentralized finance (DeFi) functions similar to lending and buying and selling.

On the time, Superstate launched Opening Bell, a platform for buying and selling SEC-registered shares on-chain, doubtlessly laying the groundwork for Galaxy’s experiment.

Regardless of rising curiosity in tokenized real-world belongings, Galaxy cautioned that “the marketplace for tokenized securities is nascent,” and there’s no assure {that a} liquid or orderly marketplace for tokenized GLXY will emerge.

Chatting with CryptoNews, Ali Mahir Aksu, founding father of Untold.io, mentioned, “Galaxy’s transfer to tokenize its shares through Superstate is a powerful sign that on-chain public equities are shifting from concept to institutional actuality. At Untold, we’re centered on bringing extra real-world belongings—particularly in IP, tech, and digital infrastructure—onto the chain in a compliant means, so this second resonates. It displays a rising shift the place tokenization isn’t nearly liquidity; it’s about programmability, entry, and future-proofing possession fashions.”

Galaxy Digital’s Q2 Asset ‘Plunge’ Sparks Fears, However Specialists Level to AI Pivot and Document 80K BTC Sale

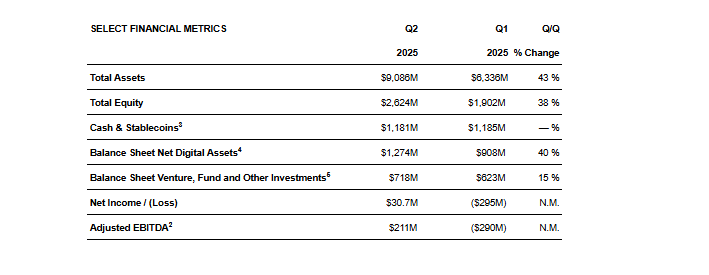

The announcement follows a turbulent second quarter for the digital asset agency. Galaxy reported $9.1 billion in whole belongings for Q2 2025, a 43% enhance from the earlier quarter, but in addition famous risky monetary exercise.

Internet earnings for the interval reached $30.7 million, a pointy turnaround from a $295 million loss in Q1. Nonetheless, adjusted gross revenues declined 30% quarter-over-quarter, and whole transaction bills fell by a 3rd.

The quarter noticed Galaxy full its company restructuring and formally debut on Nasdaq on Might 16, opening at $23.50 per share. The itemizing adopted years of delays that Novogratz described as “infuriating.”

Joël Valenzuela, Director of Advertising and BD at Sprint, instructed CryptoNews that “The Q2 asset plunge is probably going only a dip from international geopolitical uncertainty. Nonetheless, I believe we’re underestimating the uncertainty across the crypto markets that’s being lifted within the US, Europe, and elsewhere by implementing regulatory readability. As soon as the world feels empowered to leverage blockchain tech to its fullest extent, the upside potential is very large.”

Regardless of the asset fluctuations, the agency’s Digital Property division posted robust outcomes, with adjusted EBITDA of $13 million and a 28% enhance in international markets’ gross revenue. The common measurement of its mortgage guide rose to $1.1 billion amid rising demand for margin lending.

Its treasury and company division delivered a lot of the features, whereas income from its digital belongings unit and asset administration arm have been extra modest. Galaxy dealt with one of many largest Bitcoin gross sales in historical past, offloading over 80,000 BTC on behalf of a shopper.

The agency mentioned July was its greatest month ever for digital asset operations, with progress in international markets and new exercise in infrastructure. The agency additionally reported the sale of over 80,000 Bitcoin on behalf of a shopper after the quarter closed, one of many largest notional transactions of its type so far.

Galaxy’s asset administration and staking providers grew, reaching $9 billion in belongings on the platform by the top of June. Nonetheless, earnings from staking declined 26% on account of decrease exercise throughout blockchain networks.

In the meantime, the agency continues to construct out its Helios knowledge heart campus. The corporate confirmed that CoreWeave has dedicated to the total 800 megawatts of energy authorized on the web site.

Ali Mahir Aksu, founding father of Untold.io, instructed CryptoNews that “As for the Q2 asset drop, it’s half cyclical cooling, half rising pains—not a structural flaw. And Galaxy’s AI/knowledge heart pivot reveals they’re enjoying the lengthy recreation: constructing throughout cycles, not simply driving them.”

Galaxy additionally acquired a further 160 acres of land close by, elevating the campus’s whole footprint to over 1,500 acres and growing potential capability to three.5 gigawatts.

Novogratz Says Crypto Treasury Increase Might Have Peaked

Novogratz mentioned the wave of crypto treasury companies, firms holding digital belongings on their steadiness sheets, could have already peaked.

Talking throughout Galaxy’s Q2 earnings name, Novogratz famous that whereas early entrants like Michael Saylor’s Bitcoin-focused technique led the best way, newer companies may wrestle for traction.

He pointed to Ethereum-focused companies similar to BitMine and SharpLink as key gamers set for additional progress, whereas warning that future startups would possibly discover it more durable to scale. Galaxy presently companions with over 20 such companies, managing roughly $2 billion in belongings and producing regular price earnings.

Past treasury companies, Galaxy can be constructing out its institutional infrastructure. In July, it built-in its staking platform with Fireblocks, giving over 2,000 monetary establishments entry to staking providers straight by means of Fireblocks’ custody system.

@galaxyhq has expanded entry to its institutional staking platform by means of a brand new integration with crypto custody supplier @FireblocksHQ.#Galaxy #Fireblockshttps://t.co/UnN8CFkZJn

— Cryptonews.com (@cryptonews) July 9, 2025

In the meantime, Galaxy Ventures, the agency’s funding arm, closed its first exterior enterprise fund in June, securing $175 million, above its preliminary $150 million goal. The fund focuses on early-stage initiatives in tokenization, stablecoins, and blockchain infrastructure. Since 2018, Galaxy has invested in over 120 startups, together with Monad and Ethena.

Novogratz mentioned blockchain-based markets stay the long-term imaginative and prescient, although tokenized liquidity nonetheless lacks clear solutions.

The submit Galaxy Digital Eyes Tokenized GLXY After 43% Asset Surge, 80K-BTC Mega-Commerce appeared first on Cryptonews.