BitMine Immersion Applied sciences has launched one of many largest Ethereum accumulation strikes in company historical past, buying over $827 million value of ETH in the course of the latest crypto market crash.

The corporate, which already holds the world’s largest Ethereum treasury, acknowledged that the acquisition added 202,037 ETH to its reserves, bringing its whole to three,032,188 ETH, roughly 2.5% of Ethereum’s circulating provide.

The aggressive shopping for spree got here amid a weekend market sell-off that noticed greater than $19 billion in leveraged positions liquidated.

Over 1.66 million crypto merchants have been liquidated because the market skilled a pointy downturn, wiping out $19.33 billion in positions.#Trump #Bitcoinhttps://t.co/7PNRagvFrx

— Cryptonews.com (@cryptonews) October 11, 2025

Over 1.6 million merchants have been worn out in 24 hours, in response to CoinGlass information, as Bitcoin and Ethereum recorded $5.38 billion and $4.43 billion in lengthy liquidations, respectively.

The broader market’s whole capitalization dropped by over 9% to $3.8 trillion, with Bitcoin briefly plunging beneath $102,000.

Tom Lee Says Ethereum Getting into ‘Supercycle’ as BitMine Nears 5% of ETH Provide

BitMine’s newest buy lifted its whole crypto and money holdings to $13.4 billion as of October 12, together with $12.9 billion in crypto property and “moonshot” investments.

The corporate’s portfolio now contains 3,032,188 ETH, valued at $4,154 per token, 192 BTC, value roughly $22 million, a $135 million fairness stake in Nasdaq-listed Eightco Holdings, and $104 million in unencumbered money.

BitMine offered its newest holdings replace for Oct 13, 2025:

$12.9 billion in whole crypto + "moonshots":

– 3,032,188 ETH at $4,154 per ETH (Bloomberg)

– 192 Bitcoin (BTC)

– $135 million stake in Eightco Holdings (NASDAQ: ORBS) (“moonshots”) and

– unencumbered…— Bitmine (NYSE-BMNR) $ETH (@BitMNR) October 13, 2025

BitMine’s chairman, Tom Lee of Fundstrat, stated the corporate took benefit of the short-term market dislocation brought on by the liquidation cascade.

“Volatility creates deleveraging, and this will trigger property to commerce at substantial reductions to fundamentals,” Lee stated.

“We acquired over 200,000 ETH in the course of the downturn, shifting greater than midway towards our objective of proudly owning 5% of the whole ETH provide.”

Lee additionally reiterated his view that Ethereum is coming into what he calls a “Supercycle,” pushed by synthetic intelligence and the monetary sector’s growing integration with blockchain.

BitMine revealed Lee’s keynote from the Token2049 convention in Singapore as a part of its October Chairman’s Message, through which he outlined the corporate’s long-term thesis for Ethereum accumulation.

BitMine’s fast growth has positioned it as the most important Ethereum holder globally and the second-largest public crypto treasury total, behind Michael Saylor’s Technique Inc. (MSTR), which controls 640,250 BTC valued at roughly $73 billion.

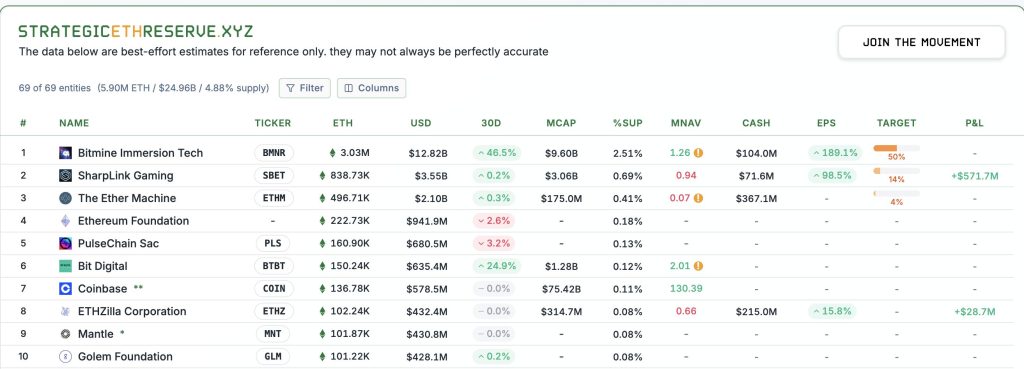

BitMine now ranks forward of different central Ethereum treasuries, together with SharpLink and The Ether Machine, which maintain 838,730 ETH and 496,710 ETH, respectively, in response to SER information.

Regardless of the market chaos, BitMine stays one of the vital closely traded U.S.-listed shares.

Fundstrat information reveals the corporate’s ticker, BMNR, has recorded a mean five-day buying and selling quantity of $3.5 billion as of October 10, rating twenty second amongst all U.S. equities, simply behind Coinbase and forward of UnitedHealth.

Mixed, BitMine and Technique account for 88% of world digital asset treasury (DAT) buying and selling quantity.

Nevertheless, BitMine’s share worth has not been proof against volatility, falling 11% over the previous week following a brief place taken by Kerrisdale Capital, which questioned the sustainability of the corporate’s enterprise mannequin.

Ethereum Eyes $10K as Fusaka Improve Nears Testnet Part

Ethereum is positioning for an additional main leap as builders put together for the Fusaka improve, anticipated to comply with the profitable Pectra rollout earlier this 12 months.

The replace, now coming into testnet trials, is designed to scale back transaction charges additional and decrease the price of changing into a validator, key steps towards bettering scalability and accessibility throughout the community.

If Fusaka launches on schedule by late 2025, analysts imagine it may strengthen Ethereum’s path towards $10,000, notably as institutional curiosity in blockchain tokenization and real-world property continues to broaden.

Each Pectra and Fusaka type a part of Ethereum’s long-term roadmap to reinforce effectivity throughout the bottom layer and layer-two networks, similar to Arbitrum.

Ethereum’s restoration from its earlier low of $1,400 gained momentum after Pectra, with ETH/USD buying and selling just lately round $3,813.

Nevertheless, volatility has remained excessive, as proven by a flash crash that worn out over $3.8 billion in leveraged positions earlier than costs rebounded above $4,100.

$ETH bouncing on the bull market help band! pic.twitter.com/2vYcYDbXub

— Crypto Rover (@rovercrc) October 11, 2025

Technical indicators point out that ETH is holding above help close to $3,720, the 23.6% Fibonacci retracement degree, suggesting a possible near-term reversal if resistance round $4,050–$4,300 is damaged.

In the meantime, renewed commentary from Wealthy Dad, Poor Dad creator Robert Kiyosaki has drawn recent consideration to Ethereum’s twin function as a retailer of worth and practical asset.

Kiyosaki warned of a looming monetary reset and described Ethereum and silver as “scorching, scorching, scorching,” arguing that each mix industrial utility with shortage.

The publish BitMine Goes on ‘$827M Aggressive’ ETH Shopping for Spree After Crypto Market Crash appeared first on Cryptonews.