Bitcoin has returned to the important thing $112K help stage, which now faces intense stress that might both spark a continuation of the bull run or sign an area peak. Presently, Bitcoin is buying and selling at $112,893, with a 1.38% every day acquire.

Nonetheless, buying and selling quantity stays average at $64 billion, decrease than the $300–500 billion quantity ranges witnessed throughout peak market exercise.

Three Key Ranges: $92K, $112K, $117K Resolve Bitcoin’s Destiny

Burak Kesmeci, an analyst at CryptoQuant, confirmed that Bitcoin is now working inside a key $109K–$112K vary.

In line with Kesmeci, a weekly shut above this zone may reinforce the upward pattern, whereas a detailed beneath could set off an accelerated correction.

Bulls vs Bears? Bitcoin’s crucial pivot zone at 109K – 112K

“The 109K – 112K vary is a crucial pivot zone within the brief time period. A weekly shut above this area may strengthen the pattern, whereas closing beneath it might speed up the correction.” – By @burak_kesmeci pic.twitter.com/AaM1hMNmNT— CryptoQuant.com (@cryptoquant_com) August 28, 2025

The analyst has recognized three key value ranges deserving consideration.

The primary is $117.3K, representing short-term resistance the place underwater buyers could look to exit their positions.

The second is the present $112K stage, serving as a short-term choice level that can decide whether or not costs advance greater or retreat to the third stage, short-term help round $92.4K.

Equally, on-chain analyst Darkfost famous that BTC Provide in Revenue has just lately fallen beneath the 90% threshold, a metric that has often indicated the onset of corrective phases.

“Bull markets usually coincide with greater than 90% of provide exhibiting earnings. We’ve now reached this crucial 90% threshold,” Darkfost defined.

Moreover, heavy promoting stress from whales and establishments by means of ETFs has weakened bullish sentiment.

SosoValue knowledge reveals that U.S. spot Bitcoin ETFs recorded solely $81.25 million in web inflows on August 27, a stark distinction to Ethereum ETFs, which attracted $309.48 million throughout the identical time-frame.

0.5% Loss Metric Proves Bull Run Nonetheless Intact

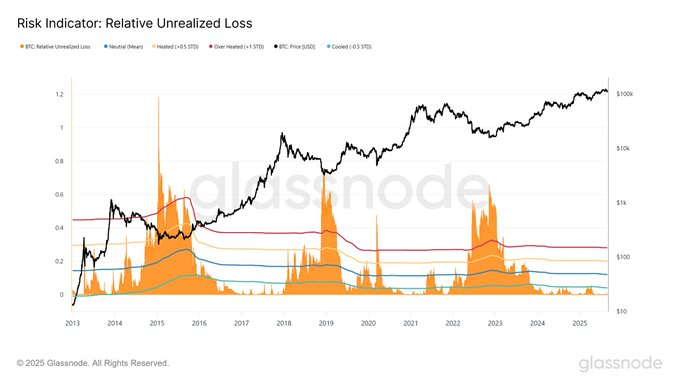

Glassnode knowledge reveals that the Relative Unrealized Loss for Bitcoin buyers stays at simply 0.5%, effectively beneath the >30% ranges attribute of bear market extremes.

This means that the majority holders keep worthwhile positions regardless of mounting short-term stress.

Moreover, throughout the current pullback to $109K, Bitcoin touched the “Oversold” territory on the short-term holder MVRV Bollinger Band.

On the pullback to $109K, $BTC tapped the ‘Oversold’ zone on the short-term holder MVRV Bollinger Band. The final incidence was on the $74K backside in April; since then, BTC is up +51%. pic.twitter.com/cN2FXII4SS

— Frank (@FrankAFetter) August 27, 2025

The earlier incidence of this situation was on the $74K backside in April, after which Bitcoin surged over 50%.

Many analysts now view the present scenario as a retest part earlier than the following leg of the bull run commences.

Supporting this thesis, company treasuries and firms are accumulating Bitcoin at a fee 4 occasions the mining fee, including roughly 1,755 BTC every day, whereas solely 450 BTC enter circulation by means of mining.

Bitcoin fanatic CryptoNewton initiatives that so long as the worth stays above the $112K threshold, subsequent targets embrace $115K, $118K, and $124K.

Technical Evaluation: $124K Liquidity Sweep Units Up Subsequent Transfer

The every day BTC/USDT chart shows a transparent liquidity-driven sample. The worth just lately cleared liquidity close to the $124,000 space, establishing a brand new all-time excessive earlier than experiencing a pointy reversal.

The RSI is climbing from impartial territory, indicating that momentum is recovering following the selloff.

Key resistance zones forward embrace $114,700 and $116,800.

A decisive breakout above $116,800 would clear the trail towards $119,500 and doubtlessly set up one other try on the highs.

Conversely, if value fails at this juncture and reverses, a return towards $111,900 stays viable, with $103,000 serving because the deeper invalidation stage.

The 4-hour BTC/USDT chart reveals a definite construction between purchaser and vendor territories.

Following a steep decline from the vendor zone round $121,000, the worth descended into the customer zone close to $111,000 and established help.

The help line and purchaser zone offered a basis for restoration, resulting in a breakout try by means of the resistance line.

The worth is presently consolidating simply above $111,000 whereas testing the decrease boundary of the $112,400 zone, which serves as short-term resistance.

The technical setup means that if consumers can maintain momentum above this purchaser zone and obtain a clear break by means of $114,400 resistance, the following goal could be roughly $118,000 (TP1), aligning with the projected trajectory.

Nonetheless, failure to keep up ranges above $113,000 would improve the chance of retesting the $109,000 purchaser zone.

The publish Bitcoin’s $112K Assist Beneath Hearth – Bull Run Pause or Market High? appeared first on Cryptonews.