TL;DR

- Ethereum now ranks twenty second globally by market cap, surpassing Mastercard and Netflix in valuation.

- File $1.01 billion in Ether ETF inflows indicators sturdy institutional demand for Ethereum publicity.

- Whale accumulates over 312,000 ETH value $1.34 billion from high liquidity suppliers inside eight days.

- RSI above 70 and value above Bollinger Band point out sturdy momentum, however overbought situations.

- Sustained $4,400 breakout may set off brief squeeze, pushing Ethereum towards $4,800–$5,000 value goal.

Outlook and Ethereum Value Predictions

Fast resistance is close to $4,344, with a stronger barrier between $4,400 and $4,450. An in depth above these factors may open the way in which towards $4,800–$5,000, consistent with analyst estimates. Ali has additionally pointed to $5,210 and $6,946 as attainable longer-term targets utilizing pricing band fashions.

$5,210 and $6,946 are the subsequent targets for Ethereum $ETH, in keeping with the Pricing Bands. pic.twitter.com/hKJNn0RKYF

— Ali (@ali_charts) August 12, 2025

Help is within the $4,150–$4,200 vary, with additional help close to $3,950 if a deeper pullback happens. Heavy ETF inflows, company shopping for, and low trade reserves are bullish elements, however overbought readings counsel short-term warning.

ETH continues to be 12% under its all-time excessive. Sturdy institutional shopping for and favorable on-chain information hold $5,000 in sight within the weeks forward.

Market Efficiency and 24-Hour Outlook

Ethereum (ETH) was buying and selling at $4,300 at press time, with 24-hour buying and selling quantity of $39.2 billion. The value is up 0.03% up to now day and 17% over the previous week.

Within the final 24 hours, ETH traded between $4,170 and $4,347. Over the week, the vary was $3,560 to $4,330.

ETH is presently about 12% under its all-time excessive of $4,878 from November 10, 2021. Current buying and selling periods have been marked by sturdy quantity and huge inflows into spot Ether exchange-traded funds (ETFs).

Monday recorded $1.01 billion in internet inflows to those funds, the best on report. BlackRock’s iShares Ethereum Belief ETF (ETHA) took in $640 million, and Constancy’s Ethereum Fund (FETH) added $277 million.

Furthermore, Ethereum now ranks twenty second among the many world’s largest belongings by market capitalization, forward of Mastercard and Netflix. Reflecting its increasing position each in crypto and amongst conventional world belongings, market analyst Rand famous,

“$ETH simply surpassed Mastercard and Netflix on MarketCap valuation, taking the World twenty second rank place.”

GM guys! $ETH simply surpassed Mastercard and Netflix on MarketCap valuation, taking the World twenty second rank place  pic.twitter.com/p4bKLy4Ncb

pic.twitter.com/p4bKLy4Ncb

— Rand (@crypto_rand) August 12, 2025

Technical Evaluation

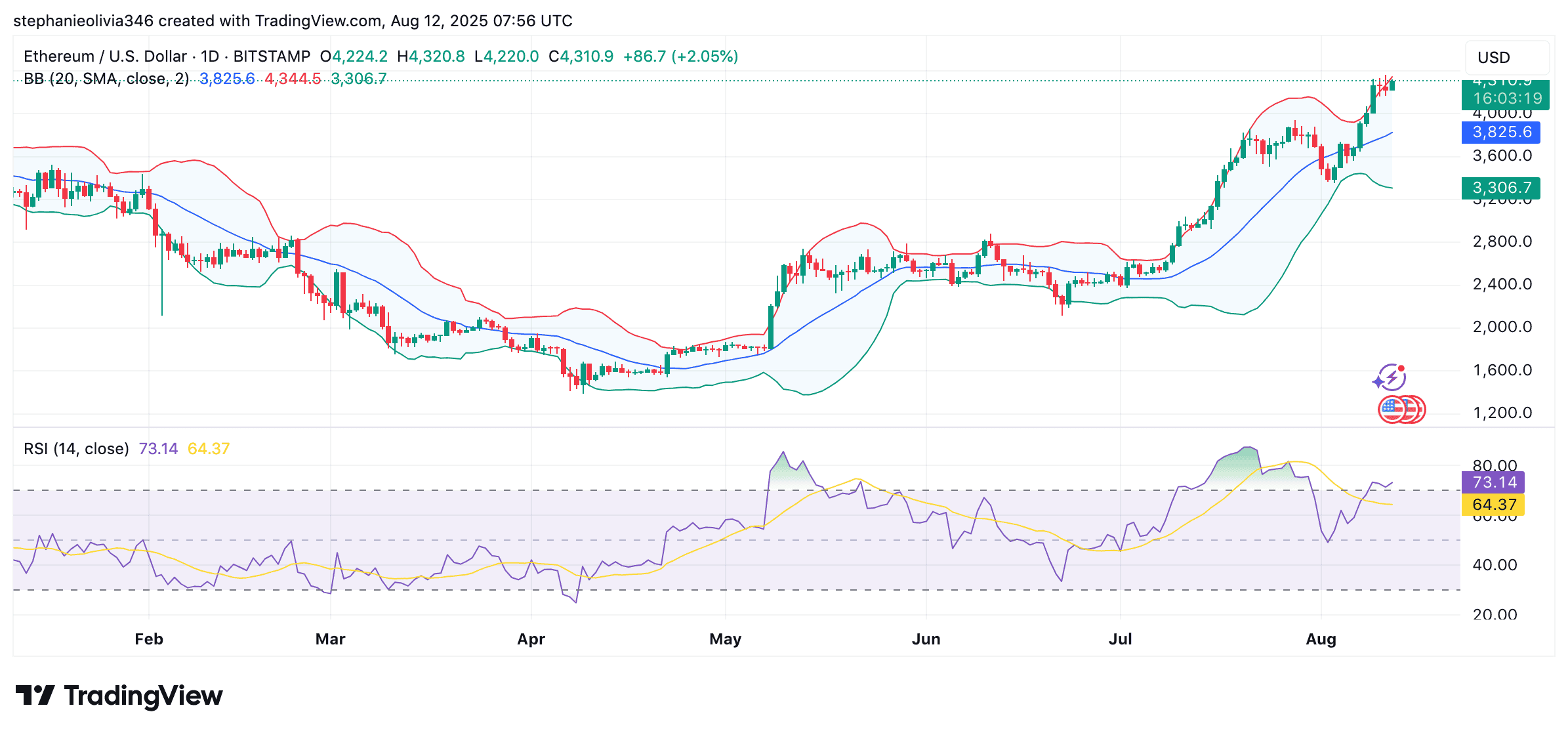

On the day by day chart, ETH trades above the higher Bollinger Band, which sits close to $4,344. This place typically factors to sturdy bullish momentum however may also imply overbought situations. The bands are wider than earlier within the yr, displaying greater market volatility.

In the meantime, the 14-period Relative Energy Index (RSI) stands at 73. Readings above 70 can point out overbought situations. The RSI has held above 50 since mid-July, displaying sustained shopping for power.

Analyst ZYN famous,

“This RSI trendline has completely marked ETH tops… I feel $ETH native high may occur round $4.8K-$5K this time.”

Open curiosity in ETH derivatives is at $10 billion on Binance, up 46% in 30 days. Brief positions have jumped 500% year-on-year and 40% up to now week. Crypto Patel noticed {that a} transfer above $4,400 may “set off a brief squeeze,” which can drive costs sharply greater.

Ethereum May Be Headed for a Large Squeeze$ETH again at $4,300, simply 12% from ATH.

Binance ETH Open Curiosity → $10B (+46% in 30d)

Brief positions up 500% YoY, +40% this week.30% of provide staked. Alternate reserves close to report lows.

ETF inflows > $117B. Whales including… pic.twitter.com/0nDzVfkVxW— Crypto Patel (@CryptoPatel) August 11, 2025

On-Chain and Market Information

Pockets exercise reveals large-scale accumulation. Lookonchain reported one entity created 10 new wallets in eight days, shopping for 312,052 ETH value about $1.34 billion from main suppliers akin to FalconX, Galaxy Digital, and BitGo. Round 30% of the ETH provide is staked, whereas trade reserves are close to historic lows.

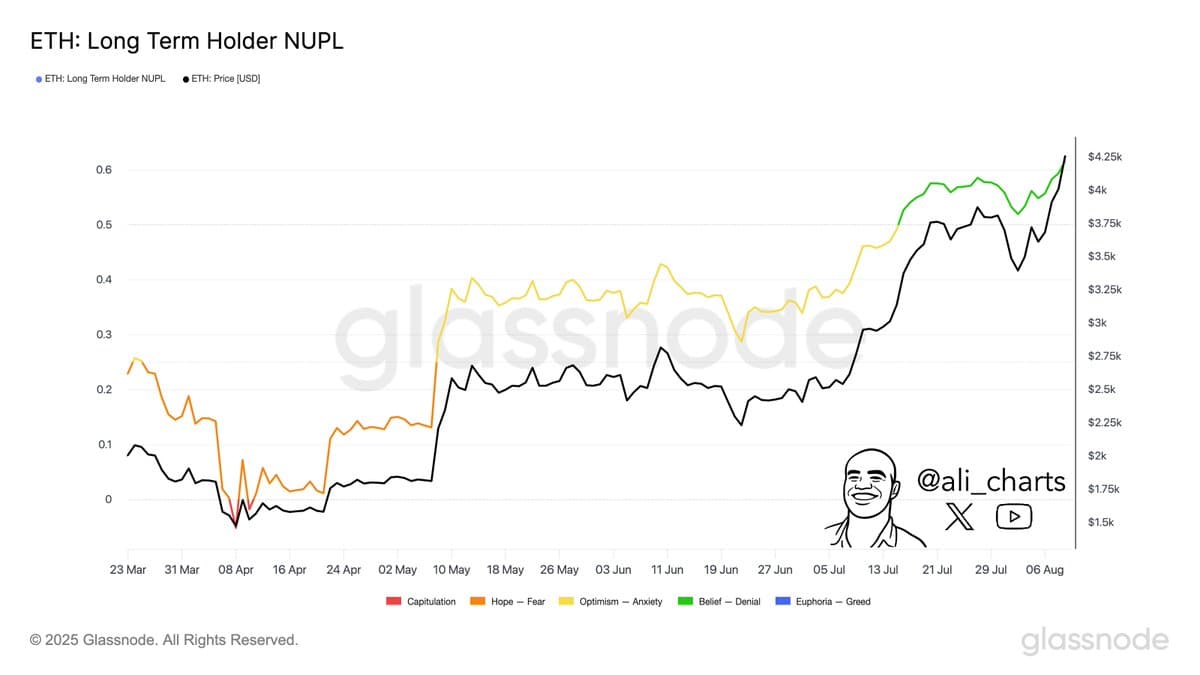

Lengthy-Time period Holder Internet Unrealized Revenue/Loss (NUPL) information from April confirmed most holders in a loss when ETH was close to $1,800. By late July, with ETH over $3,000, the NUPL moved into the “perception” zone, which means most holders are actually in revenue.

Company shopping for can also be sturdy. BitMine Immersion (BMNR) disclosed holdings of greater than 1.15 million ETH, valued at $4.9 billion, making it the most important company ETH holder. This is a rise of 317,000 ETH in a single week.

ETF demand stays a key issue. Ether ETFs have drawn extra inflows than Bitcoin ETFs, with some analysts saying these merchandise had been initially underestimated.

Nate Geraci commented, “Really feel like spot eth ETFs had been severely underestimated merely [because] tradfi buyers didn’t perceive eth,” including that establishments now view Ethereum because the “spine of future monetary markets.”

Broader Market Context

Market sentiment is influenced by expectations of rate of interest cuts, looser liquidity guidelines, and attainable inflows from retirement accounts and institutional funds. Commentator Ted pointed to elements together with pro-crypto legal guidelines, ETF growth, financial institution capital adjustments, and huge money reserves in cash markets that might enter the market.

Altcoin market worth is approaching a resistance degree that led to a 50% drop in late 2024. Ether Wizz stated situations now differ, with extra liquidity and stronger momentum in Ethereum and different altcoins, which may help a breakout.

Altcoin MCap has reached a significant resistance zone.

In This fall 2024, Altcoin MCap received rejected from this degree which resulted in a 50% crash.

However this time, the dynamics are totally different.$ETH and alts are displaying unbelievable power, and new liquidity is getting into the market.

I assume a… pic.twitter.com/3irVGYFWAz

— Ether Wizz (@EtherWizz_) August 11, 2025

Do ETH Value Predictions Make Sense?

Ethereum value forecasts define potential future ranges utilizing market traits, technical indicators, and blockchain information. They aren’t assured outcomes.

The truth is, the market can change rapidly as a consequence of world financial shifts, coverage strikes, or adjustments in investor conduct. A transfer to $5K is feasible if present momentum holds.

Chart patterns, previous RSI readings, and shifting averages can present steering, however they’re simplest when mixed with on-chain metrics and buying and selling circulation information. No single measure can assure outcomes.

How Are Ethereum Value Predictions Made?

Forecasts typically mix three primary approaches.

Technical evaluation examines charts, shifting averages, and indicators like RSI to search out probably help and resistance ranges.

On-chain evaluation evaluations pockets actions, staking figures, and trade balances to see how individuals are positioning.

Macro evaluation considers rates of interest, liquidity ranges, and institutional adoption.

By combining these, analysts can kind a state of affairs for probably value course and key ranges to look at.

The publish Ethereum (ETH) Value Prediction: Can Bulls Push Previous $5,000 on the Again of Huge ETF Inflows? appeared first on CryptoPotato.