After breaking beneath the ascending flag sample, Ethereum has retraced to retest the damaged trendline. Ought to the promoting at this degree strain intensify, a deeper decline towards the $2K assist zone might comply with.

Ethereum (ETH) Value Evaluation: Technicals

By Shayan

The Day by day Chart

ETH just lately broke down from its ascending flag sample, triggering a corrective section. After discovering robust assist across the $2.1K degree, the cryptocurrency bounced and retraced towards the damaged trendline at $2.4K, the place it now seems to be encountering resistance.

Regardless of the rebound, the shortage of serious volatility and waning momentum round this key degree means that consumers are exhausted. If the promoting strain intensifies right here, ETH is more likely to full its pullback and lengthen its correction.

On this case, the $2K mark is rising as the subsequent key defensive zone the place the bulls might try to regain management.

The 4-Hour Chart

Zooming into the 4-hour timeframe, ETH initially discovered robust assist inside the 0.5–0.618 Fibonacci retracement zone, a traditionally dependable degree throughout corrections.

The sharp response from this vary led to a fast transfer upward. Nevertheless, the rally has now stalled exactly on the earlier flag’s decrease boundary, which at present acts as resistance close to $2.4K.

This rejection will increase the likelihood of one other downward leg, until the consumers are capable of swiftly reclaim management. The $2.1K zone, which overlaps with the Fib assist, stays a key battleground.

So long as this space holds, the market construction retains a bullish bias. If breached, nevertheless, it could pave the way in which for a deeper decline towards $2,000.

Onchain Evaluation

By Shayan

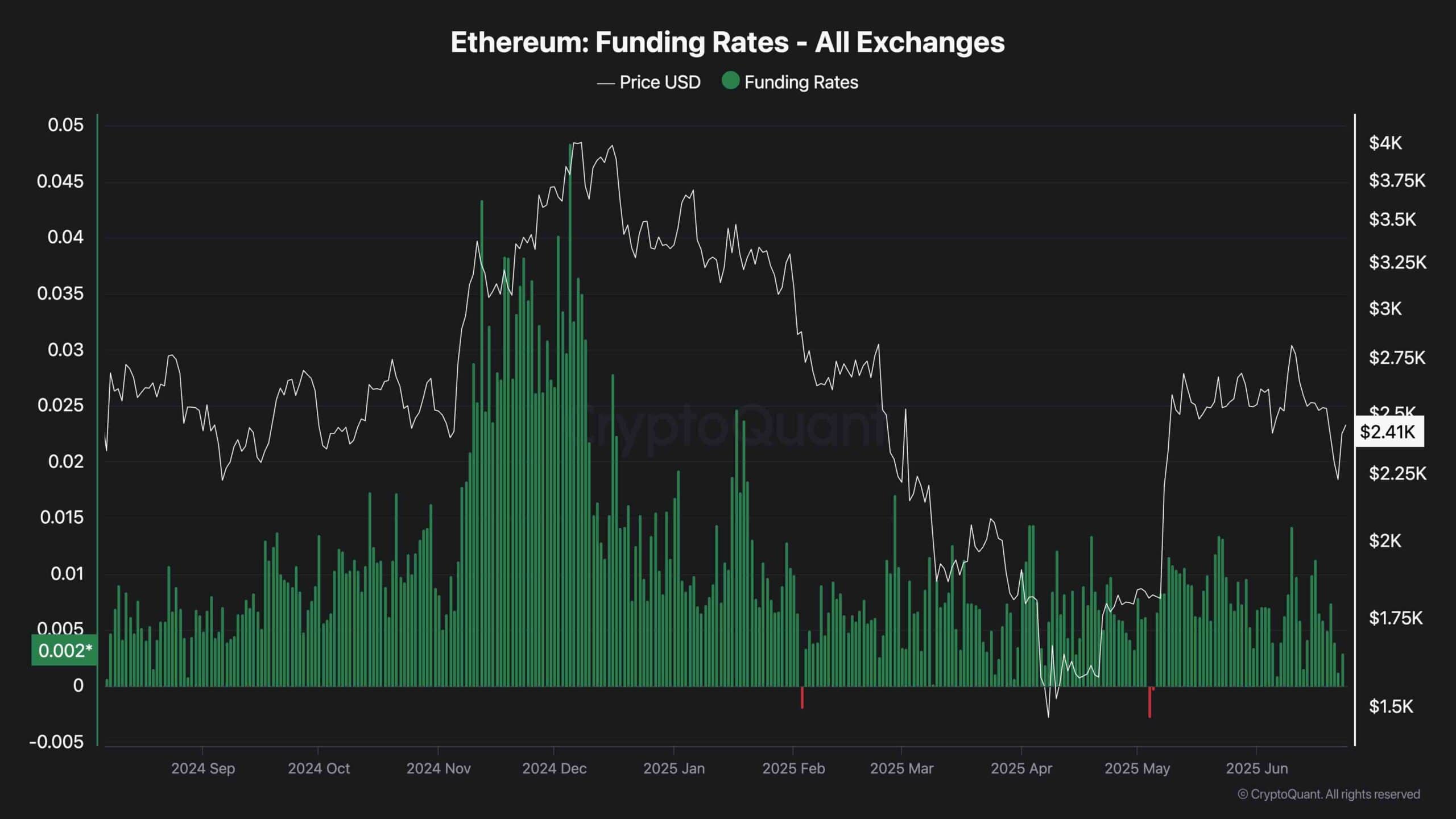

The funding charge metric serves as an important gauge of dealer sentiment inside the futures market. Sometimes, in a wholesome and sustainable uptrend, funding charges improve steadily, reflecting rising curiosity from lengthy place merchants throughout each the perpetual futures and spot markets.

Nevertheless, current tendencies reveal a decline in Ethereum’s funding charges, signalling waning bullish momentum and potential purchaser fatigue. This shift raises the likelihood of a short-term rejection and deeper corrective motion.

That mentioned, as funding charges strategy the impartial zone close to zero, it could counsel a reset in leveraged positions, indicating that the market is cooling off. This atmosphere usually precedes renewed demand and will pave the way in which for a robust bullish continuation as soon as the present consolidation section concludes.

The submit Ethereum Value Evaluation: Is ETH Staging a Push Towards $2.8K or Dealing with a Crash to $2K? appeared first on CryptoPotato.