ChatGPT’s o3 Professional AI mannequin digested 42 reside indicators and yielded a centered Ethereum value forecast as ETH hovers close to $2,419.57 amid short-term consolidation and longer-term bullish cues.

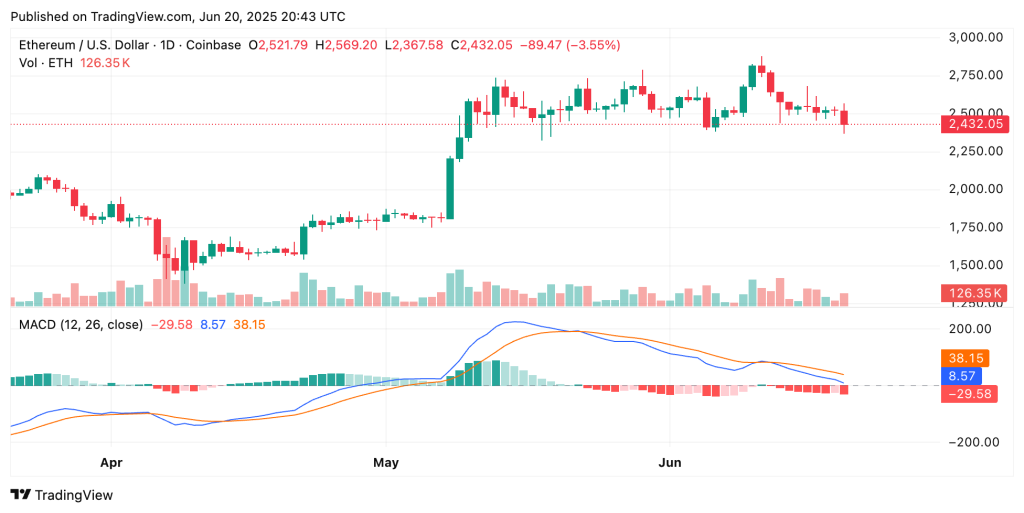

With the RSI close to 43 and MACD exhibiting bearish momentum, Ethereum trades between fast help round $2,485 and resistance close to $2,557. Quantity stays reasonable at roughly $20.15 billion day by day.

After oscillating in a $2,480–$2,547 vary in the present day, longer-term EMAs point out underlying power as the value sits above the 50, 100, and 200-day EMAs but beneath the 20-day EMA.

The next evaluation was carried out utilizing certainly one of ChatGPT’s AI fashions, the brand new o3 professional. The predictions have been then reanalyzed and edited collectively for enhanced readability whereas sustaining analytical precision.

Technical Pulse: Impartial Consolidation Amid Longer-Time period Energy

Ethereum’s day by day chart on Binance reveals a market in a holding sample. As of June 20, 2025, ETH trades round $2,432.47, having opened close to $2,523 and swung between a excessive of $2,547.5 and a low of $2,368.68.

This tight band displays short-term consolidation after prior strikes, with RSI at 43.12 hovering slightly below impartial and MACD displaying a damaging histogram round 45.35, indicating gentle bearish momentum with out decisive breakdown.

Volatility stays reasonable, with day by day value swings staying inside roughly $180 – $201, in line with ATR ranges implied by in the present day’s high-low vary.

Shifting averages convey a combined however total bullish medium-term construction. The 20-day EMA sits barely above the value at $2,557, suggesting short-term resistance and consolidation stress.

In distinction, the 50-day EMA at $2,438, the 100-day EMA close to $2,372, and the 200-day EMA round $2,476 lie beneath the present value, indicating that on medium and longer timeframes, the pattern retains a bullish orientation.

Worth holding above these EMAs argues that dips close to $2,438–$2,485 may appeal to consumers defending the uptrend, whereas reclaiming the 20-day EMA would sign a resumption of upward momentum towards increased resistance zones.

Quantity stays reasonable at roughly 204,000 ETH traded day by day, reflecting regular institutional and retail participation however not but a surge.

Buying and selling inside the $2,485–$2,547 vary exhibits a balanced tug-of-war, with sellers cap rallies close to the 20-day EMA, whereas consumers step in close to the 50-day EMA or intraday lows.

This sort of stability usually units up a breakout as soon as a catalyst seems. For now, the short-term temper is impartial to barely bearish, but the broader medium-term uptrend means any drop beneath fast help will doubtless be temporary and shallow.

Any profitable reclaiming of the 20-day EMA may rapidly appeal to momentum merchants.

Assist & Resistance: Defining the Key Zones

Instant help emerges at in the present day’s low round $2,485. Ought to that stage fail on heavier quantity, the subsequent anchor lies close to the 50-day EMA (~$2,438), a zone the place consumers might re-enter if the broader uptrend stays intact.

Beneath that, psychological and structural help round $2,400 coincides with a stop-loss area that many merchants reference, however a sustained break beneath the 50-day EMA would shift focus towards deeper corrective territory nearer to main help zones round $1,800–$1,900, although such a transfer would doubtless require main damaging catalysts given Ethereum’s longer-term power.

On the upside, fast resistance resides on the 20-day EMA close to $2,557, a hurdle that value has struggled to clear.

Past this, in the present day’s excessive at $2,547 marks the short-term ceiling; clearing that space convincingly on sturdy quantity may open a path towards the subsequent main resistance zone between $2,700 and $2,800, the place prior swing highs reside.

Above that, sturdy resistance lies within the $3,200–$3,400 vary, ranges reached in earlier bullish runs however requiring sturdy catalysts and sustained bullish conviction to revisit.

Inside the present consolidation, the interaction between help close to $2,438–$2,485 and resistance close to $2,557 shapes buying and selling dynamics.

Merchants watching day by day closes above $2,557 search for affirmation of renewed upside, whereas breaches beneath $2,485, particularly with quantity pickup, point out potential deeper assessments of the 50-day EMA.

Given reasonable volatility, breakout or breakdown past these pivot factors may happen rapidly as soon as momentum shifts, with day by day ranges of roughly $60–$70 broadening if ATR expands.

Liquidity & Market Depth: Assessing Gasoline for Strikes

Ethereum’s market cap is round $293.41 billion, and day by day buying and selling quantity exceeds $21.91 billion, which exhibits deep liquidity throughout main venues.

Binance order-book depth usually absorbs sizable orders with manageable slippage, a essential situation for sizable strikes when quantity surges.

Institutional participation seems common, with stablecoin flows and on-chain exercise reflecting continued utilization.

Order-book clusters usually type round help zones close to $2,480–$2,500, providing a buffer in opposition to gentle sell-offs, whereas resting asks close to $2,550–$2,580 can take in minor rallies till a catalyst drives stronger shopping for.

Monitoring volume-weighted shifting averages in tandem with order-book snapshots can reveal delicate accumulation.

If volume-weighted metrics pattern upward whereas value lingers beneath the 20-day EMA, selective accumulation could also be underway regardless of short-term consolidation.

Given deep liquidity, a significant breakout above $2,557 would doubtless require noticeable quantity enlargement, indicating a shift in conviction.

Conversely, a breach of $2,485 supported by increased promote quantity may result in a swift transfer towards the 50-day EMA at $2,438.

On-Chain Insights: Utilization Developments and Community Well being

Ethereum’s on-chain metrics proceed as an instance sturdy ecosystem engagement.

Lively tackle counts and transaction volumes throughout layer-1 and layer-2 networks replicate ongoing utilization. Practically 1% of circulating ETH is held as a reserve asset on layer-2 networks, whereas whales are accumulating at charges unseen since 2017.

These behaviors counsel a requirement baseline past mere hypothesis, as contributors lock up ETH for staking, layer-2 exercise, DeFi participation, and reserve methods.

Statements from Ethereum co-founders emphasize Ethereum’s imaginative and prescient as a “grasp ledger for the world,” underpinned by layer-2 enlargement and ecosystem development.

Ethereum Layer 1 would be the grasp ledger for the

.

Permissionless to examine, use and add information or performance to.

Credibly impartial.

Censorship resistant.

Tamper resistant and tamper evident (through slashing and transparency).

Incessantly progressively decentralizing… https://t.co/jMaHHpK2na— Joseph Lubin (@ethereumJoseph) June 19, 2025

Rising stablecoin provide on Ethereum and surges in layer-2 utilization point out that transaction demand might persist or enhance, supporting fee-related demand for ETH.

On the similar time, staking yields and burning mechanisms beneath EIP-1559 proceed to cut back internet provide, offering a deflationary tilt that underlies longer-term bullish narratives.

Nonetheless, token unlock schedules or massive whale actions warrant consideration, as massive accumulation by whales can bolster value flooring if shopping for outpaces promoting. But, any large-scale sell-offs may stress help zones.

General, on-chain metrics level to a wholesome community with sustained utilization and structural provide components that favor longer-term power, at the same time as short-term value consolidates.

Social Sentiment: Gauging Group and Market Temper

LunarCrush information for Ethereum reveals a broadly constructive however cautious sentiment atmosphere. A Galaxy Rating round 41 suggests a mildly bullish bias, whereas an AltRank near380 signifies excessive engagement relative to different belongings.

Engagement metrics totaled billions of interactions, and mentions stay elevated within the tens of 1000’s, with creators numbering almost 37,570 voices shaping narratives.

Sentiment sits round 83% constructive or neutral-positive, indicating prevailing optimism tempered by consciousness of broader market uncertainty. Social dominance close to 13.35% signifies Ethereum’s outsized share of crypto chatter, which means main information or shifts can drive swift sentiment swings.

THE $ETH SETUP IS IDENTICAL TO $BTC IN 2020

Similar construction. Similar retrace.

Similar disbelief.

Bitcoin went 11x.

If Ethereum does the identical… you recognize the quantity. pic.twitter.com/isvpngSw4K— Merlijn The Dealer (@MerlijnTrader) June 19, 2025

Current commentary factors out themes akin to Ethereum’s evolving position as layer-1 spine, sturdy technical setups in comparison with historic BTC patterns, and potential breakout situations following consolidation within the $2,170–$2,480 zone.

In sum, social sentiment displays confidence in Ethereum’s fundamentals and community potential, however merchants stay watchful for affirmation cues.

Macro & Ecosystem Catalysts: Potential Triggers

Ethereum’s value trajectory will hinge on a mixture of ecosystem developments and broader market forces over the approaching months.

Main catalysts embody progress on layer-2 rollouts, distinguished DeFi or further stablecoins launches driving transaction spikes, and bulletins round protocol upgrades that improve scalability or interoperability.

Stablecoin provide on $ETH is skyrocketing! pic.twitter.com/uh3TOLv5zn

— Crypto Rover (@rovercrc) June 19, 2025

Broader crypto sentiment, influenced by macro liquidity circumstances, regulatory readability round digital belongings, and institutional adoption (e.g., ETFs, company treasury allocations), additionally closely impacts Ethereum’s outlook.

Given its central position in decentralized finance, geopolitical occasions influencing threat urge for food may additionally immediate rotations away from or again into Ethereum.

Ecosystem dynamics, akin to shifts in gasoline charge economics or competitors from different layer-1s, issue into longer-term narratives however are much less more likely to drive abrupt short-term strikes until tied to concrete community efficiency information or notable challenge launches.

Three-Month ETH Worth Forecast Eventualities

Over the subsequent 90 days, Ethereum’s value will doubtless comply with certainly one of three broad paths, formed by the interaction between technical circumstances, on-chain developments, social temper, and macro catalysts.

Vary-Certain Consolidation (Base Case)

Within the absence of a decisive catalyst, ETH might commerce inside roughly $2,400–$2,600.

Brief-term momentum stays neutral-to-slightly bearish beneath the 20-day EMA, however medium-term pattern stays bullish as value holds above the 50-, 100-, and 200-day EMAs. On-chain utilization continues steadily, and social sentiment retains modest optimism with out euphoria.

Quantity and volatility stay reasonable, yielding uneven swings that savvy merchants can exploit between help close to $2,365–$2,461 and resistance close to $2,557–$2,600.

Longer-term holders might await clearer directional indicators earlier than including publicity.

Bullish Breakout Towards $3,000+ (Bull Case)

A convergence of constructive components, akin to a sustained surge in layer-2 exercise, a serious improve announcement, or a broad crypto rally fueled by macro liquidity or ETF information, may elevate ETH above the 20-day EMA close to $2,557.

Affirmation requires sturdy quantity enlargement pushing value by $2,600 and towards the $2,700–$2,800 zone, the place prior resistance resides.

On-chain metrics would want to register spikes in transaction quantity or staking inflows, whereas social sentiment (Galaxy Rating rising above 60, engagement uptick) reinforces confidence.

Upon clearing $2,800, the trail to $3,000 and past turns into possible, doubtlessly revisiting multi-month highs if market circumstances stay constructive.

Merchants ought to handle threat with trailing stops and look ahead to profit-taking close to key resistance zones to protect in opposition to sharp pullbacks.

Deeper Correction Towards $2,200–$2,300 (Bear Case)

Ought to damaging catalysts emerge, akin to disappointing ecosystem information, regulatory headwinds, or broader risk-off driving crypto-wide declines, ETH may breach near-term help round $2,485 and check the 50-day EMA close to $2,438.

Affirmation of deeper weak point would contain volume-backed breakdown beneath $2,438, accompanied by RSI falling beneath 45 and MACD deepening damaging.

On-chain indicators may present slowed transaction development or unwind of staking positions, whereas social sentiment shifts towards warning or concern. On this state of affairs, the value might retest zones at round $2,300–$2,200, reflecting deeper consolidation territories.

A breach beneath these may invite additional promoting stress towards $2,000 or decrease. Nonetheless, given Ethereum’s structural power, such strikes would doubtless be met with elevated shopping for curiosity at perceived worth ranges. Threat administration through stop-loss placement and hedging methods turns into paramount.

ETH Worth Forecast: Balancing Technicals, On-Chain Well being, and Sentiment

Ethereum’s present consolidation displays a market balancing short-term warning in opposition to medium-term bullish undercurrents.

Worth wedged between roughly $2,485 help and $2,557 resistance underlines a ready recreation: will on-chain utilization or macro-driven optimism tip momentum upward, or will exterior headwinds set off a check of deeper help?

Contributors ought to deal with every swing as a diagnostic: does value maintain close to $2,485 on regular or rising transaction volumes? Does reclaiming the 20-day EMA coincide with an uptick in layer-2 exercise or a surge in staking inflows? Conversely, does a breach of $2,438 align with waning on-chain metrics or broader crypto weak point?

Breakout or Consolidation?

Ethereum’s present vary between roughly $2,485 help and $2,557 resistance displays a market the place short-term momentum leans impartial to barely bearish beneath the 20-day EMA. But, the medium-term construction stays bullish as the value is above 50, 100, and 200-day EMAs.

Over the subsequent 90 days, the interaction of on-chain utilization developments, social sentiment shifts, ecosystem milestones, and macro dynamics will decide whether or not ETH breaks increased towards $3,000+ or undergoes a deeper correction towards $2,200–$2,300.

Merchants ought to look ahead to day by day closes above $2,557 to validate bullish continuation or breakdowns beneath $2,485–$2,438 to sign warning.

On the similar time, watching layer-2 exercise, staking developments, consumer engagement, and wider market indicators can both again up or problem current value motion.

The submit ChatGPT’s 42-Sign AI ETH Worth Forecast Suggests Consolidation with Breakout Potential appeared first on Cryptonews.