TL;DR

- Physician Revenue warns that 90–100% of crypto buyers in revenue may set off mass profit-taking and subsequent worth drops.

- XRP weakens whereas BNB absolutely peaks, however Solana reveals robust development with rising community exercise.

- $261M liquidations hit each longs and shorts, elevating doubts regardless of near-universal profitability.

Buyers Deep in Revenue

A pointy rise in profitability amongst main cryptocurrencies has prompted analysts to warn of potential profit-taking.

Physician Revenue wrote,

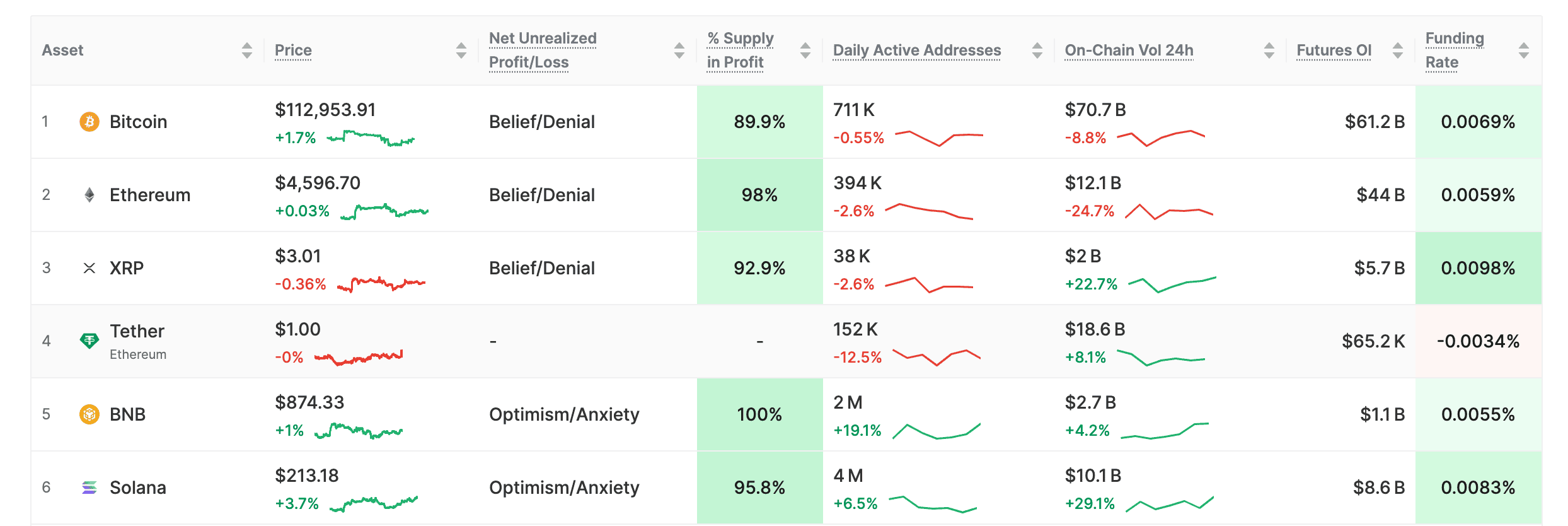

“90% of all BTC buyers are in revenue, 98% of all ETH buyers are in revenue, 92% of all XRP buyers are in revenue, and 100% of all BNB buyers are in revenue. There’s an excessive amount of revenue within the markets!”

Bitcoin trades at $113,000, with practically 90% of provide in revenue. Day by day lively addresses stand at about 711,000, although on-chain quantity fell virtually 9%. Futures open curiosity is $61.2 billion, supported by a small optimistic funding price.

Ethereum reveals an excellent stronger image. At $4,600, about 98% of the provision is in revenue. Exercise has cooled, with every day lively addresses down 3% and on-chain quantity off practically 25%. Futures open curiosity is $44 billion, with longs nonetheless main.

XRP Slips, BNB Peaks, Solana Soars

XRP trades at $3, with 92% of provide in revenue. Day by day addresses fell to 38,000, however on-chain quantity rose 23% to $2 billion, suggesting some buyers are beginning to take good points.

BNB, at $870, has 100% of its provide in revenue, a uncommon state of affairs. Exercise surged 19% to 2 million every day addresses, and quantity grew to $2.7 billion. Funding charges, nonetheless, slipped into unfavourable territory at -0.0034%, pointing to hedging in opposition to draw back threat.

Solana is buying and selling at $213, with 96% of provide in revenue. Community use is powerful, with 4 million every day addresses, up 7%. On-chain quantity jumped 29% to $10.1 billion. Futures open curiosity is at $8.6 billion, with optimistic funding. Not like Bitcoin and Ethereum, Solana’s profitability is paired with rising utilization.

As well as, Cronos (CRO) has surged 59% in 24 hours to $0.37, making it the most effective performers available in the market. On-chain information reveals 87% of CRO holders are in revenue, inserting it alongside different main cash flashing excessive profitability.

Buying and selling quantity has jumped to multi-month highs. The transfer follows weeks of regular restoration and was accelerated by information of a Trump Media partnership with Crypto.com. Sentiment round CRO reveals each optimism and anxiousness, with analysts cautioning that such revenue ranges usually precede promoting strain.

Liquidations Sweep the Market

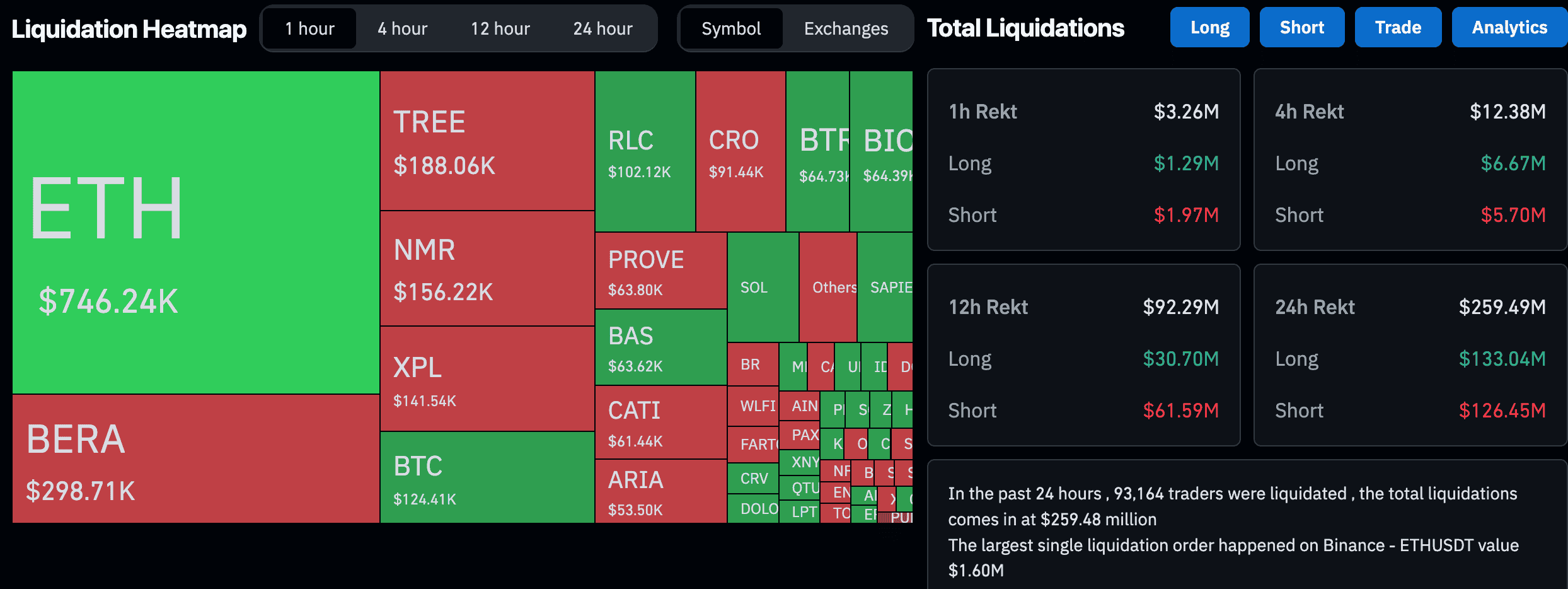

Even with most buyers in revenue, liquidations stay heavy. Up to now day, over 93,900 merchants had been liquidated, totaling $261 million. Longs accounted for $134.52 million, whereas shorts misplaced $126.35 million.

Ethereum led with $746,000 liquidated, adopted by BERA at $298,000. Bitcoin noticed $124,000 in liquidations. Mid-cap and smaller tokens like NMR, XPL, and RLC ranged from $50,000 to $150,000.

DeFi Planet questioned the disconnect:

“If virtually everyone seems to be in revenue, then who’s getting liquidated after we hear headlines like $550M worn out from the market?”

The submit BTC, ETH, XRP, BNB Warnings: Revenue Standing May Set off Value Declines Quickly appeared first on CryptoPotato.