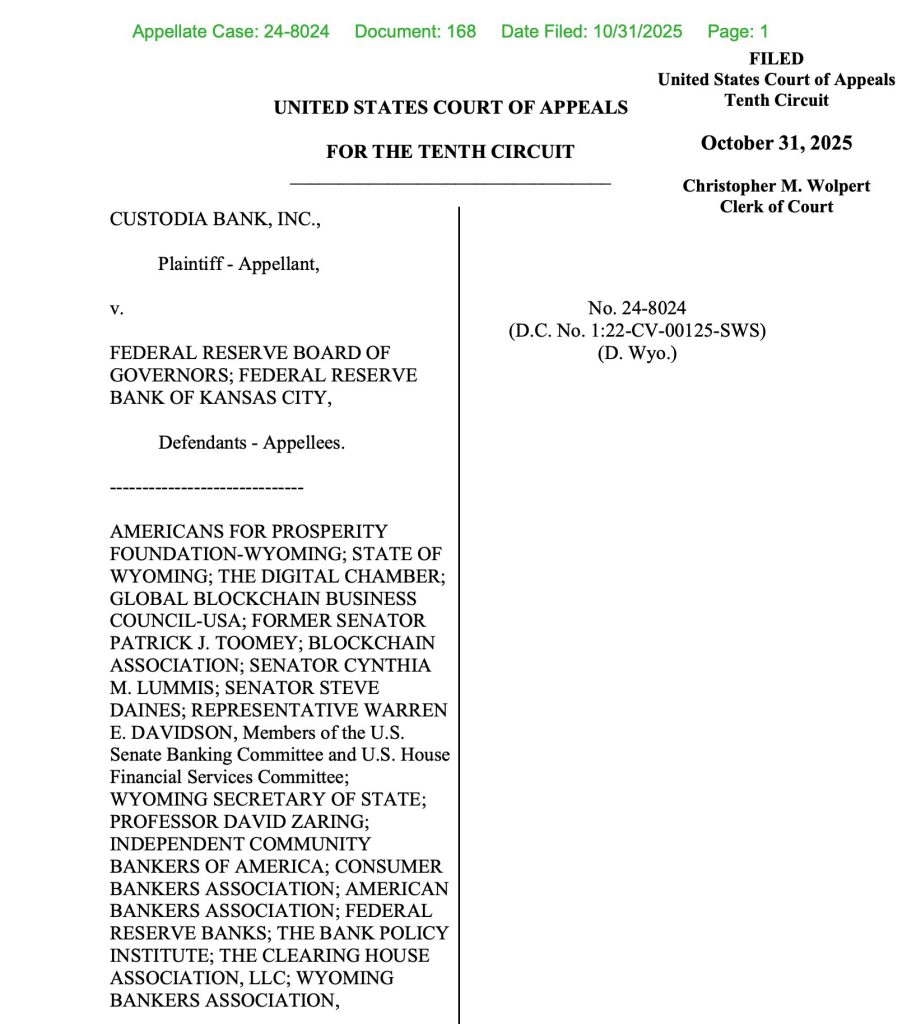

A U.S. appellate court docket has dominated towards Custodia Financial institution, the Wyoming-based crypto-focused establishment based by former Morgan Stanley government Caitlin Lengthy, in its long-running battle to realize direct entry to the Federal Reserve’s fee system.

In a call filed Friday, the U.S. Courtroom of Appeals for the Tenth Circuit affirmed an earlier ruling from the District of Wyoming that sided with the Federal Reserve Board of Governors and the Federal Reserve Financial institution of Kansas Metropolis.

Tenth Circuit Upholds Fed’s Determination to Block Custodia’s Entry to U.S. Fee System

The judgment marks the most recent setback in Custodia’s five-year effort to acquire a Federal Reserve “grasp account,” a vital gateway for direct participation within the U.S. banking system.

“This case comes clothed in twenty first Century phrases: cryptocurrency, digital property, immediate wire transfers, and grasp accounts,” the judges wrote within the opinion.

“However there’s nothing new about this concern. Courts have probed the legality of our nation’s central financial institution and interpreted the related statutes because the founding.”

The three-judge panel, composed of Circuit Judges Tymkovich, Ebel, and Rossman, upheld the decrease court docket’s conclusion that the Federal Reserve acted inside its authority when it denied Custodia’s software.

The ruling successfully leaves the central financial institution’s resolution intact, confirming that the Fed retains broad discretion in figuring out which monetary establishments can entry its fee infrastructure.

Custodia, beforehand generally known as Avanti Financial institution, first utilized for a grasp account in October 2020 after receiving a special-purpose depository establishment (SPDI) constitution from the state of Wyoming.

The appliance, sometimes processed inside every week, languished for over 19 months with out decision.

In January 2023, the Federal Reserve Financial institution of Kansas Metropolis formally rejected the request, citing “security and soundness” considerations tied to the financial institution’s give attention to digital property.

U.S. digital asset-focused financial institution Custodia has filed a lawsuit towards the FED Board of Governors and the Federal Reserve Financial institution of Kansas Metropolis over “unlawfully” delaying its software for a grasp account with the FED.

Learn extrahttps://t.co/8rpBp5piaM

— Cryptonews.com (@cryptonews) September 23, 2022

The Fed argued that Custodia’s enterprise mannequin relied too closely on unstable crypto markets and lacked ample controls to handle illicit finance dangers.

It additionally pointed to the financial institution’s restricted expertise in conventional threat administration and the potential systemic implications of granting direct entry to a crypto-centered establishment.

Custodia sued the Federal Reserve in June 2022, claiming an “illegal delay” and arguing that eligible establishments are entitled to a grasp account below federal legislation.

After the Wyoming court docket dominated in favor of the Fed in March 2024, Custodia appealed, asserting that the choice gave the central financial institution extreme discretion over market entry.

Decide Guidelines Towards Digital Asset Financial institution Custodia’s Bid for Federal Reserve Grasp Account

Custodia Financial institution has been denied a U.S. Federal Reserve grasp account by the USA District Courtroom for the District of Wyoming. #CryptoNewshttps://t.co/lHtNJ69ZdW— Cryptonews.com (@cryptonews) March 31, 2024

Friday’s ruling reaffirmed the decrease court docket’s place, dealing one other blow to Lengthy’s push to combine crypto banking into the U.S. monetary system.

In an announcement posted to X following the judgment, Custodia mentioned it was “actively contemplating” petitioning for a rehearing.

Assertion of @custodiabank: pic.twitter.com/6U0FPzaKCm

— Custodia Financial institution

(@custodiabank) October 31, 2025

“Whereas we had been hoping for a win on the Tenth Circuit at the moment, we acquired the following massive factor — a robust dissent,” the corporate wrote, referring to a partial dissent that raised constitutional questions in regards to the Federal Reserve’s authority.

Why Gained’t the Fed Grant Crypto Companies a Grasp Account?

A Federal Reserve grasp account would have allowed Custodia to attach on to core U.S. fee techniques corresponding to Fedwire and the Automated Clearing Home (ACH).

Such entry permits banks to settle transactions, maintain reserves, and take part straight in financial coverage operations, advantages at present restricted to regulated depository establishments.

Crypto-focused corporations have lengthy sought comparable entry to enhance effectivity and scale back reliance on middleman banks.

Nonetheless, the Federal Reserve has not accepted any grasp account functions from crypto-native establishments so far.

The central financial institution has repeatedly cited the sector’s excessive volatility, potential for fraud, and inadequate client safety as causes for warning.

Custodia’s case has grow to be a focus within the broader debate over how conventional banking regulation ought to apply to crypto corporations.

Custodia Financial institution CEO @CaitlinLong_ has criticized the U.S. authorities’s failure to handle crypto debanking since Trump returned to workplace. #Trump #Regulationhttps://t.co/iSH4RxoinL

— Cryptonews.com (@cryptonews) March 2, 2025

Lengthy has accused the Fed of double requirements, arguing that enormous conventional banks obtain preferential remedy whereas smaller innovators face “debanking.”

In April, Lengthy criticized the Federal Reserve for sustaining restrictions that stop banks from straight holding crypto or issuing stablecoins on public blockchains like Ethereum.

Caitlin Lengthy claims the US Federal Reserve masked its anti-crypto stance with faux rule relaxations whereas defending big-bank stablecoins and blocking actual crypto progress.#Caitlin Lengthy #USFed.https://t.co/6kALn4okMF

— Cryptonews.com (@cryptonews) April 28, 2025

She argued that the Fed continues to favor non-public blockchain techniques managed by main banks, making a aggressive imbalance.

Earlier this 12 months, Custodia introduced it had launched “Avit,” a tokenized U.S. greenback stablecoin issued collectively with Vantage Financial institution on Ethereum.

@custodiabank and @Vantage_Bank have introduced the launch of the first-ever U.S. bank-issued stablecoin deployed on blockchain.#Custodia #Stablecoinhttps://t.co/Y7VyUBlr2i

— Cryptonews.com (@cryptonews) March 26, 2025

The undertaking, backed by on-demand deposits held inside the banking system, was described as the primary U.S. bank-issued stablecoin deployed on a public blockchain.

Lengthy mentioned the initiative proved that banks may “tokenize demand deposits on a permissionless blockchain in a regulatorily compliant method.”

Regardless of such efforts, federal regulators have maintained a cautious stance.

Talking in March, Lengthy mentioned that below the present administration, no significant adjustments have been made to guidelines labeling digital asset publicity as “unsafe and unsound” for banks.

The submit Fed Crushes Caitlin Lengthy’s Crypto Financial institution’s 5-Yr Bid for Grasp Account appeared first on Cryptonews.