The blockchain abstraction layer continues to shut the hole between conventional and DLT markets.

This newest characteristic will carry tokenized US equities and ETFs to the blockchain, making entry to those belongings simpler and obtainable across the clock.

Advancing The Tokenization Market

Chainlink, a bridge between real-world knowledge and blockchain, shared yesterday a few flagship product – Knowledge Streams for the US Fairness and ETF market. A number of DeFi protocols are already on board, similar to GMX, GMX Solana, and Kamino.

Already built-in into main equities and exchange-traded funds (ETFs), the Knowledge Streams present real-time pricing for conventional finance (TradFi) belongings, together with CRCL, QQQ, NVDA, MSFT, and plenty of extra, throughout 37 blockchain networks.

Builders can now entry stay, contextual knowledge for these markets straight on-chain, enabling tokenized inventory buying and selling, perpetual futures, and artificial ETFs, all backed by institutional dependability. The development additionally brings a roster of novel options, similar to market hours enforcement, staleness detection, and high-frequency pricing.

“With Chainlink Knowledge Streams’ quick, dependable, and context-rich market knowledge, production-ready tokenized monetary merchandise tied to U.S. equities and ETFs can now be launched straight on-chain.

This represents a big leap ahead for tokenized markets, closing a essential hole between conventional finance and blockchain infrastructure.

We’re excited to be collaborating with Kamino and GMX, two forward-thinking DeFi groups whose work continues to speed up the convergence of TradFi and DeFi.” – Johann Eid, Chief Enterprise Officer at Chainlink Labs.

To ascertain a dependable on-chain change for these belongings would require quick and high-integrity market knowledge. Crypto markets function 24/7, whereas conventional ones don’t, and so they can moreover undergo from occasional interference, which poses a problem for continuous, decentralized functions (DApps). This may embody worth gaps, inaccuracies in off-market knowledge, and outages.

How Will it Work

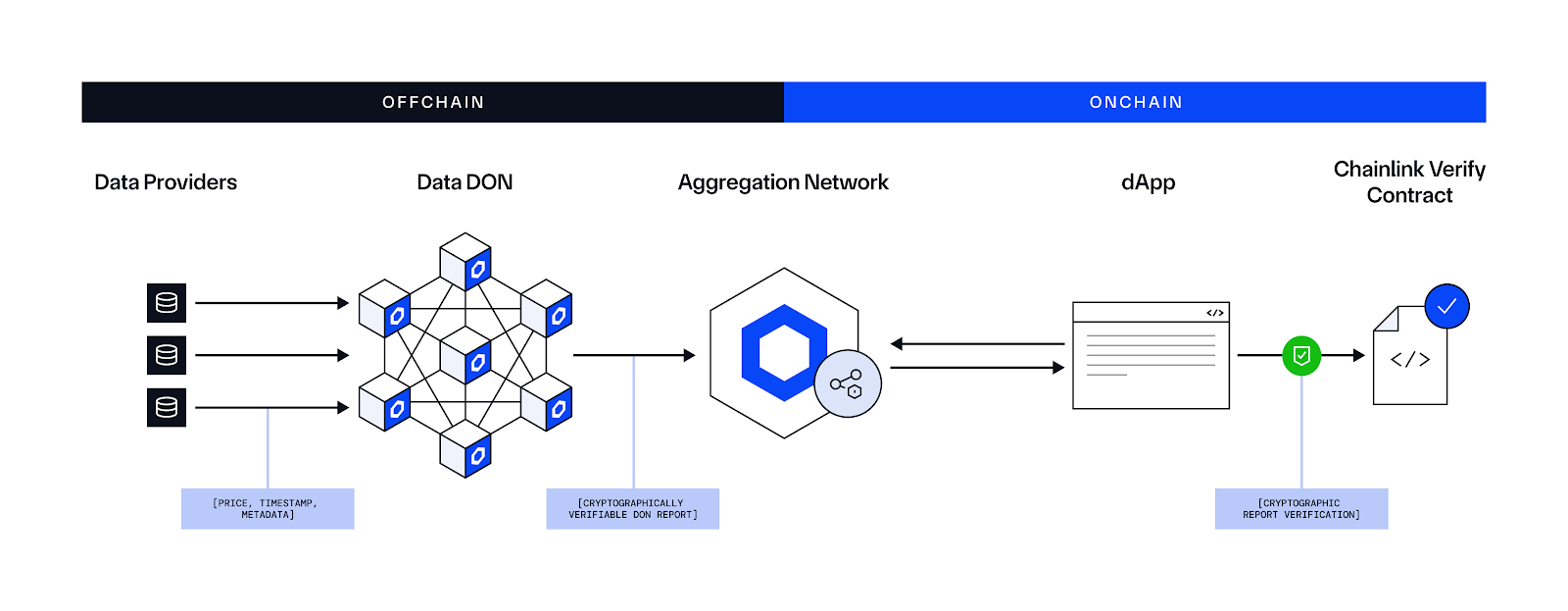

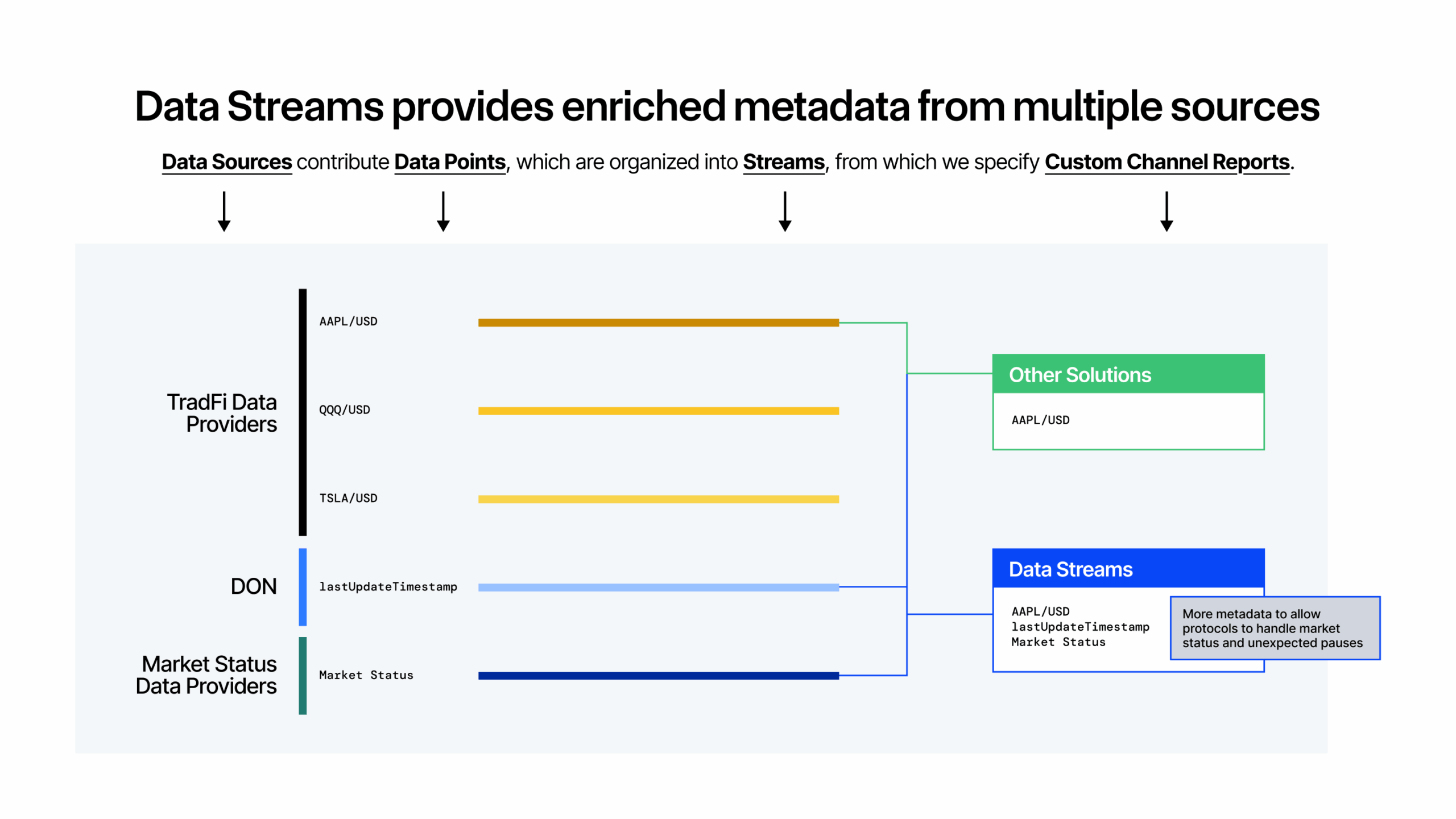

Chainlink Knowledge Streams will mixture enter from a number of main and backup knowledge sources, thereby enhancing uptime and reliability. This aggregated knowledge will then be processed by decentralized oracle networks (DONs) and transmitted on-chain by way of a structured schema.

Every knowledge level might be timestamped, permitting protocols to determine the variations between present and historic costs, pause robotically throughout market off-hours, and implement real-time threat administration.

This knowledge schema is designed for superior DeFi composability, because it supplies structured pricing that aids in correct liquidations, commerce halts, technique changes, and collateral valuation. It’s going to additionally have the ability to distinguish between real-world costs taken from conventional, open markets and costs of tokenized shares obtainable 24/7. This may open the door for arbitrage alternatives and threat administration methods.

Some use circumstances for the merchandise enabled by the Knowledge Streams are perpetuals, lending/borrowing, vault protocols, brokerage platforms, and extra.

The publish Chainlink Connects Wall Road to Blockchain With Reside US Fairness and ETF Knowledge appeared first on CryptoPotato.