Ethereum continued its upward trajectory this week, buying and selling close to $3,881.50 after gaining 4.04% prior to now 24 hours and lengthening its rally over seven days. The world’s second-largest cryptocurrency noticed its intraday excessive attain $3,924, supported by bettering on-chain fundamentals, renewed investor optimism, and rising institutional accumulation.

In line with DefiLlama, Ethereum’s Complete Worth Locked (TVL) sits close to $84 billion, sustaining its place because the dominant power in decentralized finance with roughly two-thirds of world DeFi liquidity. Regardless of a modest 0.7% every day dip, Ethereum’s community exercise stays strong, underscoring its resilience.

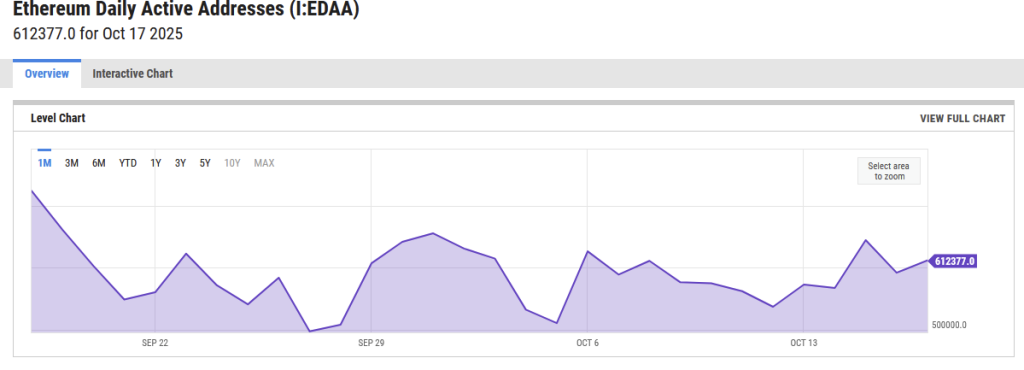

Ethereum’s every day lively addresses climbed to 612,377 as of October 17, 2025, marking one of many strongest ranges this month. Transaction volumes proceed to hover above 1.6 million per day, whereas community charges exceeded $1.6 million in 24 hours, signaling sustained demand for block area.

On the similar time, ETH change reserves have continued to fall, suggesting long-term accumulation and decreased short-term promoting strain amongst holders.

Key takeaways from Ethereum’s present on-chain panorama:

- TVL close to $84B regardless of minor pullback

- 612K every day lively addresses; 1.6M+ transactions

- Trade balances declining, signaling accumulation

Asian Buyers Plan $1 Billion Ethereum Treasury

A consortium of Asian traders is making ready a $1 billion Ethereum treasury to ascertain ETH as a regional reserve asset. The trouble is led by Li Lin, founding father of Huobi and chairman of Avenir Capital, with participation from HashKey Group’s Xiao Feng, Fenbushi Capital’s Shen Bo, and Meitu founder Cai Wensheng.

Ethereum getting one other $1 billion ETH treasury firm.

Bullish. pic.twitter.com/ghoU4Jg8aL— RYAN SΞAN ADAMS – rsa.eth

(@RyanSAdams) October 17, 2025

Bloomberg reviews that pledges already exceed $1 billion, together with $500 million from HongShan Capital Group (previously Sequoia China) and $200 million from Avenir Capital. The initiative, anticipated to be introduced inside weeks, will reportedly mix direct ETH holdings with yield-based methods constructed on Ethereum’s DeFi ecosystem.

Institutional portfolios have been steadily including ETH. Company treasuries now maintain roughly 3.6 million ETH, led by BitMine Immersion (1.7 million ETH) and SharpLink Gaming (797,000 ETH)—collectively valued at about $3 billion.

Whereas some analysts warn of overvaluation in digital asset treasuries, others view this as an indication of market maturation, significantly as Ethereum continues to outperform most Layer-1 rivals in community adoption and liquidity retention.

Ethereum Technical Outlook: Triangle Sample Hints at Breakout

From a technical perspective, Ethereum worth prediction stays impartial is consolidating inside a symmetrical triangle, a sample that usually precedes sharp breakouts. The higher resistance lies close to $3,937, aligning with the 100-EMA, whereas help sits round $3,713–$3,510, the place the 50-EMA converges.

A confirmed breakout above $3,937 may propel ETH towards $4,093, with an prolonged goal at $4,299, similar to key Fibonacci retracement ranges. Conversely, a breakdown under $3,510 would possibly set off a pullback towards $3,350.

With the RSI hovering close to 48 and refined bullish divergence forming, Ethereum seems poised for renewed upside momentum. If worth confirms above resistance, ETH may rally towards $4,300–$4,550, aligning with the higher boundary of the descending channel.

Ethereum’s present consolidation seemingly represents a interval of accumulation earlier than its subsequent main leg larger, a setup more and more supported by on-chain information, institutional inflows, and optimism surrounding the upcoming $1 billion Asian treasury launch.

With momentum constructing throughout each institutional and on-chain fronts, Ethereum’s construction suggests this consolidation may precede a decisive breakout towards $4,500 and past.

Bitcoin Hyper: The Subsequent Evolution of BTC on Solana?

Bitcoin Hyper ($HYPER) is bringing a brand new part to the Bitcoin ecosystem. Whereas BTC stays the gold customary for safety, Bitcoin Hyper provides what it all the time lacked: Solana-level pace.

Constructed as the primary Bitcoin-native Layer 2 powered by the Solana Digital Machine (SVM), it merges Bitcoin’s stability with Solana’s high-performance framework. The outcome: lightning-fast, low-cost good contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Seek the advice of, the undertaking emphasizes belief and scalability as adoption builds. And momentum is already robust. The presale has surpassed $23.9 million, with tokens priced at simply $0.013125 earlier than the following enhance.

As Bitcoin exercise climbs and demand for environment friendly BTC-based apps rises, Bitcoin Hyper stands out because the bridge uniting two of crypto’s largest ecosystems.

If Bitcoin constructed the inspiration, Bitcoin Hyper may make it quick, versatile, and enjoyable once more.

Click on Right here to Take part within the Presale

The submit Ethereum Worth Prediction: Analyzing Onchain Metrics After ETH Posts Strong 24h and 7d Positive aspects appeared first on Cryptonews.