Ethereum stays range-bound between the 100-day and 200-day transferring averages, signalling a consolidation section.

Nonetheless, a decisive breakout in both route will doubtless outline the following main development, with market sentiment leaning towards a possible bullish breakout within the coming days.

ETH Value Evaluation: Technicals

By Shayan

The Day by day Chart

ETH is at the moment consolidating between the 100-day and 200-day transferring averages, getting into a decisive section in its worth motion.

After breaking above the pivotal 200-day MA round $2.5K, an space that has acted as robust resistance in current weeks, the worth has pulled again to retest this degree. This pullback is essential: if bullish demand resurfaces and holds ETH above this transferring common, it might doubtless ignite one other leg upward, focusing on the $2.8K resistance zone.

For now, the cryptocurrency seems to be range-bound between $2.5K and $2.8K, and a transparent breakout from this zone will doubtless set the stage for the following important development route. Market contributors are carefully looking ahead to a bullish continuation, which may solidify ETH’s reversal construction.

The 4-Hour Chart

On the decrease timeframe, ETH’s current rally encountered resistance at a key bearish order block between $2625 and $2670, the place sellers re-entered the market. This rejection has pushed the worth again towards the $2.5K assist degree, a traditionally important zone for ETH.

This space now serves as an important battleground. If consumers handle to defend it, Ethereum may regain momentum and reattempt a breakout above the overhead provide.

Nonetheless, failure to carry $2.5K may set off prolonged consolidation or perhaps a retracement towards decrease helps.

Onchain Evaluation

By Shayan

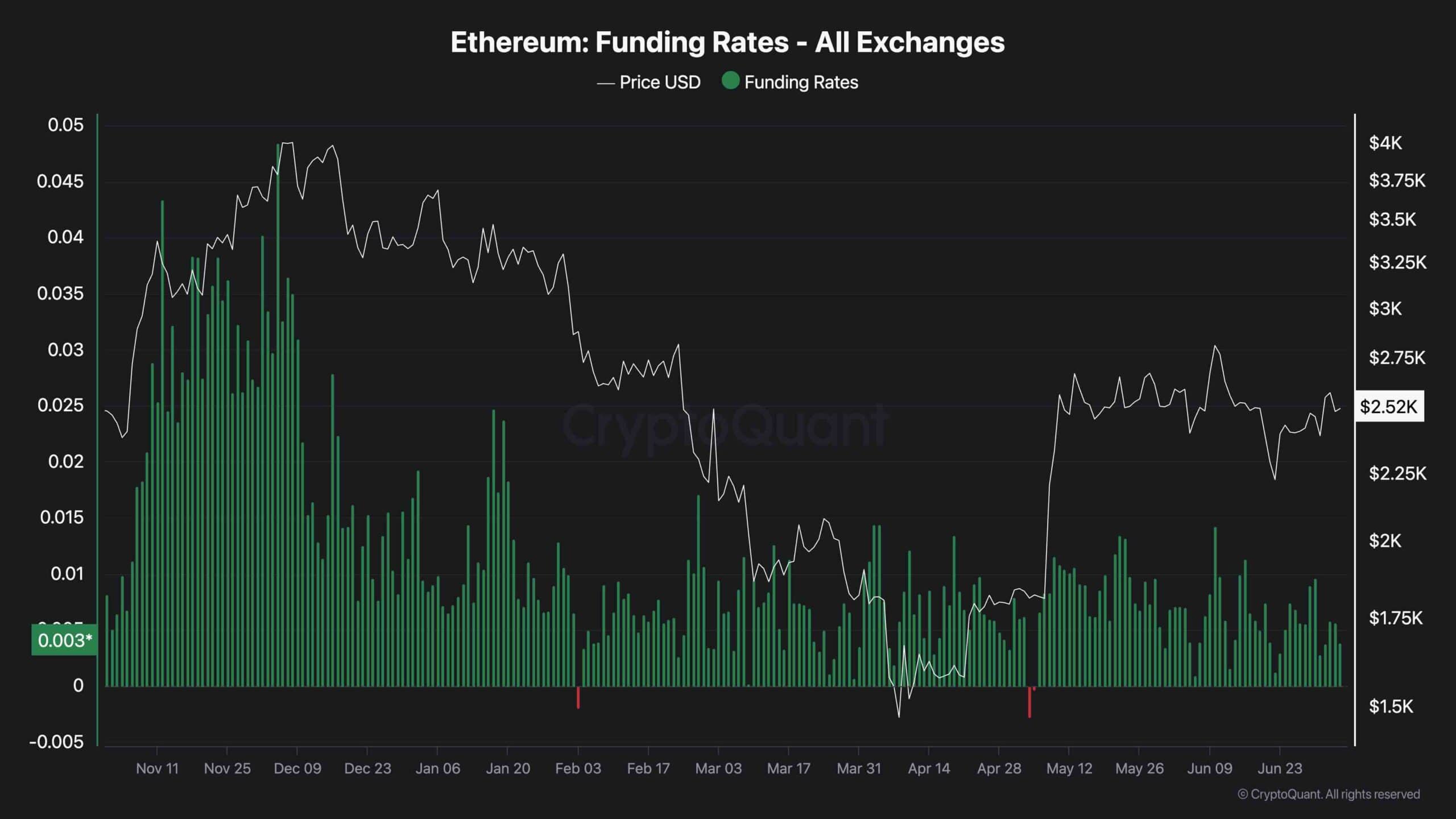

The funding charge stays a key indicator of market sentiment in Ethereum’s futures market. In a wholesome uptrend, this metric sometimes tendencies upward, reflecting growing confidence and positioning from long-biased merchants in each spot and perpetual markets.

Presently, nevertheless, ETH’s funding charges have been declining amid worth consolidation between the 100-day and 200-day transferring averages. This implies lowered bullish conviction and indicators of purchaser exhaustion, elevating the probability of continued short-term sideways motion.

For Ethereum to interrupt above the crucial $2.6K and $2.8K resistance zones, stronger demand should stream into the derivatives market, lifting the funding charge to extra optimistic ranges. Till that shift materializes, the consolidation section is more likely to persist.

The put up Ethereum Features 4% This Week, What are the Subsequent Targets? ETH Value Evaluation appeared first on CryptoPotato.