Ethereum has entered a consolidation part after a powerful rally within the final couple of months. The worth has been ranging between key help and resistance zones, with a number of failed makes an attempt to interrupt above the $2,700–$2,800 area.

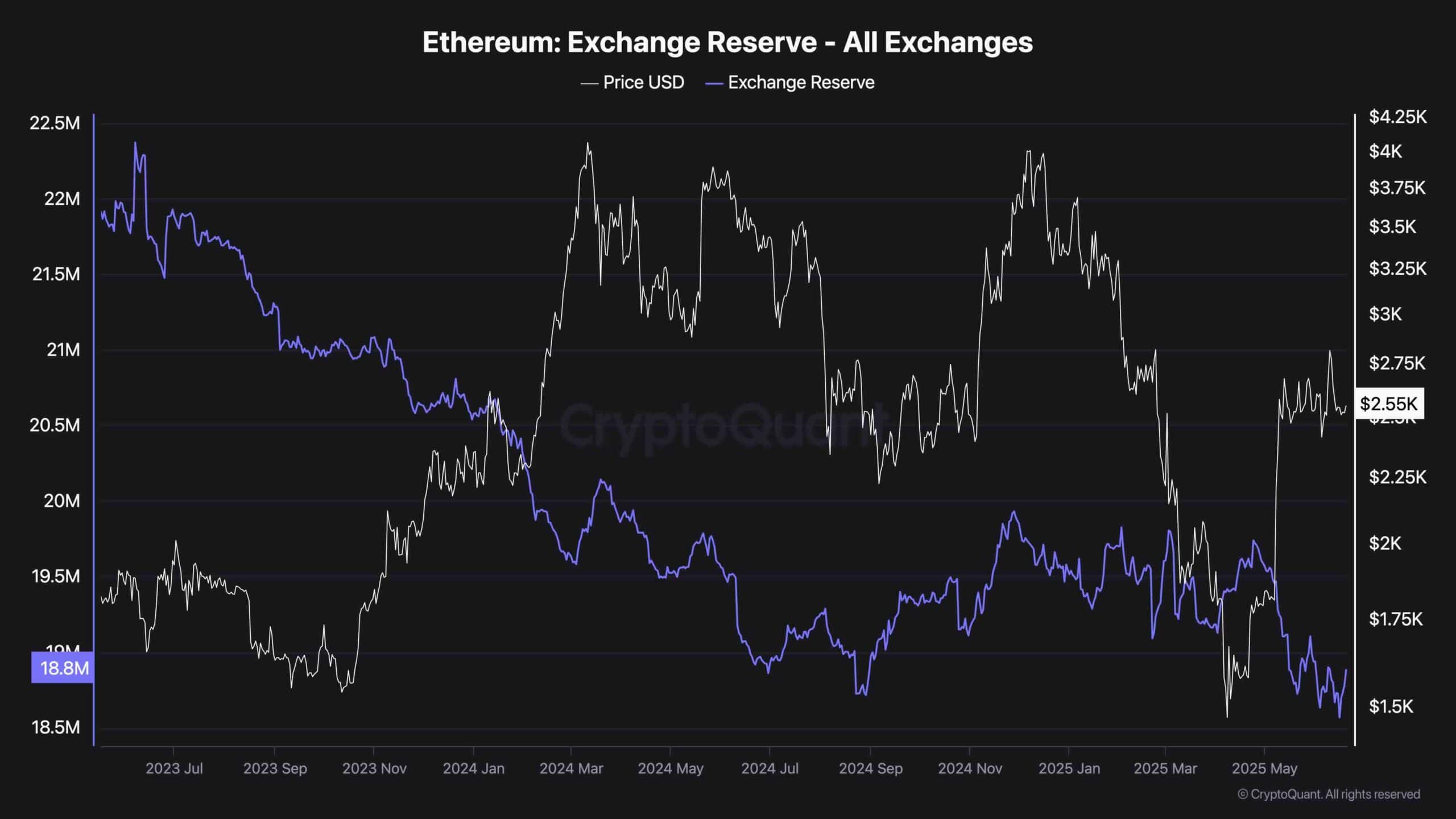

Regardless of the dearth of instant pattern continuation, on-chain fundamentals equivalent to trade reserves trace at vital structural shifts. This units the stage for potential volatility forward because the market prepares for its subsequent directional transfer.

Technical Evaluation

By ShayanMarkets

The Every day Chart

On the every day timeframe, ETH stays inside an ascending channel, constantly discovering help across the $2,400 space whereas struggling to interrupt above the $2,800 mark.

The higher boundary of this channel, mixed with the 200-day shifting common and a key order block fashioned in February, is performing as a heavy resistance factor. Every take a look at of this stage has led to a rejection, however thus far, the construction hasn’t damaged down, indicating that bulls are nonetheless in management for now.

Momentum, nevertheless, is weakening. The RSI hovers across the midline at 51, reflecting indecision and a scarcity of robust directional drive. If ETH can reclaim the higher vary and flip the $2,700–$2,800 space into help, it might provoke a brand new leg larger towards $3,000 and above. On the flip facet, a breakdown beneath $2,400 would shift the bias bearish, exposing the $2,150 help zone.

The 4-Hour Chart

Zooming in on the 4H chart, ETH continues to be grinding inside the identical rising channel. After the latest drop from $2,875 to $2,430, the worth retraced into the 0.5–0.618 Fibonacci zone, however has been rejected to the draw back and is now consolidating beneath it. This space, between $2,600 and $2,700, has repeatedly acted as a provide zone, rejecting bullish makes an attempt a number of occasions. For brief-term merchants, this stays the important thing stage to flip.

Till this resistance breaks, ETH could proceed its range-bound conduct. The RSI has recovered barely from oversold situations, now sitting close to 52. Whereas this means a slight uptick in momentum, there’s nonetheless no clear signal of bullish dominance. If the bulls fail to interrupt above this key fib zone quickly, one other drop towards the decrease boundary of the channel close to $2,400 is probably going.

Sentiment Evaluation

Some of the vital long-term indicators for Ethereum stays the constant downtrend in trade reserves. At the moment sitting at 18.8 million ETH, this is without doubt one of the lowest ranges in latest historical past. Change reserve information signifies how a lot ETH is held on centralized buying and selling platforms, which means a downtrend indicators that cash are being withdrawn into self-custody, staking, or chilly wallets.

Traditionally, sustained drops in trade reserves recommend a provide squeeze narrative constructing beneath the floor. Fewer tokens on exchanges scale back the accessible promoting strain and might result in explosive upside when demand rises.

Whilst ETH struggles to interrupt out technically, this silent accumulation part exhibits confidence amongst long-term holders. If this pattern continues, it might act as a strong tailwind as soon as technical resistance ranges are lastly breached.

The publish Ethereum Value Evaluation: ETH Consolidation Continues as Bullish Momentum Begins to Fade appeared first on CryptoPotato.