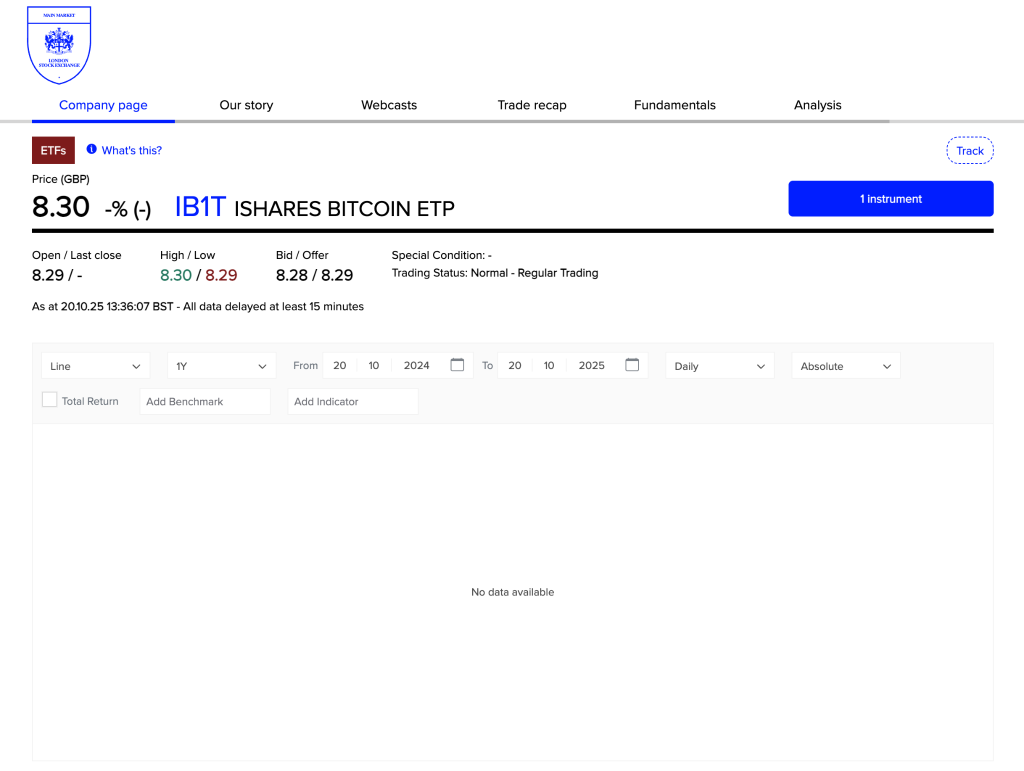

BlackRock’s long-awaited iShares Bitcoin ETP (IB1T) made its debut on the London Inventory Alternate (LSE) on Monday, permitting the UK customers to be uncovered to retail property.

The product permits retail traders to achieve regulated publicity to Bitcoin with out straight holding the asset. Notably, that is made attainable by the Monetary Conduct Authority’s (FCA) current resolution to carry its multi-year ban on crypto-based exchange-traded merchandise.

Inside its first hour of buying and selling, the bodily backed product custodied by Coinbase noticed over 1,000 shares change palms, indicating a cautious however rising curiosity amongst UK traders in regulated Bitcoin publicity.

The launch comes amid institutional adoption for ETFs surging globally following the success of U.S. spot Bitcoin ETFs, which have collectively drawn billions in inflows since approval earlier this yr.

The FCA’s August coverage reversal successfully reopened the UK’s retail crypto funding market, which had been closed since 2021. For BlackRock, the world’s largest asset supervisor, the transfer reveals confidence that British traders are prepared for mainstream digital asset merchandise.

BlackRock Surpasses $245M in Annual Charges because it Expands Bitcoin ETP Footprint with UK Launch

Whereas early buying and selling quantity stays modest in comparison with U.S. figures, analysts say the launch is symbolically vital. It positions London, which was as soon as cautious towards digital property, as a re-emerging hub for regulated crypto finance.

“IB1T’s debut is extra than simply one other Bitcoin product,” mentioned one market strategist. “It’s a sign that the UK is warming as much as digital property once more, bridging conventional finance with the following technology of funding demand.”

With international spot Bitcoin ETF inflows surging and regulatory readability enhancing, BlackRock’s London itemizing might mark the start of a brand new chapter for crypto participation within the UK, whereas additionally extending its footprint globally.

Notably, BlackRock’s iShares Bitcoin ETP (IB1T), which formally debuted at the moment, was already listed throughout a number of European markets, together with Germany’s Xetra, Euronext Amsterdam, and Euronext Paris, earlier than making its UK debut.

Whereas the IB1T launch is important for each the UK crypto neighborhood and BlackRock itself, the launch comes as a part of BlackRock’s broader international technique to develop its digital asset choices.

The agency, which manages over $13 trillion in property, has loved robust momentum in crypto markets because the success of its U.S.-listed iShares Bitcoin Belief (IBIT).

BlackRock generates $260 million yearly from Bitcoin and Ether ETFs as Wall Road institutional adoption reaches new heights.#Bitcoin #Ethereumhttps://t.co/0dAGyws3jZ

— Cryptonews.com (@cryptonews) September 23, 2025

That fund, launched in early 2024, now holds $85.5 billion in web property, making it the most important spot bitcoin ETF on this planet, and has generated practically $245 million in annual charges, surpassing long-established funds such because the iShares Russell 1000 Progress ETF and the iShares MSCI EAFE ETF.

In keeping with Bloomberg ETF analyst Eric Balchunas, IBIT is on tempo to turn into the quickest ETF in historical past to achieve $100 billion in property, doubtlessly surpassing Vanguard’s S&P 500 index fund.

The momentum round IB1T’s London debut additionally displays the rising institutional acceptance of Bitcoin as an asset class.

In keeping with Bitbo knowledge, Bitcoin ETPs now maintain greater than 1.35 million BTC, representing 6.47% of the cryptocurrency’s whole provide.

UK Retail Traders Lastly Get a Bitcoin ETP After FCA Lifts 3-Yr Ban — Extra to Launch Quickly?

The introduction of IB1T in London extends that momentum to Europe’s monetary hub, arriving lower than two weeks after the FCA formally lifted its ban on crypto exchange-traded notes (ETNs) and ETPs for retail traders.

The UK FCA will permit retail traders to entry crypto ETNs beginning Oct 8—reversing a 4+ yr ban.#FCA #ETNshttps://t.co/aK2NkOS0Md

— Cryptonews.com (@cryptonews) August 1, 2025

The transfer ended restrictions imposed in 2021 when the regulator barred such merchandise over considerations about volatility and fraud.

The FCA’s reversal, efficient October 8, has been broadly seen as a turning level for UK crypto coverage. After years of warning, the regulator accelerated its overview course of this yr, chopping approval occasions by practically two-thirds.

The rollout of crypto ETPs on the LSE had confronted brief delays because the FCA and trade finalized operational procedures, together with discussions over whether or not to introduce a devoted section for retail-eligible crypto merchandise.

With these points now resolved, the arrival of IB1T marks the primary time UK retail traders can entry a regulated bitcoin ETP by the home trade.

So what: The debut of IB1T signifies a shift in UK monetary coverage that would normalize crypto publicity inside conventional portfolios and appeal to a brand new wave of institutional and retail curiosity.

Analysts say the transfer may pave the way in which for extra issuers to enter the market, with London now positioning itself as Europe’s subsequent crypto-financial hub.

WisdomTree has obtained approval from the UK’s Monetary Conduct Authority (FCA) to supply its UK-listed crypto ETPs to retail traders.#ETPs #FCAhttps://t.co/VMTeftr4Xt

— Cryptonews.com (@cryptonews) October 16, 2025

Notably, different rivals like 21Shares and WisdomTree additionally launched related bitcoin and ether ETPs for British purchasers, suggesting that competitors and liquidity are about to warmth up quick.

The submit BlackRock’s IB1T Goes Stay in London — First-Hour Quantity Hints at Rising UK Bitcoin Urge for food appeared first on Cryptonews.