Ethereum is exhibiting combined alerts on the charts, with analysts watching key technical ranges and momentum indicators.

Whereas draw back dangers have emerged, different alerts counsel attainable help close to present costs. The asset stays above $3,900, a degree that a number of merchants are monitoring as a key zone.

Bearish Momentum Builds on Weekly MACD

Ali Martinez famous that Ethereum is near a bearish MACD crossover on the weekly timeframe, a sample that has led to steep worth drops in previous cycles. The final two occasions this sign appeared, ETH fell by 43% and 61%. The MACD histogram can be turning decrease, pointing to fading momentum.

Ethereum $ETH is on the verge of a bearish MACD crossover on the weekly chart. The final two occasions it occurred, the worth dropped 43% and 61%. pic.twitter.com/RRIjFeR63k

— Ali (@ali_charts) October 16, 2025

Ethereum is buying and selling close to $4,000 at press time, down 4% over the previous day and 10% on the week. The crossover has not but been confirmed. If the sign completes, some count on a stronger correction to comply with.

RSI Oversold and Flag Sample Nonetheless Energetic

Tom Tucker famous Ethereum’s RSI is sitting at round 16, a degree thought of deeply oversold. He mentioned, “RSI at 16.25 = closely oversold territory,” including that rebounds usually comply with comparable readings. Tucker additionally famous that bearish alerts could be drawing in sellers too early.

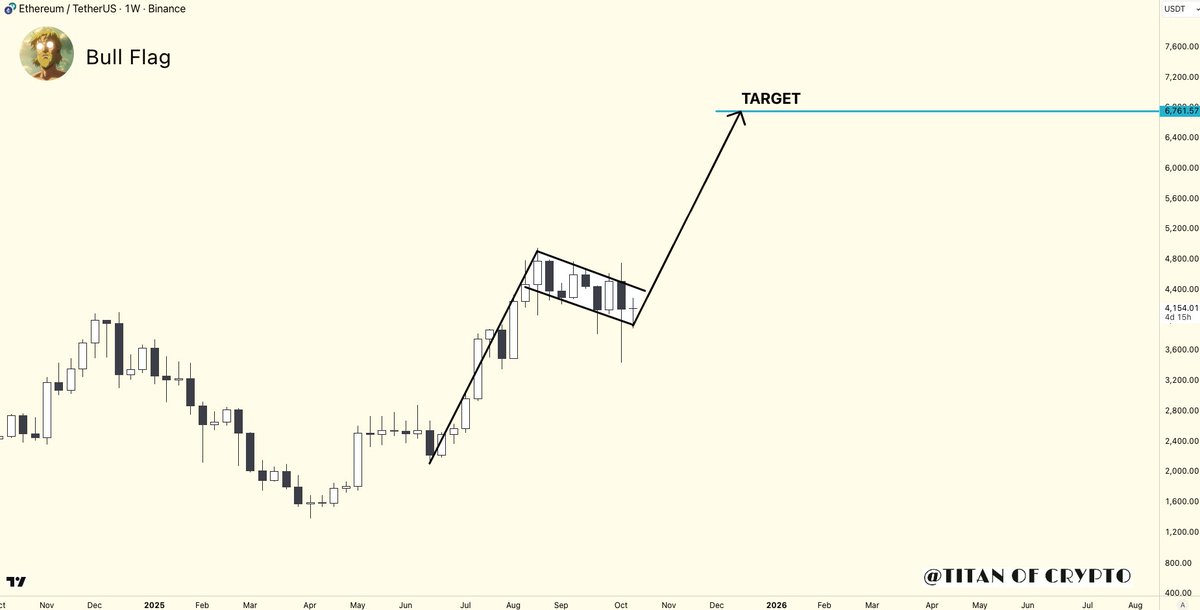

Titan of Crypto shared a chart exhibiting a bull flag sample on Ethereum’s weekly chart. The flag follows a pointy rally and remains to be intact. If the breakout happens, the sample factors to a transfer towards $6,700. That is primarily based on the peak of the flagpole added to the breakout level.

Furthermore, Martinez additionally highlighted MVRV Pricing Bands, which monitor historic deviation from Ethereum’s realized worth. ETH is holding above the imply band at $3,900, marking it as a help space.

$3,900 is a significant help zone for Ethereum $ETH. If it holds, the Pricing Bands level to a transfer towards $5,000 and even $6,000. pic.twitter.com/GV6OFQqO3T

— Ali (@ali_charts) October 15, 2025

If this space holds, the higher pricing bands counsel upside towards $5,000 and $6,000. If it fails, merchants could look towards decrease zones close to $2,800.

Institutional Demand and Blockchain Use Increasing

Bitwise reported that 95% of ETH held by public corporations was purchased within the final quarter. A complete of 4.4 million ETH was added, a 1,937% rise in comparison with the earlier quarter. Mixed holdings by public corporations and ETFs now stand at 12.50 million ETH, or 10.31% of the full provide.

Cipher X mentioned Ethereum is changing into the settlement layer of the digital economic system. USDC provide is nearing $45 billion, whereas BlackRock’s BUIDL fund now holds over $2 billion in tokenized US Treasuries. Cipher mentioned each are “rising facet by facet” with out coordination, powered by market use of Ethereum’s infrastructure.

The publish Ethereum (ETH) Market Cut up: Bearish MACD or Incoming Bull Flag Rally? appeared first on CryptoPotato.