The previous week was a wild one on the cryptocurrency market however that’s additionally true for legacy markets as nicely. This simply goes to point out that the mounting institutional involvement in crypto is, partly, liable for the correlation, however that’s a subject for one more dialogue.

Although Bitcoin is buying and selling nearly flat on the weekly chart, the previous seven days have been something however calm. Naturally, a lot of the volatility needed to do with the struggle between Iran and Israel.

Round June twenty third, BTC dropped beneath $100K for the primary time since early Could, sending the markets right into a state of discomfort and inflicting over $1 billion value of liquidated positions. This was brought on largely due to the information that the US had determined to enter the struggle on the aspect of Israel and bomb strategic nuclear websites in Iran.

The turmoil didn’t cease there, however doomsayers had all of it incorrect as a result of on the very subsequent day, the scenario began de-escalating following what many believed to be a staged retaliation by Iran concentrating on a US base in Qatar, inflicting minor harm.

Following this case, US President Donald Trump introduced a ceasefire and regardless of the minor tensions, it seems that the battle is now subdued. Markets reacted positively, with BTC rallying from the sub-$100K area to a excessive at round $108,000.

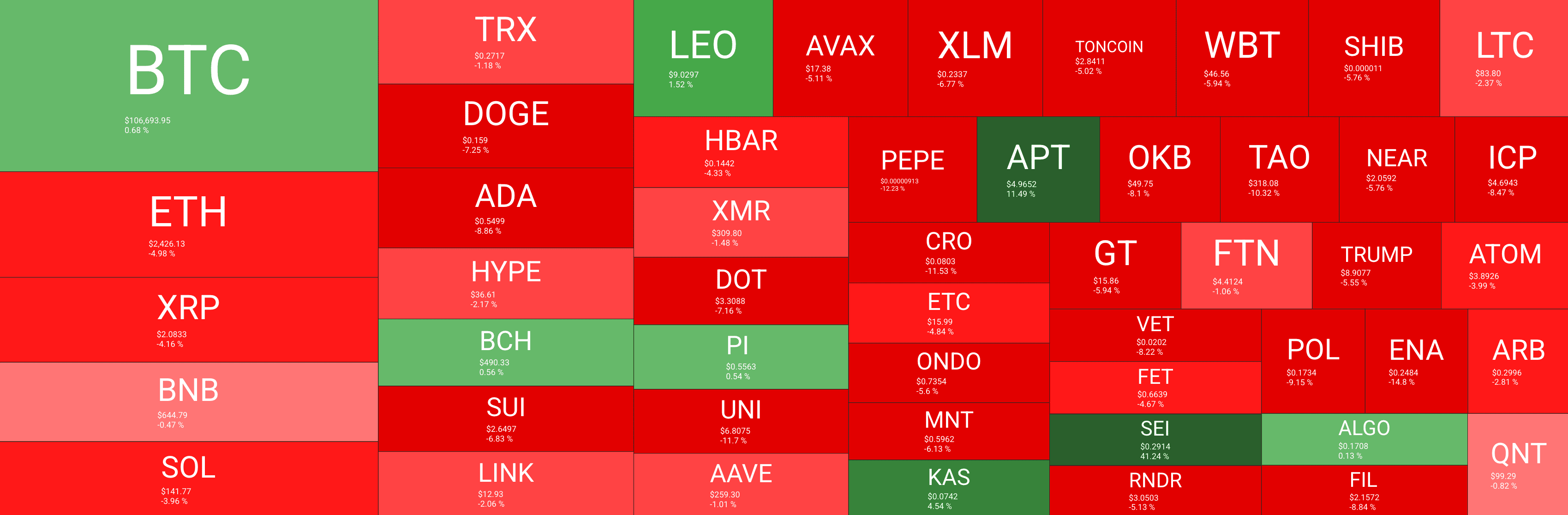

On the time of this writing, the cryptocurrency is buying and selling at $107,000, however the majority of altcoins, as you may see within the heatmap beneath, took a way more appreciable punch. A lot of them are down between 4% and 10%, signaling, as soon as once more at Bitcoin’s unshakable dominance prior to now few months.

In different information, one of many extra attention-grabbing developments got here from Chainlink as Mastercard – one of many world’s main fee processing corporations – introduced a partnership with the goals of enabling its 3 billion customers to seamlessly purchase crypto. That is what adoption appears like.

One other are that many are monitoring intently is the authorized battle between the US SEC and Ripple. Lots of people have been anticipating the case to formally finish this week, however the presiding decide tossed the events’ movement for indicative ruling, which signifies that the entire thing shall be dragged out, presumably for one more few months. All of it is dependent upon Ripple now.

All in all, the market fared very nicely within the face of mounting geopolitical turmoil and financial instability, however it’s very attention-grabbing to see how issues will develop within the weeks to come back.

Market Information

Market Cap: $3.384T | 24H Vol: $84B | BTC Dominance: 62.7%

BTC: $106,693 (+0.6%) | ETH: $2,426 (-5%) | XRP: $2.08 (-4%)

This Week’s Crypto Headlines You Can’t Miss

Surprising Quantity of BTC Absorbed by Consumers Throughout Current Market Turmoil. Over the previous couple of weeks, market members have bought about 720,000 BTC, nearly all of which was off-loaded by comparatively new holders. It’s very spectacular that the market was capable of take in this amount with out falling off a cliff.

Final Time Bitcoin Did This, the Worth Went From $60K to $100K. The LTH/STH ratio is creeping up. This significantly constructive on-chain metric has beforehand been the precursor to large rallies such because the one from $28K to $60K and from $60K to $100,000. We all know that historical past doesn’t repeat, however will it rhyme?

Prime Cryptos to Watch: These Are Poised for Breakout In response to Information. In an attention-grabbing report from this week, the favored crypto analytics agency Santiment launched its insights into a number of the extra thrilling cash to observe as we’re getting into the third quarter of the yr. A few of them may shock you.

Chainlink Companions With Mastercard Enabling 3 Billion Cardholders to Purchase Crypto. The world’s main oracle offering – Chainlink – has teamed up with one of many world’s main fee networks – Mastercard. The partnership goals to allow a whopping 3 billion Mastercard cardholders to purchase crypto seamlessly.

XRP Drops Following Ripple’s Newest Setback in SEC Authorized Battle. Many anticipated the Ripple v. SEC case to come back to a halt this week, however sadly for XRP holders, the decide didn’t grant the events’ movement for indicative ruling. This principally signifies that Ripple is now going through a selection – to proceed with the enchantment or to drop it solely.

Circle Hits $66B Valuation, Surpassing USDC Provide. Circle, the world’s second-largest stablecoin issuer, is now sitting at a valuation of greater than $66 billion, following the newest will increase in its share values. The corporate is now trailing Coinbase after what appears to be a really profitable preliminary public providing.

Charts

This week, we’ve got a chart evaluation of Ethereum, Ripple, Cardano, Solana, and Hype – click on right here for the whole worth evaluation.

The publish From $98K to $108K Amid Main Geopolitical Turmoil, Bitcoin’s Doing Fairly Properly: Your Weekly Crypto Recap appeared first on CryptoPotato.