It was one other eventful week within the general scheme of issues, however bitcoin and crypto remained comparatively resilient and even steady when it comes to costs.

It began final Friday morning when Israel launched a missile assault in opposition to Iran, killing over 70 folks within the course of, together with a number of high-end commanders and nuclear scientists. Given the shock nature of the assault, it was no marvel that BTC’s worth tumbled in response, going from over $108,000 to below $103,000 in minutes.

The state of affairs continued to escalate within the following days, with Iran retaliating and Israel doubling down on its assaults. The US President Donald Trump was vocal on the matter, urging Iran to make a nuclear deal earlier than it’s too late.

Regardless of the growing stress, BTC’s worth really recovered some floor and spent the subsequent few days round $104,000-$105,000. It skyrocketed as soon as the enterprise week began and jumped to $109,000 on Tuesday. Nevertheless, that was a short-lived rally, and its worth dropped instantly to $103,500.

The main target turned to the US Fed, which concluded its newest FOMC assembly on Wednesday. To the shock of nobody, it left the rates of interest unchanged, and bitcoin’s worth remained flat at round $104,000.

On Friday, although, BTC began to realize some traction and spiked above $106,000 for simply the second time this week. It at present hovers round that stage amid studies that Iran is contemplating inserting sure limitations on its Uranium program. Such a price ticket signifies that bitcoin is definitely barely up on a weekly scale.

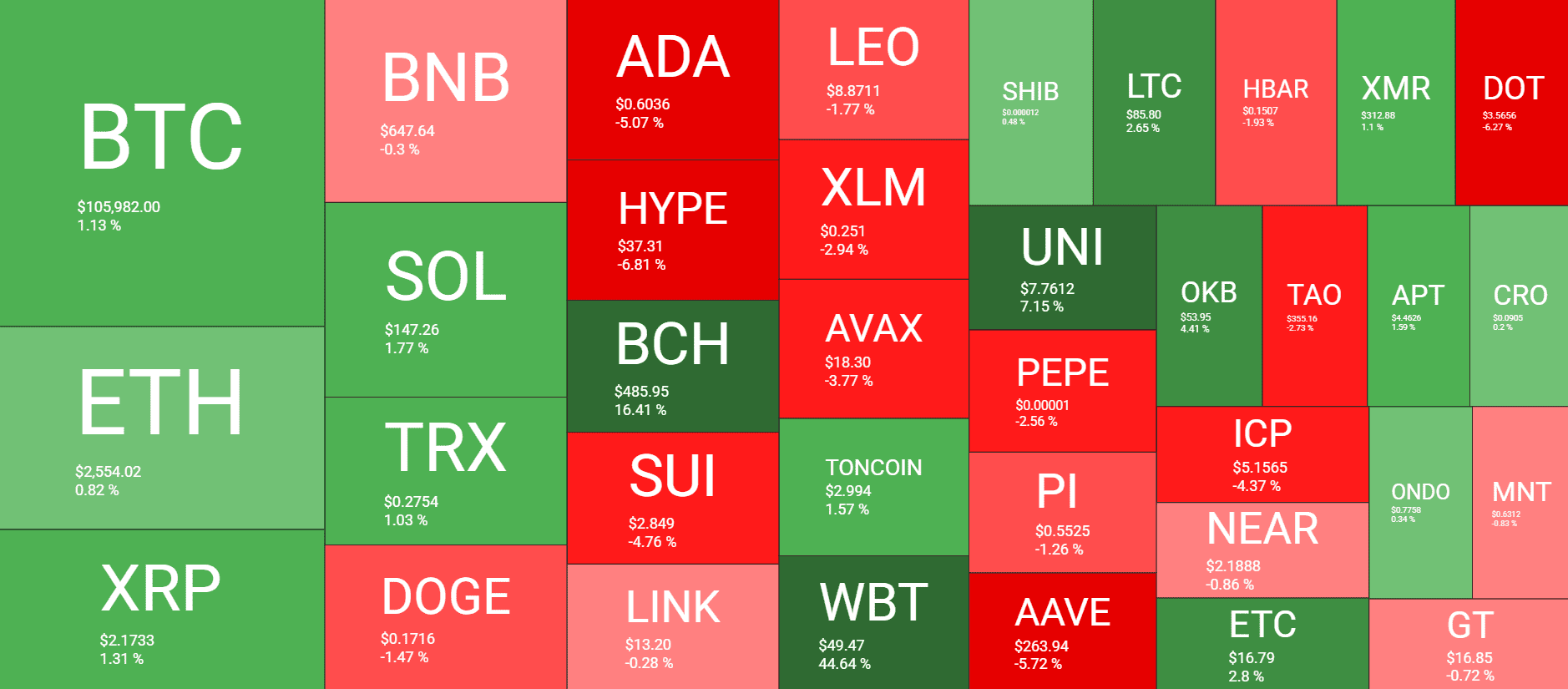

The highest performer on this regard from the larger-cap alts is WBT, which set a brand new all-time excessive earlier this week. Regardless of retracing barely since then, it’s nonetheless 45% up weekly. Bitcoin Money trails behind with a 17% surge, whereas UNI is third with a 6.6% leap.

In distinction, HYPE has slipped by over 7% in the identical timeframe, adopted by ADA (-5%), SUI (-5%), and DOT (-6%).

Market Information

Market Cap: $3.406T | 24H Vol: $103B | BTC Dominance: 61.8%

BTC: $106,100 (+1.2%) | ETH: $2,560 (+0.8%) | XRP: $2.17 (+1.5%)

This Week’s Crypto Headlines You Can’t Miss

Justin Solar’s Tron to Go Public within the US: Report. The nice and cozy relationship between Tron’s Justin Solar and the present US presidential administration appears to be paying off. In keeping with a current report, the blockchain undertaking is planning to go public within the US by way of a reverse merger with SRM Leisure.

GENIUS Act Clears Senate, Setting the Stage for Stablecoin Oversight. The Guiding and Establishing Nationwide Innovation for US Stablecoins (GENIUS) Act handed the US Senate with an awesome 68 to 30 vote on June 17. The invoice now must be authorized by the Home, which is managed by the Republicans.

Ethereum Breaks Data: 35M ETH Staked, 22.8M Held Lengthy-Time period. Though ether’s worth has stagnated just lately, the token is constantly being staked and transferred to long-term holders, who’re much less inclined to promote.

Not Sufficient Bitcoin: What Does The Skyrocketing Historic BTC Provide Inform Us? The accessible provide of bitcoin appears to be drying up. In keeping with a current report by Constancy, a mean of 566 BTC per day is falling right into a long-term “historic provide” bucket, whereas the day by day issuance price of BTC is simply 450.

Bitcoin at $100K Exhibits Institutional Dominance, Not Retail FOMO. On-chain knowledge reveals that retail buyers are nonetheless lacking, because the smaller transactions are missing. Because of this bitcoin’s worth is being supported above $100,000 principally by institutional gamers, because the community exercise reveals primarily massive transactions.

They Hold Shopping for: Technique, Metaplanet, Genius. It wasn’t actually a shock on Monday when Michael Saylor introduced the newest BTC acquisition by Technique, which is again within the billions of {dollars}. Earlier than the NASDAQ-listed firm, Metaplanet additionally outlined its newest bitcoin buy, whereas Genius Group expanded its BTC holdings by 52% regardless of some regulatory points.

Charts

This week, we now have a chart evaluation of Binance Coin, Ripple, Cardano, Hype, and Solana – click on right here for the whole worth evaluation.

The put up BTC Worth Stabilizes After FOMC Assembly as Israel-Iran Battle Awaits Trump’s Subsequent Transfer: Your Weekly Crypto Recap appeared first on CryptoPotato.