Market anxiousness is driving worth motion. Bitcoin is buying and selling round $85,000 after a pointy single-session drop of practically 6%, extending a decline from the October peak of round $125,000.

The Crypto Concern and Greed Index is at the moment close to 20, following a trough round 10, which nonetheless signifies excessive concern. That backdrop hyperlinks on to central-bank indicators, thinner liquidity, and continued lengthy liquidations.

Bitcoin Underneath Coverage Stress

The Financial institution of Japan has been getting ready markets for a shift away from ultra-easy settings, with Governor Kazuo Ueda indicating {that a} coverage change assembly is scheduled for December, contingent on wage information. Merchants have learn that steerage as a possible finish to the negative-rate period, which tightened monetary situations into the weekend and helped set off the slide.

On the U.S. facet, Federal Reserve officers have leaned cautious on extra easing. Boston Fed President Susan Collins stated she could be “hesitant to ease coverage additional,” describing a “comparatively excessive bar” for additional strikes with out clearer labor-market deterioration.

The remarks of the Federal Reserve and the speak of a coverage shift in Japan have pushed yields increased and firmed the greenback; the mixture raises funding prices, softens futures foundation towards impartial, and reduces tolerance for leverage that had supported rallies throughout stronger tapes.

Outflows from some spot autos on risk-off classes compound that stress as a result of they drain money that might in any other case stabilize closes.

What Would Ease The Pressure

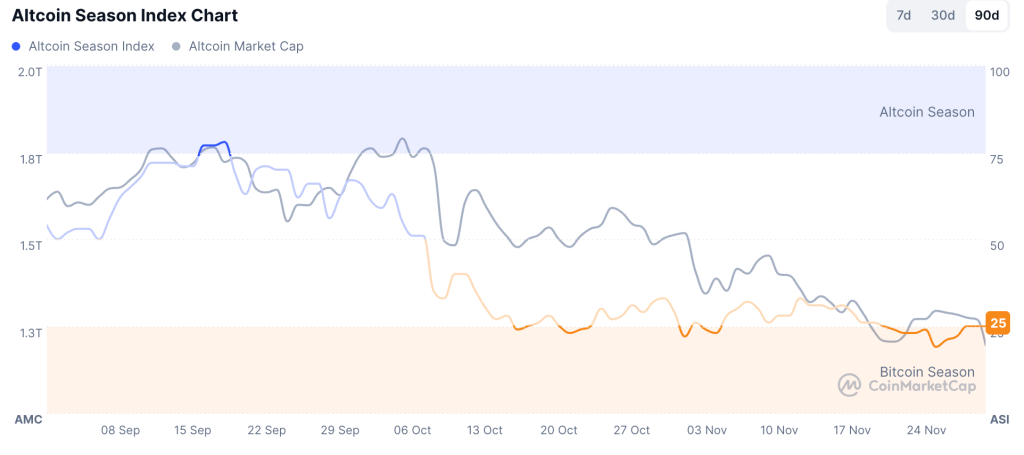

Crypto markets shed billions as the worldwide market enters December 2025. Greater than $637 million in lengthy positions had been liquidated in the course of the slide, and the Altcoin Season Index fell to 25, pointing to weak breadth past Bitcoin.

Altcoin Season Index (Supply: CoinMarketCap)

A reputable flip would present up collectively moderately than in fragments. Order-book depth on the biggest BTC and ETH pairs would rebuild into and after the US session, whereas spreads would keep contained throughout average promoting, and funding would stabilize with out leaning on brief squeezes that exhaust by the shut.

Spot product creations would want to enhance alongside an increase in internet stablecoin issuance, since that pairing indicators contemporary money coming in moderately than transient masking. When these flows persist for a number of classes, rebounds are likely to settle extra cleanly on the finish of the day.

Central financial institution remarks that push yields increased or agency the greenback can maintain bids tender, and reduction rallies danger fading when depth thins and exchange-traded move doesn’t offset de-risking. The tone throughout majors nonetheless follows Bitcoin, and Bitcoin stays one coverage headline away from one other take a look at of assist.

The put up Federal Reserve and Financial institution of Japan Indicators Hit Crypto, Market Losses Deepen appeared first on Cryptonews.