BNB surged to an all-time excessive of $1,111.90 on October 3, extending beneficial properties to 7.27% in 24 hours and triggering $268 million in brief liquidations throughout crypto markets.

The rally pushed BNB’s market capitalization above $160 billion, solidifying its place because the world’s fourth-largest crypto whereas processing $3.74 billion in every day DEX quantity in accordance with DefiLlama information. This spike additionally solidifies BNB’s place among the many prime crypto tokens when it comes to value efficiency in latest weeks.

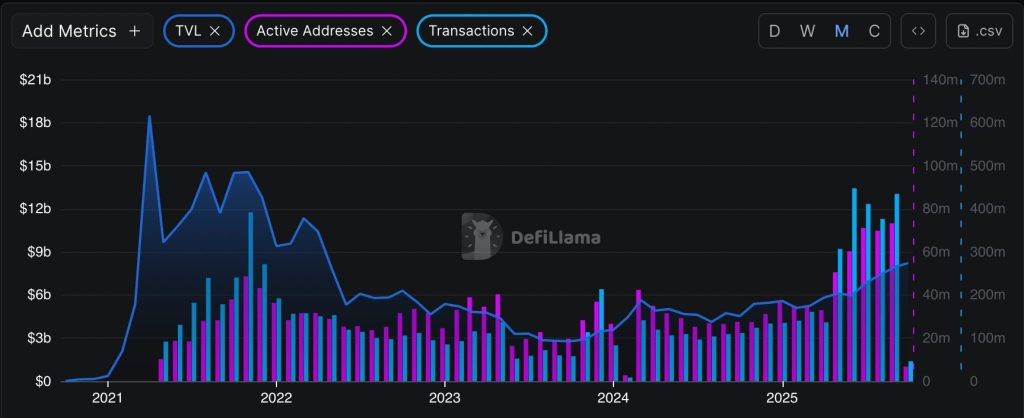

The breakthrough comes as BNB Chain processes 2.3 million energetic addresses every day, with a complete worth locked of $8.23 billion throughout DeFi protocols, representing a 2.49% progress over the previous 24 hours.

The community generated $1.01 million in chain charges and $3.4 million in software charges, whereas sustaining a stablecoin market capitalization of $13.47 billion.

Kazakhstan’s number of BNB because the inaugural asset for its Alem Crypto Fund nationwide reserve supplied institutional validation, contributing to the accelerated ascent of BNB past the psychological $1,000 barrier.

Kazakhstan Reserve Launch Sparks Institutional Treasury Development

Kazakhstan’s Ministry of Synthetic Intelligence and Digital Improvement has established the Alem Crypto Fund in partnership with Binance Kazakhstan.

Deputy Prime Minister Zhaslan Madiyev acknowledged that the fund goals to develop into “a dependable instrument for main traders and a key basis for digital state reserves.”

The initiative builds on President Kassym-Jomart Tokayev’s directive to create state-backed crypto reserves by means of the Nationwide Financial institution’s Funding Company.

Earlier in Aug, B Technique launched a $1 billion BNB-focused treasury firm backed by YZi Labs, previously Binance Labs, establishing what founders name the primary US-listed BNB treasury car.

A number of Asia-based household workplaces, together with these linked to Binance founder Changpeng Zhao, anchored the preliminary elevate.

The transfer follows 10X Capital’s separate US-based BNB treasury firm, led by Galaxy Digital co-founder David Namdar and former CalPERS CIO Russell Learn, as they put together for a serious change itemizing.

BNB Community Firm bought 200,000 BNB value $160 million, turning into the most important company holder.

Hong Kong-listed Nano Labs additionally acquired 74,315 BNB for $50 million in July at a median value of $672, outlining plans to build up as much as $1 billion concentrating on 5-10% of the circulating provide.

Nasdaq-listed Windtree Therapeutics additionally plans to allocate 99% of its $520 million funding spherical towards BNB purchases.

Validator Proposal Targets 50% Price Lower to Problem Solana

Simply final month, BNB Chain validators proposed slashing fuel charges by 50% and accelerating block speeds to take care of competitiveness in opposition to Solana and Base.

The proposal would scale back the minimal fuel value from 0.1 Gwei to 0.05 Gwei, whereas shortening block intervals from 750 milliseconds to 450 milliseconds.

Common transaction prices would drop to roughly $0.005 per transaction beneath the proposal, positioning BNB Good Chain alongside the most cost effective networks.

Changpeng Zhao endorsed the initiative shortly after the proposal emerged, as BNB reached its earlier peak above $1,000 in September.

BNB Chain validators suggest slicing fuel charges in half to $0.005 per transaction as BNB token surges previous $1,000 all-time excessive.#Binance #BNBhttps://t.co/bZpWe37kzz

— Cryptonews.com (@cryptonews) September 24, 2025

Earlier charge reductions led to large utilization will increase, with every day transactions surging 140% to exceed 12 million.

The rally notably occurred regardless of a safety breach of the official BNB Chain X account on October 1, with Zhao warning customers to not click on suspicious hyperlinks selling a pretend $BSC rewards program.

The account posted fraudulent messages claiming early rewards for voting on “upcoming BSC rewards date,” although groups rapidly recognized and contained the phishing try.

Technical Evaluation Tasks $1,200-$1,500 Close to-Time period Targets

BNB’s 4-hour chart shows a bullish flag sample breaking to the upside, at the moment buying and selling round $1,109 slightly below the projected $1,200 goal.

The sample exhibits consolidation inside converging trendlines after the preliminary surge to all-time highs, with latest breakout suggesting continuation.

From an extended logarithmic view, the chart exhibits the entire journey from 2018 lows round $3 to present ranges above $1,000, with Fibonacci extensions suggesting projected advances to $3,018, $4,280, and finally $6,155.

BNB has delivered returns exceeding 30,000% from its 2018 backside, though strikes from $1,000 to $6,000 require essentially totally different capital inflows than early-stage advances.

Technical patterns counsel a near-term continuation towards $1,200-$1,300 if momentum is sustained, with a possible extension to $1,500 on robust institutional shopping for.

The $950 – $1,000 zone represents important help, with failure to carry this degree triggering a retracement towards $850 – $900.

Aggressive multi-thousand-dollar targets ($2,000-$6,000) require extraordinary progress assumptions and capital inflows that will not materialize, notably given the present market capitalization exceeding $160 billion.

Probably the most possible situation includes consolidation between $1,000 and $1,300 over the approaching weeks, with a breakout above $1,300 opening the trail towards $1,500-$1,600 earlier than an prolonged correction.

The submit BNB Units $1,111 All-Time Excessive as Community Exercise Grows and Treasuries Proceed Shopping for – $2,000 Attainable? appeared first on Cryptonews.