The Ethereum Basis has as soon as once more thrown its help behind Twister Money developer Roman Storm, pledging $500,000 in donations to fund the privacy-protocol developer’s authorized protection.

This announcement comes simply days after the Twister Money co-founder was convicted on certainly one of three federal costs that authorized consultants warn might set a harmful precedent for criminalizing open-source improvement.

Privateness is regular, and writing code just isn’t a criminal offense. https://t.co/BD55K5GDW3

— Ethereum (@ethereum) August 7, 2025

In an August 7 announcement, Hsiao-Wei Wang, co-executive director of the Ethereum Basis, disclosed particulars of the donation and known as upon the broader crypto group to contribute to the Twister Money developer’s authorized protection fund.

Ethereum Basis Help Bold $7M donation objective as Storm Faces 5-Yr Jail

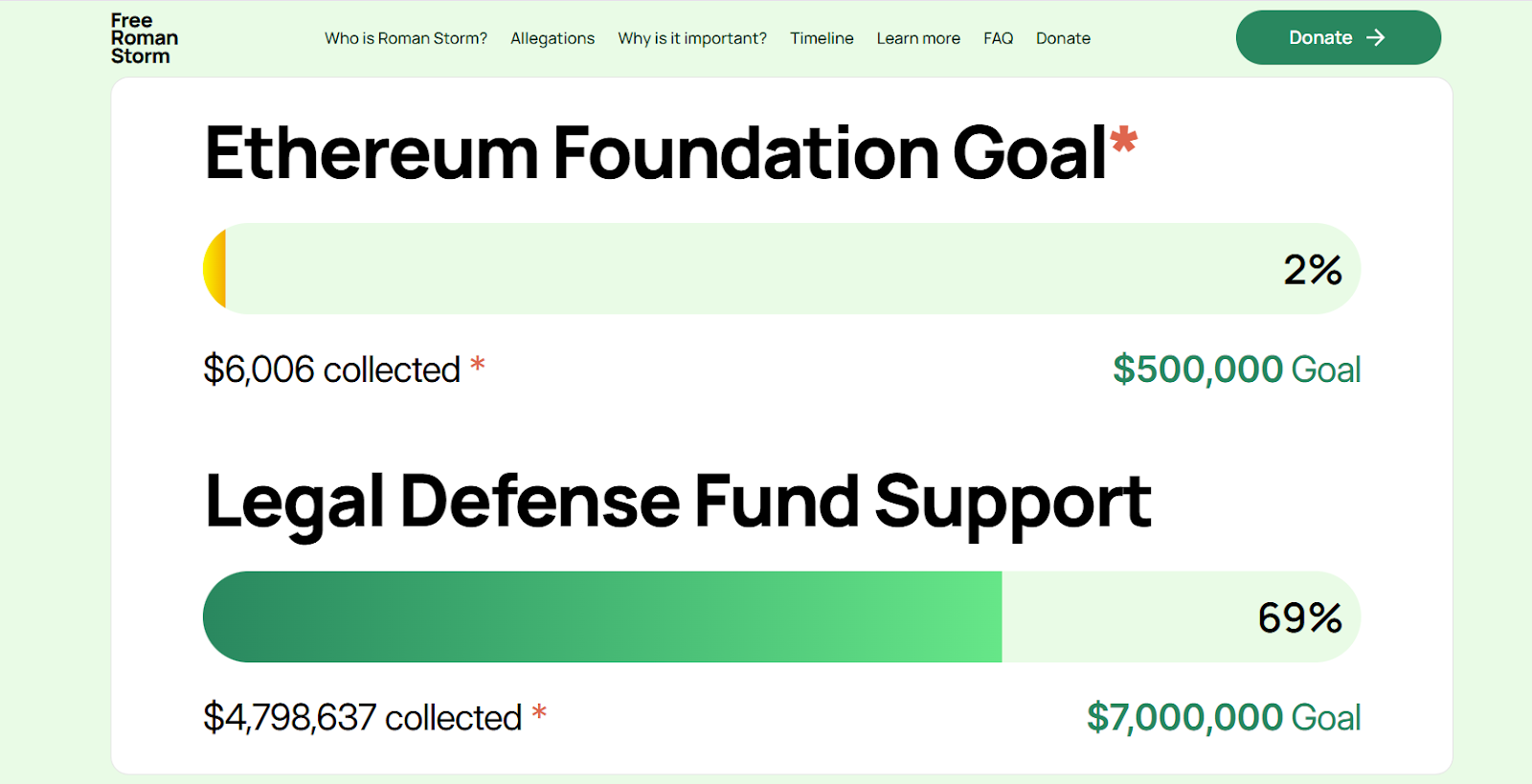

In line with the “freeromanstorm” donation tracker, the Ethereum Basis has contributed solely 2% of the $500,000 goal, whereas complete authorized fund help acquired by the Twister Money developer presently exceeds $4.7 million, nonetheless 31% in need of the bold $7 million objective.

Supporting Roman Storm’s trigger, Wang emphasised that “Privateness is regular, and writing code just isn’t a criminal offense.”

Storm himself has been actively soliciting public contributions to his authorized protection fund.

A July 26 X put up from the Twister Money developer urgently said: “We’re operating out of time — authorized prices are piling up quick, and we urgently want your assist.”

The present authorized urgency and plea for donations comes as a Manhattan jury on August 6 discovered Storm responsible of conspiring to function an unlicensed cash transmitter.

Coin Middle’s Seven Takeaways from the Storm Verdict:

1. The only real conviction—unlicensed cash transmission (18 U.S.C. § 1960)—turns primarily on authorized/regulatory interpretation (“does this depend as cash transmission?”), not jury fact-finding.

2. The court docket, on the…

— Peter Van Valkenburgh (@valkenburgh) August 6, 2025

Nonetheless, jurors remained deadlocked on separate conspiracy costs for cash laundering and sanctions evasion after 4 days of deliberation.

Below 18 U.S. Code Part 1960, Storm was convicted of working an unlicensed cash transmitting enterprise, which stipulates that anybody who “knowingly conducts, controls, manages, supervises, directs, or owns all or a part of an unlicensed cash transmitting enterprise, shall be fined underneath this title or imprisoned no more than 5 years, or each.”

The Free Pertsev & Storm authorized help group highlighted the urgency of continued funding, confirming that Storm “dangers as much as 5 years of jail time if he doesn’t win the attraction, and probably a long time if the federal government decides to retry Counts 1 & 3.”

Counts 1 and three, which stay in authorized impasse, embrace costs of conspiracy to commit cash laundering and conspiracy to violate U.S. sanctions, respectively.

Roman has been convicted on Rely 2 of conspiracy to Function an Unlicensed Cash Transmitting Enterprise (max sentence of 5 years in jail). Right here's a superb thread by @valkenburgh about this cost + why it is unnecessary: https://t.co/GlyEj9kPyy

— Free Pertsev & Storm (@FreeAlexeyRoman) August 6, 2025

The group famous that this case’s consequence “will set a significant precedent for builders worldwide.”

“Unhappy Day for DeFi”: Crypto Attorneys And Group Rally Help for Twister Money Builders

The crypto group has extensively criticized the unfairness of Storm’s case.

On August 6, crypto lawyer Jake Chervinsky known as the current verdict “a tragic day for DeFi,” arguing that “the federal government ought to by no means have introduced this case.”

He contended that Part 1960 mustn’t apply to builders of non-custodial protocols who lack management over consumer funds.

The federal government ought to by no means have introduced this case.

Part 1960 mustn’t apply to the developer of a non-custodial protocol who lacks management of consumer funds.

This case ought to go up on attraction. Hopefully the Second Circuit will appropriate this (and plenty of different) errors within the case.— Jake Chervinsky (@jchervinsky) August 6, 2025

Chervinsky urged the case to proceed on attraction, expressing hope that “the Second Circuit will appropriate this (and plenty of different) errors.”

Storm’s authorized difficulties stem from his function in growing Twister Money, a cryptocurrency mixer that permits customers to obscure transaction histories by pooling funds with different customers.

The U.S. Treasury Division sanctioned the protocol in August 2022, alleging that $7 billion had been laundered by way of the platform since 2019, together with frequent use by North Korea’s Lazarus Group hackers.

Federal prosecutors characterised Storm as somebody who profited from “hiding soiled cash for criminals.” On the similar time, his protection staff argued that Twister Money was designed as a privateness software for respectable customers, not particularly for illicit actions.

Storm was indicted on these costs and sanctions violations alongside Twister Money co-founder Roman Semenov and Alexey Pertsev, one other developer related to the cryptocurrency-mixing platform.

Twister Money customers, builders, and crypto executives proceed difficult the Treasury’s sanctions in court docket, arguing that the platform’s immutable sensible contracts shouldn’t be topic to OFAC restrictions.

Roman Storm, co-founder of the crypto mixing platform Twister Money, is urging a U.S. federal choose to dismiss all felony costs towards him. #TornadoCash #Stormhttps://t.co/UR6SpxMSw3

— Cryptonews.com (@cryptonews) December 20, 2024

On March 24, Coinbase’s Chief Authorized Officer, Paul Grewal, demanded a ultimate court docket judgment within the Twister Case, regardless of the U.S. Division of the Treasury’s resolution to delist the crypto mixer.

The put up Ethereum Basis Backs Twister Money Developer with $500K Authorized Protection Fund appeared first on Cryptonews.