Chainlink has introduced a collaboration with FTSE Russell to carry the index supplier’s benchmarks on-chain by way of DataLink, Chainlink’s institutional-grade knowledge publishing service.

We’re excited to announce that @FTSERussell, a number one world index supplier with $18T+ in AUM benchmarked, is collaborating with Chainlink to publish its world-leading world indices onchain for the primary time by way of DataLink.https://t.co/hCSHCvweNy

With this integration, the… pic.twitter.com/MIIhP6kTrl— Chainlink (@chainlink) November 3, 2025

In a press launch shared with CryptoNews, the agency explains that this transfer marks the primary time FTSE Russell’s knowledge—together with the Russell 1000, Russell 2000, Russell 3000, and FTSE 100 indexes, alongside WMR FX benchmarks and FTSE Digital Asset Indices—can be obtainable instantly on blockchain networks.

With over $18 trillion in belongings below administration benchmarked towards its indices, FTSE Russell’s entry into the blockchain area represents a serious step in bridging conventional finance and decentralized ecosystems.

The information will now be accessible throughout greater than 50 private and non-private blockchains to 2,000+ Chainlink ecosystem functions, opening the door to new tokenized monetary merchandise.

Accelerating Institutional Adoption of Tokenized Belongings

FTSE Russell’s determination to publish its index knowledge on-chain displays the rising demand amongst monetary establishments for trusted, regulated knowledge sources in digital markets. By utilizing Chainlink’s oracle infrastructure, establishments and builders can construct tokenized belongings, ETFs, and next-generation monetary merchandise.

“We’re excited to carry our index knowledge on-chain utilizing Chainlink’s institutional-grade infrastructure,” mentioned Fiona Bassett, CEO at FTSE Russell, an LSEG enterprise.

“This marks a serious step in enabling innovation round tokenized belongings and next-generation monetary merchandise. DataLink permits FTSE Russell to securely distribute trusted benchmarks throughout world on-chain markets,” provides Bassett.

DataLink: A Bridge Between Conventional and Decentralized Markets

Chainlink’s DataLink serves as a turnkey resolution, permitting knowledge suppliers to publish info instantly onto blockchains with out constructing or sustaining new infrastructure.

It makes use of Chainlink’s oracle know-how, which has allowed over $25 trillion in transaction worth and actively secures almost $100 billion in DeFi complete worth locked (TVL).

The service ensures that knowledge from established suppliers like FTSE Russell is authenticated, tamper-proof, and accessible 24/7, permitting DeFi protocols to reference the identical high-quality knowledge that powers conventional monetary programs.

A Defining Second for On-chain Finance

Chainlink co-founder Sergey Nazarov described the collaboration as a “landmark second” for each industries. “FTSE Russell bringing its trusted benchmarks to blockchains by way of Chainlink is a crucial step towards enabling the following era of data-driven monetary merchandise and tokenized belongings,” Nazarov mentioned.

With this integration, blockchain builders and monetary establishments can confirm, reference, and construct with FTSE Russell’s knowledge throughout a number of blockchains, setting the stage for broader adoption of regulated, data-backed monetary devices in decentralized markets.

U.S. Commerce Dept Companions with Chainlink to Convey Knowledge On-chain

In August, the USA Division of Commerce (DOC) mentioned it has teamed up with Chainlink to carry macroeconomic knowledge from the Bureau of Financial Evaluation (BEA) on-chain.

Chainlink shared that by means of its oracle infrastructure, key indicators equivalent to Actual Gross Home Product (GDP), the Private Consumption Expenditures (PCE) Worth Index, and Actual Ultimate Gross sales to Non-public Home Purchasers are actually obtainable throughout ten blockchain programs.

This transfer additionally marked the primary time U.S. authorities financial knowledge has been revealed on-chain in a verifiable manner. Based on the agency, builders can instantly combine the Chainlink Knowledge Feeds into decentralized functions (dApps), unlocking use circumstances equivalent to automated buying and selling methods, composable tokenized belongings, prediction markets, and threat administration instruments for DeFi protocols.

Chainlink Worth Motion

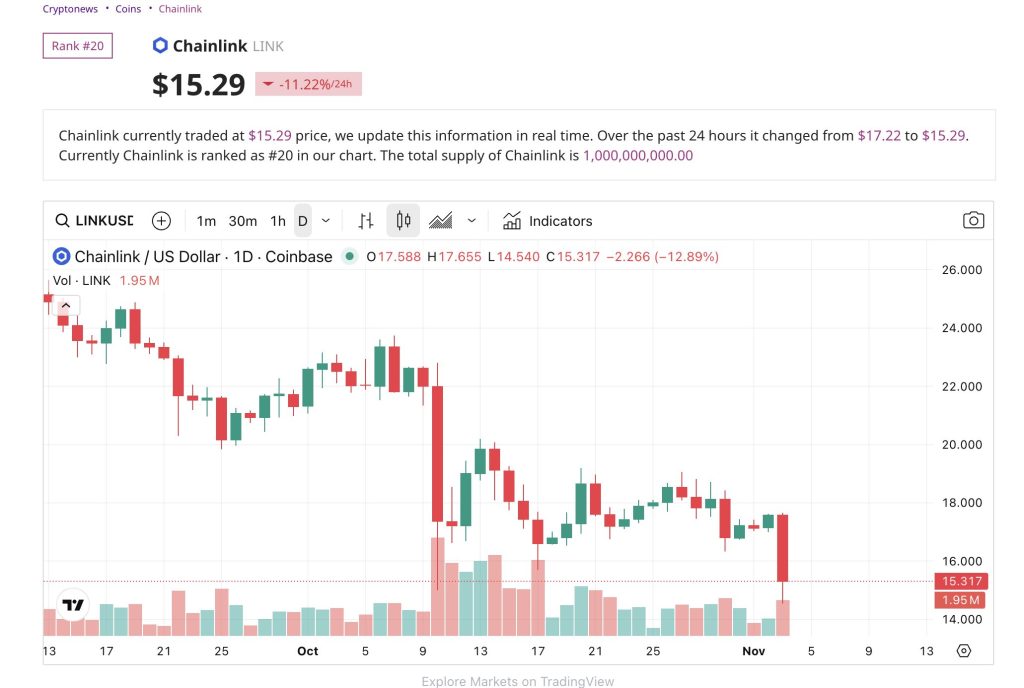

Chainlink’s native token, LINK, fell sharply over the previous 24 hours, sliding 11.22% to $15.29 on the time of writing, in keeping with knowledge from CryptoNews.

The LINK/USD pair, buying and selling on Coinbase, recorded a day by day excessive of $17.65 and a low of $14.54, closing at $15.31—a drop of almost 13% on the day. Buying and selling quantity surged to 1.95 million LINK, indicating robust sell-side exercise. Chainlink at present ranks #20 by market capitalization, with a complete provide of 1 billion tokens.

The put up FTSE Russell Brings Its Indices Onchain Via Chainlink’s DataLink – Turning Level for Institutional Finance? appeared first on Cryptonews.